Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

One common argument against mixing housing types and densities is that if housing type A (for example, townhouses or single-family homes) is mixed with housing type B (for example, condos), the neighborhood will somehow be “ruined” for residents of the less dense housing types. Last week, my new wife and I visited Chicago for our honeymoon. The most interesting street we visited, on Chicago’s wealthy Gold Coast, was Astor Street, just a block from high-rise dominated Lake Shore Drive. What is unusual about Astor Street is its mix of housing types. Although this street is dominated by large attached houses, it also has a few tall-ish buildings next to the townhouses, such as the 25-floor condo building at 1300 North Astor, the 20-story Astor Villas at 1430 North Astor, and the 27-story Park Astor condos at 1515 North Astor. Despite the tall buildings, this street felt like a quiet, beautiful, tree-shaded urban street. And the real estate market seems to agree: recent Zillow ads show a single-family house on Astor Street selling for over $2 million, and another one selling for over $3 million. By contrast, the average house in Astor Street’s zip code (60610) is valued at less than half a million dollars, and only 14.6 percent are worth over $1 million. Clearly, multifamily housing has not “ruined” Astor Street.

In my regular discussions of U.S. zoning, I often hear a defense that goes something like this: “You may have concerns about zoning, but it sure is popular with the American people. After all, every state has approved of zoning and virtually every city in the country has implemented zoning.” One of two implications might be drawn from this defense of Euclidean zoning: First, perhaps conventional zoning critics are missing some redeeming benefit that obviates its many costs. Second, like it or not, we live in a democratic country and zoning as it exists today is evidently the will of the people and thus deserves your respect. The first possible interpretation is vague and unsatisfying. The second possible interpretation, however, is what I take to really be at the heart of this defense. After all, Americans love to make “love it or leave it” arguments when they’re in the temporary majority on a policy. But is Euclidean zoning actually popular? The evidence for any kind of mass support for zoning in the early days is surprisingly weak. Despite the revolutionary impact that zoning would have on how cities operate, many cities quietly adopted zoning through administrative means. Occasionally city councils would design and adopt zoning regimes on their own, but often they would simply authorize the local executive to establish and staff a zoning commission. Houston was among the only major U.S. city to put zoning to a public vote—a surefire way to gauge popularity, if it were there—and it was rejected in all five referendums. In the most recent referendum in 1995, low-income and minority residents voted overwhelmingly against zoning. Houston lacks zoning to this day. Meanwhile, the major proponents of early zoning programs in cities like New York and Chicago were business groups and elite philanthropists. Where votes were […]

Several cities have jumped on the bandwagon of building Micro-apartments, a hot trend in apartment development. San Francisco and Seattle already have them. New York outlawed them, but is testing them on one project, and may legalize them again. Even developers in smaller cities like Denver and Grand Rapids are taking a shot at micro-apartments. At the same time, Chicago is building lots of apartments, and is known for having low barriers to entry for downtown development. Yet we aren’t hearing of much new construction of micro-apartments here. Premier studios are fetching as much as $2,000 a month. Certainly there must be demand for something more approachable to young professionals. In theory, we should expect to see Chicago leading the way in innovative small spaces. Chicago doesn’t have an outright ban on small apartments like New York, but there are four regulatory obstacles in the Chicago zoning code. These are outdated remnants from eras where excluding undesirable people were main objectives of zoning, and combined to effectively prohibit small apartments: 1. Minimum Average Size: Interestingly, there is no explicit prohibition of small units. This is unlike New York City’s zoning, which prohibits units smaller than 400sf. There is, however, a stipulation that the average gross size of apartments constructed within a development be greater that 500sf. Assuming 15% of your floor-plate is taken by hallways, lobbies, stairs, etc; this means for every 300sf unit, you need one 550sf unit to balance it out. Source: 17-2-0312 for residential; 17-4-0408 for downtown 2. Limits on “Efficiency Units”: Zoning stipulates a minimum percentage of “efficiency units” within a development. The highest density areas downtown allow as much as 50%, but these are the most expensive areas where land is most expensive. In areas traditionally more affordable, the ratio is as low as 20% to discourage studios, and encourage […]

