Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

I recently saw a tweet complaining that left-wing YIMBYs favored urban containment- a strategy of limiting suburban sprawl by prohibiting new housing at the outer edge of a metropolitan area. (Portland’s urban growth boundaries, I think, are the most widely…

Is it even possible today to write a vigorous argument in favor of the urban renewal policies of the 1950s? I doubt it. Jeanne Lowe's 1967 "Cities in a Race with Time* is a sympathetic account of the urban renewal era in its own terms. How does it hold up?

Most master plans are a costly effort by a team of temporary consultants, spread over two to three years, to prepare a blueprint that is usually obsolete as soon as it is completed.

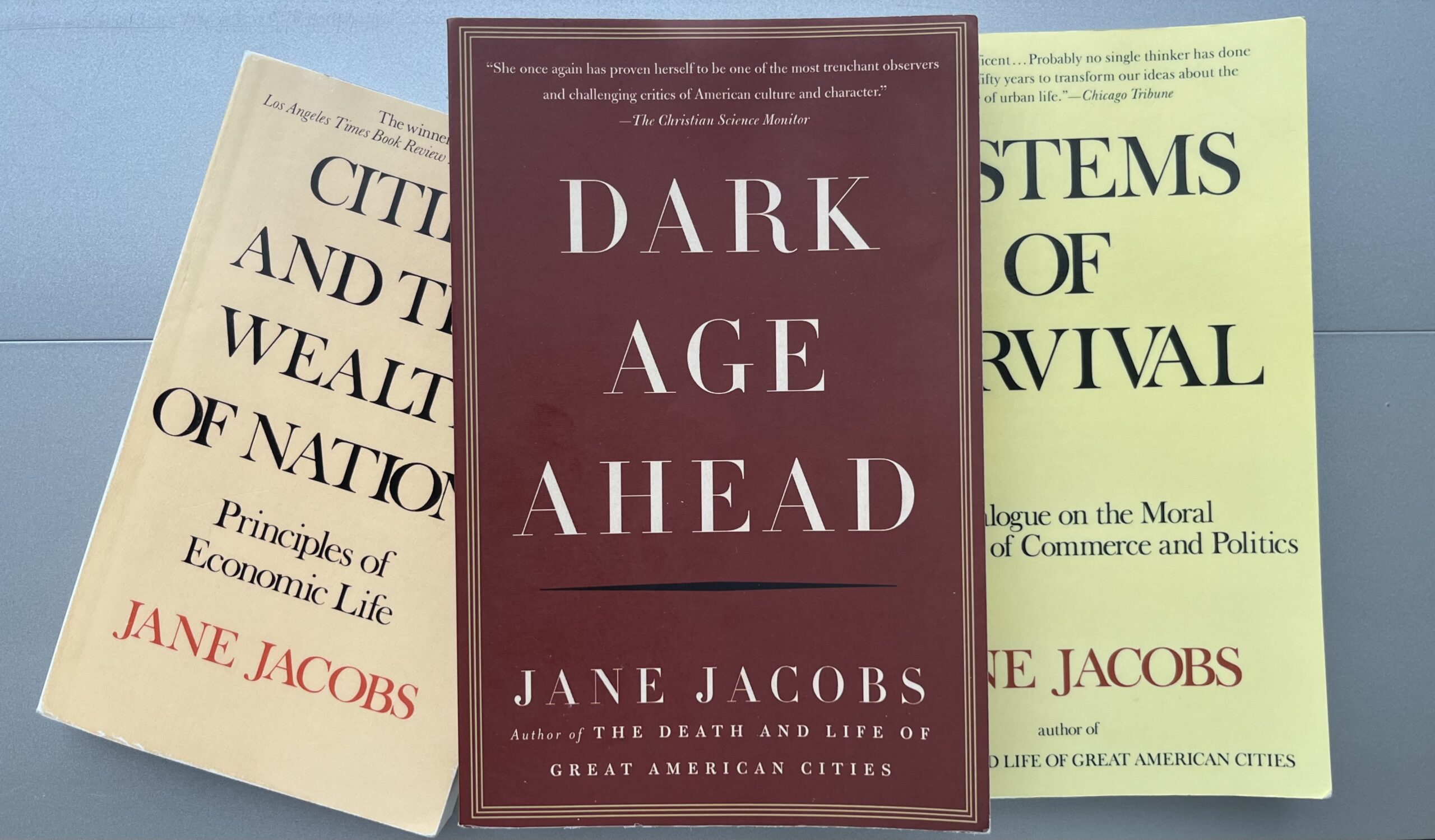

Jane Jacobs wasn’t optimistic about the future of civilisation. ‘We show signs of rushing headlong into a Dark Age,’ she declares in Dark Age Ahead, her final book published in 2004. She evidences a breakdown in family and civic life, universities which focus more on credentialling than on actually imbuing knowledge in its participants, broken feedback mechanisms in government and business, and the abandonment of science in favour of ‘pseudo-scientific’ methods. Jacobs’ prose is, as always, rich, convincing and successful in making the reader see the importance of her claims. Yet the argument that we are spiralling into a new Dark Age, similar to that which followed the fall of the Roman Empire, is not quite complete and I remain unconvinced that the areas she identified point towards collapse as opposed to merely things we could, and should, work to improve. Let us start with the idea that families are ‘rigged to fail,’ as she puts it in chapter two. Jacobs, urbanist at heart, cites ‘inhumanely long car commutes’ stemming from the disbanding of urban transit systems, rising housing costs, and a breakdown in ‘community resources’ – the result of increasingly low-dense forms of urban development – as a significant reason why families are now set up for failure. She suggests our days are filled with increasingly vacuous activities, leading to the rise of ‘sitcom families’ which ‘can and do fill isolated hours’ at the expense of ‘live friends.’ That phenomenon has now been replaced by the ‘smartphone family’ where time spent on TikTok, and consuming other forms of digital media have supplanted the ‘sitcom’ family of the past. There has been significant literature on the detrimental effects of digital technologies to our physical and mental health, not least in Jonathan Haidt’s most recent book, The Anxious Generation. A similar picture is painted by Timothy Carney in […]

