Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Because there are no market signals that could identify the best and highest use of street space, it is the role of urban planners to allocate the use of street space between different users and to design boundaries between them where needed.

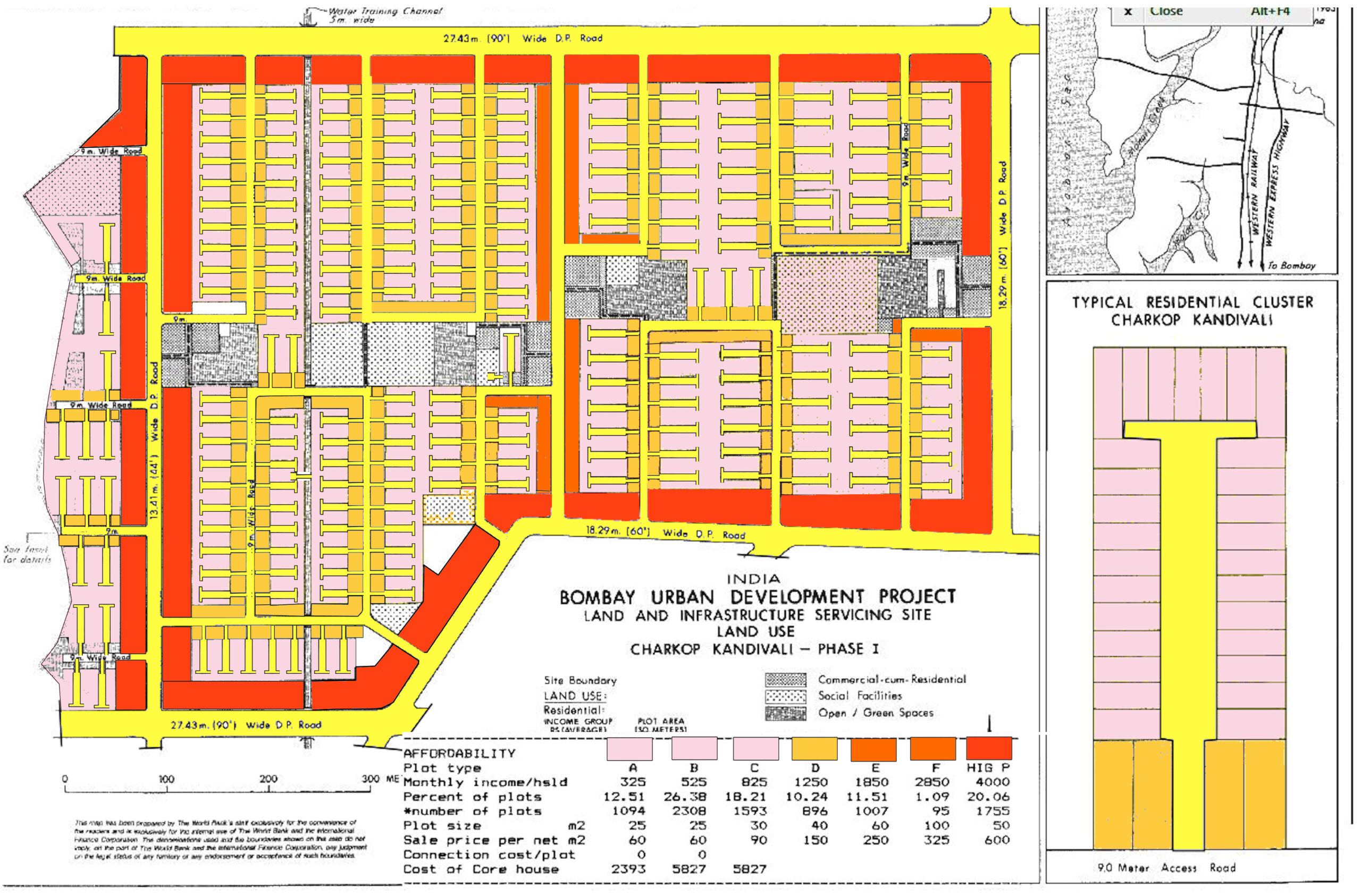

Alain Bertaud revisits a Mumbai development project he helped design in 1983. The neighborhood is thriving.