1. This week at Market Urbanism: Emily Washington described The Need For Low-Quality Housing in America’s most desirable cities. People of very little means could afford to live in cities with the highest housing demand because they lived in boarding houses, residential hotels, and low-quality apartments, most of which are illegal today. Making housing affordable again requires not only permitting construction of more new units, but also allowing existing housing to be used in ways that are illegal under today’s codes. Adam Hengels posted part 7 in his long dormant Rothbard the Urbanist series Tragically, Rothbard’s insights on these subjects have been mostly neglected for over 30 years, while apologists for sprawl and automobile dominance have nearly monopolized the conversation among free-market advocates. 2. At the Market Urbanism Facebook Group: Naor Deleanu updated us on San Diego‘s stadium subsidy proposal Mark Frazier shares the pros and cons of a privately-run city in India Nolan Gray: Classic New York Streetscapes, Then and Now Interesting what changed and what hasn’t Anthony Ling shared an invite to a conference at NYU. Success Without Design: Lessons from the Unplanned World of Development 3. Elsewhere: Highways gutted American cities. So why did they build them? Stephen Eide makes the case for states taking back control from mismanaged cities. An interview with the author of “Evicted:” a story of “eight peripatetic families in Milwaukee — and two landlords” How Chicago racked up a $662M police misconduct bill …not to be outdone, Chicago’s teachers’ union may strike again 4. Stephen Smith‘s Tweet of the Week: “Housing is a human right,” says the group founded for the sole purpose of preventing new housing from being built https://t.co/mvpBmDda1R — Market Urbanism (@MarketUrbanism) March 19, 2016

1. Where’s Scott? Scott Beyer spent his second week in the Oklahoma City area, finding a place in the relatively wealthy northern college suburb of Edmond, OK. This week he wrote for Governing about New Orleans‘ music noise issue, and profiled a man in Forbes who escaped Cuba by raft for Miami. There are over 1.1 million Cuban immigrants in the United States, and even more than other immigrant groups, they have clustered, with over two-thirds living in greater Miami. What unites this group is not dislike of their home country, but the need to leave the Castro brothers’ Communist regime. 2. At the Market Urbanism Facebook Group: Nolan Gray found another great Daniel Hertz article: Great neighborhoods don’t have to be illegal—they’re not elsewhere John Morris shared Donald Shoup‘s contribution to a Washington Post series on cities becoming less car-dependent (h/t Nolan Gray) John Morris also found a post at Medium calling for repeal of segregationist zoning policies Jeff Fong shared a short podcast interview with Alain Betaud Sandy Ikeda shared Bill Easterly‘s research on the largely unplanned emergence over 400 years of single block in Soho Mark Frasier congratulates Zach Caceras‘ work seeding local reforms at Startup Cities Adam Lang‘s ongoing frustration with urban renewal in his Philadelphia neighborhood which we previously covered 3. Elsewhere: New Geography reposted Nolan Gray’s recent article on Jane Jacob’s Hayekian approach William Fischel will be speaking Tuesday at NYU about his new paper: The Rise of the Homevoters: How OPEC and Earth Day Created Growth-Control Zoning that Derailed the Growth Machine Chris Hagan‘s WBEZ radio piece about population loss in Chicago‘s North Center neighborhood due to restrictive zoning Nick Zaiac wrote Maryland Is an Over-Regulated Disaster: Here’s How to Fix It and published a report at The Maryland Public Policy Institute Commutes in the U.S. are getting longer, reports the Washington Post’s Wonkblog. 4. Stephen […]

