Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Delete all Seattle's highways. Invent new neighborhoods. Explain macroeconomic trends with home size. Money flows uphill to water. Do NIMBYs really hate density? Urban economics is on a tear.

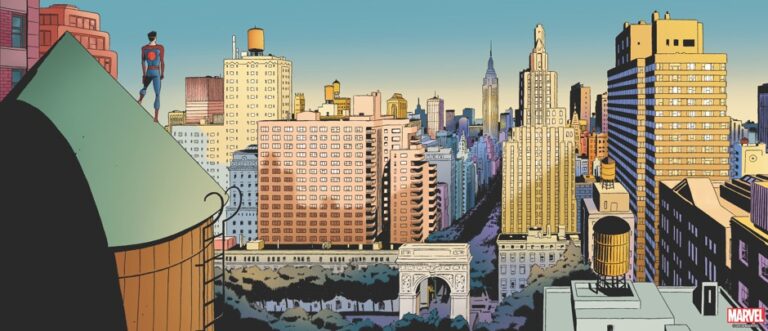

Nolan Gray plunges into the Sam Raimi "Spider-Man" trilogy to uncover the housing problems (and solutions) of expensive cities like New York.

This week’s column is drawn from a lecture I gave at the University of Southern California on the occasion of the retirement of urban economist Peter Gordon. One of my heroes is the urbanist Jane Jacobs, who taught me to appreciate the importance for entrepreneurial development of how public spaces—places where you expect to encounter strangers—are designed. And I learned from her that the more precise and comprehensive your image of a city is, the less likely that the place you’re imagining really is a city. Jacobs grasped as well as any Austrian economist that complex social orders such as cities aren’t deliberately created and that they can’t be. They arise largely unplanned from the interaction of many people and many minds. In much the same way that Ludwig von Mises and F. A. Hayek understood the limits of government planning and design in the macroeconomy, Jacobs understood the limits of government planning and the design of public spaces for a living city, and that if governments ignore those limits, bad consequences will follow. Planning as taxidermy Austrians use the term “spontaneous order” to describe the complex patterns of social interaction that arise unplanned when many minds interact. Examples of spontaneous order include markets, money, language, culture, and living cities great and small. In her The Economy of Cities, Jacobs defines a living city as “a settlement that generates its economic growth from its own local economy.” Living cities are hotbeds of creativity and they drive economic development. There is a phrase she uses in her great work, The Life and Death of Great American Cities, that captures her attitude: “A city cannot be a work of art.” As she goes on to explain: Artists, whatever their medium, make selections from the abounding materials of life, and organize these selections into works […]

1. This week at Market Urbanism: Emily Washington described The Need For Low-Quality Housing in America’s most desirable cities. People of very little means could afford to live in cities with the highest housing demand because they lived in boarding houses, residential hotels, and low-quality apartments, most of which are illegal today. Making housing affordable again requires not only permitting construction of more new units, but also allowing existing housing to be used in ways that are illegal under today’s codes. Adam Hengels posted part 7 in his long dormant Rothbard the Urbanist series Tragically, Rothbard’s insights on these subjects have been mostly neglected for over 30 years, while apologists for sprawl and automobile dominance have nearly monopolized the conversation among free-market advocates. 2. At the Market Urbanism Facebook Group: Naor Deleanu updated us on San Diego‘s stadium subsidy proposal Mark Frazier shares the pros and cons of a privately-run city in India Nolan Gray: Classic New York Streetscapes, Then and Now Interesting what changed and what hasn’t Anthony Ling shared an invite to a conference at NYU. Success Without Design: Lessons from the Unplanned World of Development 3. Elsewhere: Highways gutted American cities. So why did they build them? Stephen Eide makes the case for states taking back control from mismanaged cities. An interview with the author of “Evicted:” a story of “eight peripatetic families in Milwaukee — and two landlords” How Chicago racked up a $662M police misconduct bill …not to be outdone, Chicago’s teachers’ union may strike again 4. Stephen Smith‘s Tweet of the Week: “Housing is a human right,” says the group founded for the sole purpose of preventing new housing from being built https://t.co/mvpBmDda1R — Market Urbanism (@MarketUrbanism) March 19, 2016