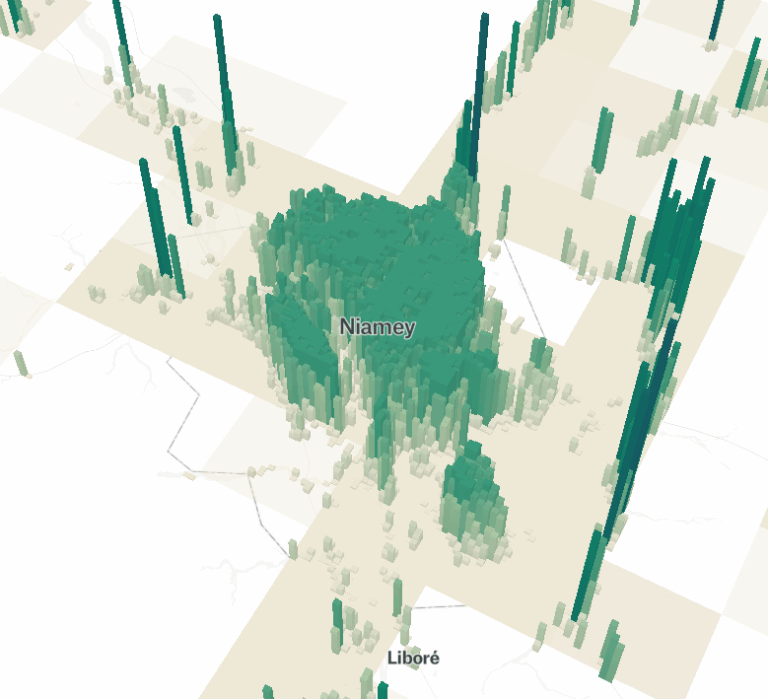

Three cool sites for data and visualizations

At the heart of Jane Jacobs’ The Economy of Cities is a simple idea: cities are the basic unit of economic growth. Our prosperity depends on the ability of cities to grow and renew themselves; neither nation nor civilisation can thrive without cities performing this vital function of growing our economies and cultivating new, and innovative, uses for capital and resources. It’s a strikingly simple message, yet it’s so easily and often forgotten and overlooked. Everything we have, we owe to cities. Everything. Consider even the most basic goods: the food staples that sustain life on earth and which in the affluent society in which we now reside, abound to the point where obesity has become one of the leading causes of illness. Obesity sure is a very real problem and one we ought to work to resolve (probably through better education and cutting those intense sugar subsidies). Yet this fact alone is striking! For much of mankind’s collective history, the story looked very different: man (and it usually was a man) would spend twelve or maybe more hours roaming around in the wild to gather sufficient food to survive. Our lives looked no different to the other animals with which we share the earth. An extract from The Economy of Cities: ‘Wild animals are strictly limited in their resources by natural resources, including other animals on which they feed. But this is because any given species of animal, except man, uses directly only a few resources and uses them indefinitely.’ What changed? Anthropologists, economists, and historians will tell you it was the Agricultural Revolution, which occurred when man began to settle in small towns and cultivate the agricultural food staples that continue to make up the bulk of our diet: wheat, barley, rice, corn, and animal food products. But […]

Research shows that the implementation of an eviction moratorium significantly disadvantaged African Americans in the housing search process.

Just 1 in 25 new apartments is owner-occupied. What happened to building condos?

I’ve noticed numerous stories and tweets about a building boom: for example, a recent CNBC story asserts that the number of new apartments is “at a 50-year high.” Various twitterati have used this claim to support their own points of view: some claim that rents are stabilizing because of this new surge in supply, while others argue that the failure of rents to decline shows that new supply doesn’t reduce rents. But is supply really increasing that rapidly? Federal statistics on housing construction are at a Census housing data webpage. I looked at the “New Housing Units Completed” table and found that about 216,000 housing units in structures with over five units were completed in the first half of 2023. On the positive side, this is definitely an improvement over the 2010s, when the economy was still recovering from the 2008 recession. For example, in the first half of 2019, just over 169,000 such units were built, and 2018 was pretty similar. But is construction still up to Reagan-era levels? Not really. In the first half of 1986, almost 258,000 relevant units were completed. And in the first half of 1973, just over 378,000(!) such units were built. And these levels of construction were in a less populous country. Today the U.S. population is about 335 million, up from about 240 million in 1986 and 212 million in 1973. So if construction had kept up with population, our new unit count would be about 1/3 higher than in 1986, and almost 60 percent higher than in 1973. Instead, construction went down. To put the facts another way: our half-year multifamily construction rate is about 644 per one million Americans for 2023, down from 1075 per million in 1986 and 1783 per million in 1973. That’s not my idea of a […]

In recent years, I have thought of Herbert Hoover as sort of an urban policy villian, thanks to his promotion of zoning. But I recently ran across one of his memoirs in our school’s library. (Hoover’s memoirs were a multivolume set, and this particular volume related to his service as Secretary of Commerce and President). Hoover devotes less than a page zoning, noting that it was designed “to protect home owners from business and factory encroachment into residential areas.” He doesn’t mention the parts of zoning that have stunted housing supply in recent decades, such as the prohibition of apartments in homeowner zones, and minimum lot sizes. In fact, he brags about increases in housing construction when he was Secretary of Commerce, writing that “The period of 1922-28 showed an increase in detached homes and in better apartments unparalleled in American history prior to that time.” In particular, he notes that 449,000 dwelling units were built in 1921, and that this number rose to 753,000 in 1928. He claims some of the credit for this, primarily because the Commerce Department helped formulate a standard building code which he believed would be less costly than existing local codes, and because the Department sought to lower interest rates on second mortgages. One common argument against new housing is that because some new housing has been built, therefore there has been a building boom sufficient to meet demand. By contrast, Hoover was not a believer in the idea that any housing construction equals enough housing construction; he notes that “The normal minimum need of the country to replace worn-out or destroyed dwellings and to provide for increased population was estimated by the Department at 400,000-500,000 dwelling units per annum.”* *By the way you might be wondering how these numbers compare to current levels […]