1. This week at Market Urbanism: Nolan Gray contributed a post Who Plans?: Jane Jacobs’ Hayekian critique of urban planning discussing Jacobs’ three arguments against central planning: Hayek and Jacobs defended the importance of local knowledge, illustrated the power of decentralized planning, and celebrated the sublime spontaneous orders that organize our lives. Yet their theoretical innovations went largely unnoticed long after their respective publications. Here, the two thinkers diverge: while Hayekian ideas have largely driven centralized economic planning into the dustbin of history, I suspect the Jacobsian urban revolution has only just begun. The post was also discussed at Reason and Urban Liberty 2. Where’s Scott?: Scott Beyer is now in Oklahoma City, with plans to spend this weekend in Stillwater, OK. This week at Forbes, he described urban liberals’ inability to understand housing “filtering”: Officials believe that if new projects can’t be forced to charge lower prices, they shouldn’t be allowed at all. A smarter approach would be to view such projects the way one would view a gated community of mansions. Sure, such housing isn’t affordable, but it still serves a purpose: to provide rich people a place to live, thereby opening up older, smaller, less luxurious units for lower-income people. 3. At the Market Urbanism Facebook Group: Nolan Gray shared a CityLab piece quantifying the influx of young people in downtowns Private Protection Co. Puts Govt. Police to Shame in Detroit via Mark Frazier Bad news from John Morris: L.A. is seizing tiny homes from the homeless What Computer Games Taught Daniel Hertz About Urban Planning via Erik Genc 4. Elsewhere: Strong Towns spent the week discussing the numerous ways federal housing policies distort the marketplace against walkable urban environments. Lots of good reads and podcasts… Chicago plans to use Eminent Domain to seize the old Post Office and sell it. (when Chicago issues an RFP, […]

1. Where’s Scott?: Scott Beyer returned to New Orleans for the end of Mardi Gras. This week at Forbes, he wrote a 4-part series on the “Quirks of New Orleans Culture,” covering things like Second Line Parades, King Cake, Mardi Gras Balls, and other idiosyncrasies. There are certain commentators who will argue that, thanks to gentrification, corporatism, and globalization, U.S. cities are losing their cultural distinctiveness. These people should really try leaving their rooms more often. One thing I’ve noticed while traveling is that cultural differences, in fact, remain alive and well in America. And nowhere is this more evident than New Orleans. 2. At the Market Urbanism Facebook Group: John Morris shared Daniel Hertz’s latest, Report: Market-rate housing construction is a weapon against displacement; and some good news from Los Angeles LA’s Metro Going to Start Charging For Parking at Rail Stations Tory Gattis notified readers about Club Nimby, a new blog by Austin attorney Chris Bradford (of Austin Contrarian fame) that tries to better explain the phenomenon of American Nimbyism. We don’t talk about Atlanta enough, so Mike Lewyn shared Atlanta’s War on Density “The data says we’re right,” says Nick Zaiac about the report on market-rate development 3. Elsewhere: fxstreet.com covers Chicago‘s dreary financial situation, namely for the public school system. Bond buyers would have the promise that CPS will use its “full faith and credit” to repay the bonds. There’s only one problem. It’s a lie, and the district officials know it. The term “full faith and credit” means that a borrower will use all assets available to repay a debt. But Chicago’s school system, in the footsteps of Detroit two years ago and now Puerto Rico, has no intention of foregoing other expenses to pay bondholders. Charles Marohn loves Memphis, but not the “orderly but dumb” pyramid. MU twitter poll on the likelihood […]

1. This week at Market Urbanism: Nolan Gray‘s second article at Market Urbanism: Return to Sender: Housing affordability and the shipping container non-solution the belief that these projects could address the growing affordability crisis hints at a profound misunderstanding of the nature of the problem and distracts policymakers from viable solutions. 2. Where’s Scott?: Scott Beyer is spending Friday in Mobile, AL, to celebrate Mardi Gras where it was invented. His article this week was at Forbes: Washington, DC Reformed Its Zoning Code; Now Time To Ditch The Height Limits The DC zoning code changes are a testament to this growing consensus favoring deregulation. If it can happen in America’s center of governance, it means similar zoning overhauls may be awaiting other cities. 3. At the Market Urbanism Facebook Group: Alex Tabarrok of Marginal Revolution‘s Quora response to “What do economists think about buying vs renting a house?” via Nolan Gray It’s Superbowl Weekend, and John Morris had coffee with Pittsburgh Post-Gazette columnist, Brian O’Neill to explain why he wants to ‘Tear down Heinz Field’ (Pittsburgh Steelers) Krishan Madan informed us that Cincinnati Built a Subway System 100 Years Ago–BUT NEVER USED IT Sandy Ikeda shared a Guardian piece on the role of cities in shaping musical genres Speaking of music, let’s all sing the “Monorail Song” with Nolan Gray 4. Elsewhere: Alon Levy, Pedestrian Observations: Why Costs Matter Joe Cortwright at City Observatory: Don’t demonize driving—just stop subsidizing it Justin Fox: Why parking your car for free is actually expensive (h/t Donald Shoup) see this too Floating cities in Tokyo Bay?? (h/t Jeff Wood) RIP Bob Elliott: Bob and Ray on Urban Planning (h/t Michael Strong) Chicago may eliminate the Clybourn Planned Manufacturing District. A move Adam Hengels called for in 2014. 5. Stephen Smith‘s Tweet of the Week: SF & NYC’s experiences w/density bonuses/mandatory IZ suggest to […]