At the heart of Jane Jacobs’ The Economy of Cities is a simple idea: cities are the basic unit of economic growth. Our prosperity depends on the ability of cities to grow and renew themselves; neither nation nor civilisation can thrive without cities performing this vital function of growing our economies and cultivating new, and innovative, uses for capital and resources. It’s a strikingly simple message, yet it’s so easily and often forgotten and overlooked. Everything we have, we owe to cities. Everything. Consider even the most basic goods: the food staples that sustain life on earth and which in the affluent society in which we now reside, abound to the point where obesity has become one of the leading causes of illness. Obesity sure is a very real problem and one we ought to work to resolve (probably through better education and cutting those intense sugar subsidies). Yet this fact alone is striking! For much of mankind’s collective history, the story looked very different: man (and it usually was a man) would spend twelve or maybe more hours roaming around in the wild to gather sufficient food to survive. Our lives looked no different to the other animals with which we share the earth. An extract from The Economy of Cities: ‘Wild animals are strictly limited in their resources by natural resources, including other animals on which they feed. But this is because any given species of animal, except man, uses directly only a few resources and uses them indefinitely.’ What changed? Anthropologists, economists, and historians will tell you it was the Agricultural Revolution, which occurred when man began to settle in small towns and cultivate the agricultural food staples that continue to make up the bulk of our diet: wheat, barley, rice, corn, and animal food products. But […]

In the standard urban growth model, a circular city lies in a featureless agricultural plain. When the price of land at the edge of the city rises above the value of agricultural land, “land conversion” occurs. In the real world, we’re more likely to call it “development” and it is, of course, a lot more complicated. Simplification is valuable and gives us more general insights. But is greenfield development complicated in ways that are interesting and might change the results of urban economic models? Or that might change the ways we think or talk about development policy? Witold Rybczynski’s 2007 book Last Harvest helps answer these questions. It tracks a specific cornfield in Londonderry, Pennsylvania, from the retirement of the last farmer to the moving boxes of the first resident. With its zoomed-in lens, Last Harvest answers (or at least raises) lots of questions that are interesting but not especially important in the grand scheme: Why do expensive homes mix some top-line finishes with cheap, plasticky ones? Why do anti-development communities permit any subdivisions at all? What is ‘community sewerage,’ and how does it work? Exactly who thinks it’s attractive to have brick and vinyl cladding on the same house? What’s it like to buy a house from a national homebuilder? Does Chester County really produce forty percent of America’s mushrooms? The Stack Rybczynski does not use this term, but what he describes is part of what I call the “stack” of housing supply. One of the central facts of development is that it relies on a very long chain of industries and professions, each of which relies on every other part of the stack doing its job. If one part is left undone, nobody gets paid: ‘Without a water contract, we can’t get a permit for the water mains, […]

Monday, Y-Combinator, an early-stage technology startup incubator, announced it will “study building new, better cities.” Some existing cities will get bigger and there’s important work being done by smart people to improve them. We also think it’s possible to do amazing things given a blank slate. Our goal is to design the best possible city given the constraints of existing laws. They are embarking on an undertaking of noble intentions, and I will explain why the technology sector needs to be at the forefront of thinking about cities. However, in the pursuit of designing “new” cities from a “blank slate” they have begun their quest with one fatally flawed premise, that wise technocrats can master-build entirely new cities catering to the infinitely diverse set of needs and desires of yet-to-be-identified citizens. Any visions of city-building must first humbly acknowledge that cities are an “emergent” phenomena. According to wikipedia, “emergence is a process whereby larger entities, patterns, and regularities arise through interactions among smaller or simpler entities that themselves do not exhibit such properties.” What makes cities vibrant are the “spontaneous order” which emerges among city dwellers as they pursue their individual desires. Cities are like the internet – networks, patterns, and interactions emerge not through design but from spontaneous order. Like no entity could conceivably understand or control the internet, no entity has the knowledge to anticipate the desires of millions of individual agents, and design a city accordingly. This is called the “knowledge problem.” According to economist Friedrich Hayek: If we can agree that the economic problem of society is mainly one of rapid adaptation to changes in the particular circumstances of time and place, it would seem to follow that the ultimate decisions must be left to the people who are familiar with these circumstances, who know directly of the […]