Market Urbanists will be gathering again in New York City for an informal meet up. Last year, we explored the fascinating ethnic neighborhoods of Williamsburg, Brooklyn. This year, we’ll meet in Midtown Manhattan, where some ethnic enclaves are nestled amongst towers and bustling streets. Come join a wide cross-section of urbanists in attendance: architects, journalists, economists, real estate developers, planners, and students. Anthony Ling of Rendering Freedom set up a Facebook event for the meetup. We’ll meet at 3pm in Herald Square (right in front of the clock tower on W 35th St.) Please sign up on Facebook, and tell your friends. (Anthony also set up a Market Urbanism Facebook group to help us connect to fellow Market Urbanists) See you then! https://www.facebook.com/events/1455717651329006/

A few things. First of all, the New York Times in 1992 on the postmodern skyline blight that is the Sony Building (then still the AT&T Building): This proposal marks the latest instance in which landlords have tried to recreate ill-conceived or little-used arcades and plazas, which generated lucrative bonuses for builders but not much in the way of genuine public amenities. In one of the most dramatic cases, a dank arcade under 2 Lincoln Square, an apartment tower on Columbus Avenue, between 65th and 66th Streets, was enclosed in 1989 and turned into a home for the Museum of American Folk Art. The Sony plan is likely to provoke wide debate on whether the public will gain or lose through the renovation, given the celebrity of 550 Madison Avenue itself, which was designed in 1978 by Philip Johnson and is marked on the skyline by a Chippendale-style broken pediment. Sony’s proposal calls for a net reduction of 8,727 square feet of space at ground level that is now devoted to the public; space that could conceivably be rented to retailers for about $200 a square foot. And now the New York Observer in 2012, on NYU’s 2031 plan, which will involve upgrading the quality and quantity of open space while adding new buildings to their modernist superblocks in the Village: “We are making publicly accessible [existing] open space that is not—and is not perceived—as publicly accessible now,” university spokesman John Beckman told The Observer. Still, this ignores the fact that this is already N.Y.U. owned land, and many of the impediments in place that the university cites, such as fences and locked gates and requisite visitor passes, could merely be done away with by the institution. The public space would not be the best, but it still underscores the […]

The rehabilitation of the postwar glazed white brick apartment building continues apace, with the condoization of 530 Park Ave., a 1941 (okay, almost postwar) 19-story white brick building. I happen to like New York’s postwar white brick buildings, and am even warming up to the red brick variants – I’ve always consider anonymous white brick to be the most New York of New York buildings. One reason that I like them is that because of the history of New York City zoning, they have the form of prewar buildings, with the embellishments (or lack thereof) of the postwar era. Up until 1961, New York’s developers were still building under essentially the 1916 code. While the 1916 code definitely restricted and guided growth in the dense commercial core, where it encouraged set backs and discouraged Equitable Building-like dense massings, developers in residential neighborhoods like the Upper East Side generally did not bump up against the zoning limits. The setbacks on 530 Park are slight and decorative, and likely built according to the style of the day (which was heavily influenced by larger buildings downtown whose shapes were dictated by zoning). So buildings erected before the 1961 code took effect tended to be lower than those that came after, but they covered more of the lot and their façades were flush with the sidewalk. Some of them included garages for the newly-motorized middle- and upper-classes, but they were small compared to those that came after. Above all they were governed by the laws of supply and demand. If you ignore the materials and lack of ornament, they were a lot like prewar buildings. But the brick apartment buildings of the ’40s and ’50s were the last in New York City built according to supply and demand, which is why I think we’ll come to hold them […]

