Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Georgists assert that a Land Value Tax (LVT) ensures land is always put to its most efficient use. They claim that increased carrying costs deter speculation. And if valuable land is never held out of use, society is better off.

I think the story about incentives is correct. But I question whether pulling development forward in time is definitionally more efficient. In a world with transaction costs, tradeoffs abound and it’s worth thinking through the implications of an LVT.

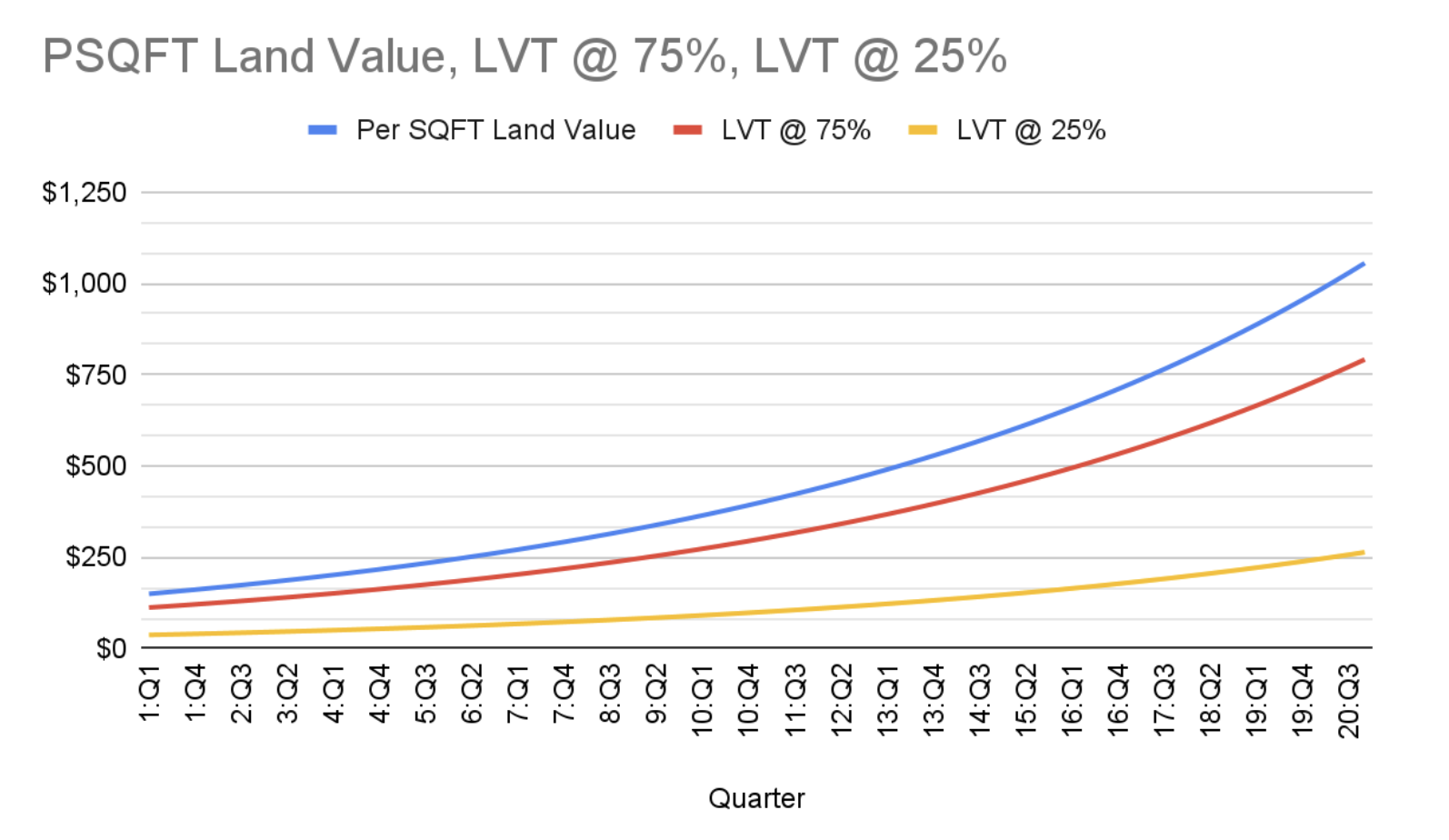

Picture a growing local economy with increasing land values and an LVT. Now suppose we split the time stream and create two parallel universes with different tax rates. In scenario A, we apply an LVT at 75%; in scenario B the LVT is set at 25%.