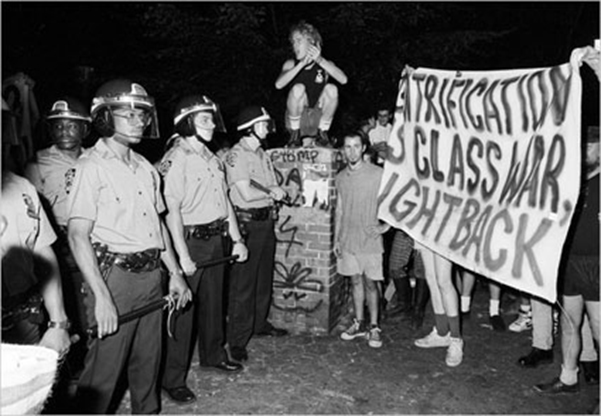

Gentrification is the result of powerful economic forces. Those who misunderstand the nature of the economic forces at play, risk misdirecting those forces. Misdirection can exasperate city-wide displacement. Before discussing solutions to fighting gentrification, it is important to accept that gentrification is one symptom of a larger problem. Anti-capitalists often portray gentrification as class war. Often, they paint the archetypal greedy developer as the culprit. As asserted in jacobin magazine: Gentrification has always been a top-down affair, not a spontaneous hipster influx, orchestrated by the real estate developers and investors who pull the strings of city policy, with individual home-buyers deployed in mopping up operations. Is Gentrification a Class War? In a way, yes. But the typical class analysis mistakes the symptom for the cause. The finger gets pointed at the wrong rich people. There is no grand conspiracy concocted by real estate developers, though it’s not surprising it seems that way. Real estate developers would be happy to build in already expensive neighborhoods. Here, demand is stable and predictable. They don’t for a simple reason: they are not allowed to. Take Chicago’s Lincoln Park for example. Daniel Hertz points out that the number of housing units in Lincoln Park actually decreased 4.1% since 2000. The neighborhood hasn’t allowed a single unit of affordable housing to be developed in 35 years. The affluent residents of Lincoln Park like their neighborhood the way it is, and have the political clout to keep it that way. Given that development projects are blocked in upper class neighborhoods, developers seek out alternatives. Here’s where “pulling the strings” is a viable strategy for developers. Politicians are far more willing to upzone working class neighborhoods. These communities are far less influential and have far fewer resources with which to fight back. Rich, entitled, white areas get down-zoned. Less-affluent, disempowered, minority […]

Co-authored with Anthony Ling, editor at Caos Planejado Gentrification Gentrification is the process through which real estate becomes more valuable and, therefore, more expensive. Rising prices displace older residents in favor of transplants with higher incomes. This shouldn’t be confused with the forced removal of citizens via eminent domain or “slum clearance.” Ejecting residents by official fiat is a different problem entirely. A classic example of gentrification is that of Greenwich Village, New York. Affluent residents initially occupied the neighborhood. It later became the city’s center for prostitution, prompting an upper-middle class exodus. Low prices and good location would later attract the textile industry. This was the neighborhood’s first wave of gentrification. But after a large factory fire, the neighborhood was once again abandoned. Failure, however, would give way to unexpected success: artists and galleries began to occupy the vacant factories. These old industrial spaces soon became home to one of the most important movements in modern art. In Greenwich Village, different populations came and went. And in the process they each made lasting contributions to New York’s economic and cultural heritage. This was only possible because change was allowed to take place. But change isn’t always easy. As a neighborhood becomes more popular, it also becomes more expensive. Tensions run high when long-time residents can’t afford rising rents. Some begin to call for rent controls or other measures to prevent demographic churn. But rent control is a temporary fix at best; in the longer term, its effects are negative. By reducing supply, rent control tends to drive up the cost of housing. And in the face of price controls, landlords may seek to exit the rental market entirely, further exacerbating any housing shortage. What, then, does this mean for urban development? How can cities evolve without completely displacing their middle and […]