It sounds like a dumb question – they exist because people like the security of owning a home combined with the services and lower costs that apartments offer, duh! But upon further reflection, condominium-style tenure can be a bit problematic. The main problem, as I see it, is that a building that’s been carved up into condo units can almost never be redeveloped. So much so that preservationists have been known to cheer on developers doing condo and co-op conversions of historic properties: Indeed, sometimes preservation advocates look to condo developers as white knights. Since the Bialystoker Center for Nursing and Rehabilitation on East Broadway closed last year, Laurie Tobias Cohen, the executive director of the Lower East Side Jewish Conservancy, has been “extremely eager” for a developer to buy the historic building and convert it to co-ops or condos. The closing of the nursing home was a great loss, she said; the goal now is to prevent the demolition, or further deterioration, of the building. “What we don’t want,” she said, “is to lose any more of the built historic fabric.” This is no doubt an elegant solution to the problem of unprotected historic buildings, but what about the less-than-stunning condos and co-ops that have been built in the US – and pretty much every where else in the world! – since the end of World War II? Why are condo buildings impossible to redevelop? Simple: gravity! You can’t keep your apartment on the 17th floor while someone demolishes their 5th floor unit. In Canada, Australia, New Zealand, and Singapore, they call condos “strata” apartments, which reflects what they really are: floors of apartments layered inseparably atop each other. To redevelop a condo or co-op building, you have to buy every single unit, after which you can dissolve the condo structure […]

Wendell Cox has received his fair share of criticism from this blog, but his post last week about Tokyo’s surprising lack of density is very interesting. Sure, Tokyo’s suburbs are dense enough to be connected by job centers by rail, but the core is almost completely low- and lower-mid-rise, and thus not very dense: Tokyo does not have intensely dense central areas. The ku area [historic core] has a density of 37,300 per square mile (14,400 per square kilometer). This is well below the densities of Manhattan (69,000 & 27,000) and the ville de Paris (51,000 & 21,000). Only one of the ku (Toshima) exceeds the density of Paris. And then the suburbs themselves aren’t as compact as they could be: Further, according to the Japan House and Land Survey of 2008, Tokyo has a large stock of detached houses, by definition lower density. Nearly 45 percent of the Tokyo region’s housing is detached. One-third of the dwellings within 30 kilometers (18 miles) of the core are detached. This figure rises to more than 60 percent outside 30 kilometers from the core and 85 percent between 60 and 70 kilometers (37-43 kilometers) from the core (Figure 2). Some might see this as a validation of New Urbanism (which is sort of a bastardization of Old Urbanism), whose response to tall building enthusiasts like myself, Ed Glaeser, and Alon Levy is that “dense doesn’t have to mean tall.” And it’s true – Tokyo manages a relatively high density with very few tall buildings. But there are costs that Tokyo bears for its lack of height and downtown density. First and foremost are the high housing prices. Imagine New York City if Midtown and the Upper East and West Sides were still tenement neighborhoods, and everyone living and working above the sixth floor […]

The other day I was stumbling around Wikipedia when I found pictures of what was apparently the first iteration of New York’s Grand Central train station, called Grand Central Depot. The “depot” opened in 1871 and was built in the neo-Renaissance style that was popular back then (as opposed to the final, neoclassical incarnation), and stood for less than 30 years. It was partly torn down and reconstructed in 1899, and then totally demolished “in phases” between 1903 and 1913 to make way for today’s Grand Central Terminal. This got me thinking about the old Pennsylvania Station whose demolition was a catalyst for the modern preservationist movement. Like nearly every big old building in New York, it was of course not the first building to stand there – development in cities during the prewar era was as much about redevelopment as it was about building in greenfield sites. It was a given that building would come down and new ones would be built – a city that’s been disrupted in most American downtowns. (Midtown Manhattan is of course one of the few places in the U.S. where this still happens – the Drake Hotel was of course torn down a few years ago by Harry Macklowe, on the site of what is now 432 Park Ave., and the Hotel Pennsylvania across from Penn Station will likely be replaced with an office tower once the market comes back.) Anyway, I put out a call on Twitter for pre-Penn Station history, and lo and behond @enf alerted me to a panel at an exhibit at the Transit History Museum in Brooklyn, which I managed to find some pictures from on Flickr. Here’s a wide shot of the panel (though you can zoom in pretty close), and here’s some of the text that […]