There are two important questions here:

1) When will a given parcel be forced into development?

2) What intensity of development will the parcel support at the moment it’s put into productive use?

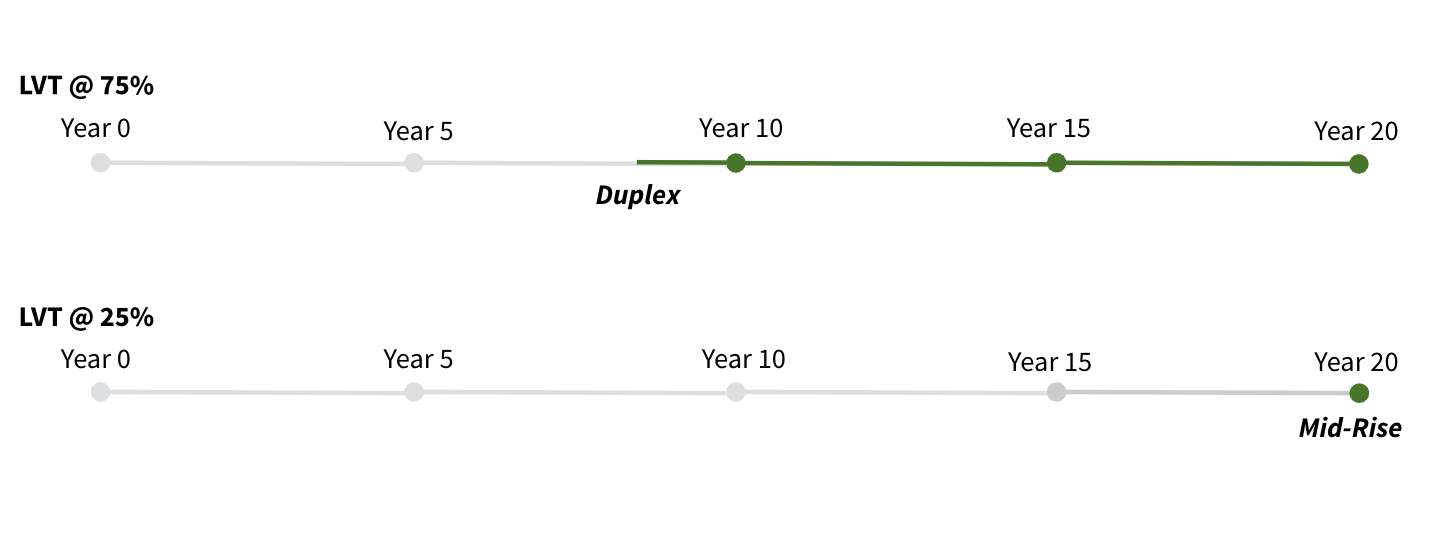

To answer our first question, we look at the tax curves and make some assumptions. Suppose carrying costs push land into productive use at $250 psqft in LVT costs, scenario (a)’s parcel goes into development around year 9 at a $331 psqft. Scenario (b)’s parcel doesn’t see development until year 20 and a ~$1K psqft value.

Given the delta between year 9 and year 20’s psqft valuations, we could expect to see different intensities of development. We’re now left with the question of whether a duplex in nine years is better than a mid-rise in twenty.

Appropriating the full rental value of land would pull development forward, but that doesn’t definitionally lead to it being put to its highest and best use. Highest and best is contingent upon what time scale we’re optimizing for and that choice of time scale is an inherently normative decision.

Now the caveats. This is a simplified thought experiment and all the numbers are completely arbitrary. I’m not making the case that there’s a specific choice between development densities at particular tax burdens. The case I am making, though, is that in a world with transaction costs an LVT would force us to make important tradeoffs.

Also, several things that exist in the real world – but not in this fictional account – complicate our story.

All said, I remain a fan of Georgist ideas. Capturing land rents for common infrastructure – whether through an LVT or by other means – is still an idea I support. But when we think about policy prescriptions, we need to recognize their limitations and that tradeoffs always and everywhere abound.