Bill Hudnut at the Urban Land Institute wrote a post that attracted some attention at Austin Contrarian and Overhead Wire. Hudnut discusses a different approach to taxing land: How about restructuring the property tax across America to install a two-tiered system? More tax on those horizontal pieces of empty land and asphalt, less on the buildings. That is, reduce the tax rate on homes and other improvements, and substantially increase the rate on the site value. I think such a system would induce more compact development and more infill work. It sure would induce more development. Higher taxes on the land, lower taxes on the building, discourages a land holder from leaving his land fallow and speculating on its increased value, and conversely, encourages improvements on the land and redevelopment. The monograph used Sydney Australia as a case study, but its general point, that a site value tax system puts “pressure on owners to sell their property for redevelopment if they cannot or will not redevelop it themselves.” Note that ULI is an organization primarily of real estate developers, investors, and related professions. (I am a member.) So, I can see why developers would favor a mechanism that would force more land into development. Overall, this type of scheme will help drive development in the short run, but be harmful in the long-run. By encouraging development in the present by discouraging land speculation, we can expect a few consequences: Speculators play an important role in the land market, even if we don’t like the surface parking lots they often operate on their land. Speculators essentially hold the land until development is optimal for the site, and all sites cannot be optimally built at once. Discouraging speculation drives the land into the hands of developers at cheaper prices than current market […]

I recently googled upon a post at a blog called “Rub-a-Dub” that mentioned a land development project in Mount Pleasant, SC called I’On. I imagine the developers of the I’On “Traditional Neighborhood Development” (TND) community are sympathetic with Market Urbanism, as they named streets after John Galt (of Ayn Rand’s Atlas Shrugged), free-market economists Ludwig Von Mises and Thomas Sowell, as well as urbanist writer Jane Jacobs. (ironically, Jane Jacobs Street doesn’t have sidewalks) Who says New Urbanists and free markets can’t mix? (well, I’m sure we all can name at least one such person…) What I found interesting was the story of the development shared in the comments of the post by Vince Graham, Founder and President of the development company. The story really conveyes the struggles developers go through to get projects through the approval process; especially when the standard 20th century, auto-centric layout is being challenged by innovative development solutions. The reason why there is only single family homes and a limited amount of commercial space in the neighborhood is due to unfortunate compromises necessary to get the neighborhood approved through the arduous political process. Here is a summary: A Summary of the Political Background and Permitting History for I’On. Background:The traditional walking neighborhood of I’On is located on a 243-acre infill site in Mt. Pleasant, SC located 5 miles from Charleston’s historic district and 3 miles from the Old Village of Mt. Pleasant. The site is surrounded by conventional subdivision development of the 1950’s, 60’s, 70’s, and 80’s. Approximately 60% of I’On’s acreage was originally comprised of former agricultural fields, 30% was 30-40 year old hard wood growth, and 10% took the form of three man made lakes. The design workshop for I’On took place in May of 1995. I’On received approval in March of […]

Brian Phillips at Live Oaks contacted me regarding the recent post by Stephen Smith on planning in Houston. Brian is a long time opponent of land use restrictions and defender of property rights in Houston. Brian has a different point of view on the subject, and has written a post on his blog, which I hope will spark some lively conversation. Brian invited me to publish a copy of his post at Market Urbanism. Tomorrow, I hope my schedule gives me the opportunity to share some of my thoughts on the topic, because I sympathize with both authors’ points of view. In the meantime, I want to share Brian’s post right away to get readers reactions to it: Urban Legends: Myths About Houston by Brian Phillips In a recent posting titled “Is Houston really Unplanned?” on Market Urbanism, Stephen Smith attempts to debunk alleged myths about Houston and planning. In the process, he actually engages in a much more widespread error–the failure to essentialize. (Here is a good explanation of essentializing.) Smith cites several examples of land use regulations in Houston, such as minimum lot size mandates and regulations dictating parking requirements for new development. He argues that these regulations, along with the city’s enforcement of deed restrictions, refute claims that Houston has developed primarily on the basis of free market principles. Smith’s position is common. Zoning advocates actually used similar arguments in the early 1990’s. Zoning advocates were wrong then, and Smith is now. Admittedly, Houston is not devoid of land use regulations. But the nature, number, and scope of those regulations is significantly different from other cities. There is an essential difference between the regulations in Houston and those in other cities. The permitting process in Houston is relatively fast compared to other cities, and the expenses incurred […]