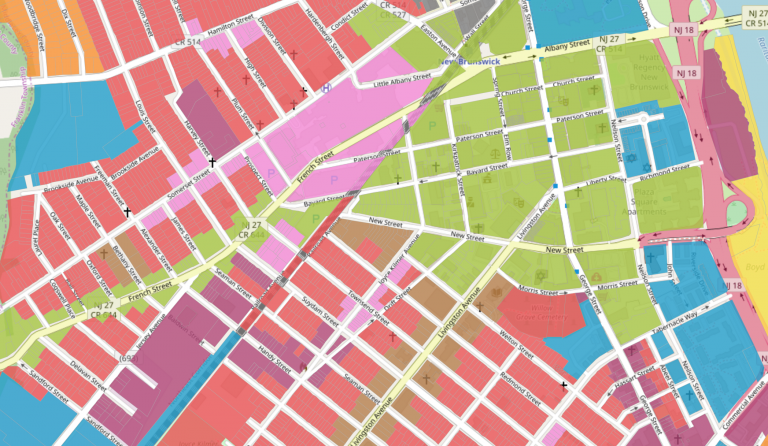

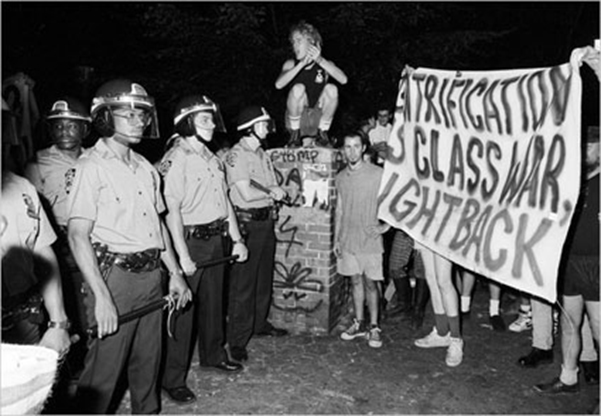

Gentrification is the result of powerful economic forces. Those who misunderstand the nature of the economic forces at play, risk misdirecting those forces. Misdirection can exasperate city-wide displacement. Before discussing solutions to fighting gentrification, it is important to accept that gentrification is one symptom of a larger problem. Anti-capitalists often portray gentrification as class war. Often, they paint the archetypal greedy developer as the culprit. As asserted in jacobin magazine: Gentrification has always been a top-down affair, not a spontaneous hipster influx, orchestrated by the real estate developers and investors who pull the strings of city policy, with individual home-buyers deployed in mopping up operations. Is Gentrification a Class War? In a way, yes. But the typical class analysis mistakes the symptom for the cause. The finger gets pointed at the wrong rich people. There is no grand conspiracy concocted by real estate developers, though it’s not surprising it seems that way. Real estate developers would be happy to build in already expensive neighborhoods. Here, demand is stable and predictable. They don’t for a simple reason: they are not allowed to. Take Chicago’s Lincoln Park for example. Daniel Hertz points out that the number of housing units in Lincoln Park actually decreased 4.1% since 2000. The neighborhood hasn’t allowed a single unit of affordable housing to be developed in 35 years. The affluent residents of Lincoln Park like their neighborhood the way it is, and have the political clout to keep it that way. Given that development projects are blocked in upper class neighborhoods, developers seek out alternatives. Here’s where “pulling the strings” is a viable strategy for developers. Politicians are far more willing to upzone working class neighborhoods. These communities are far less influential and have far fewer resources with which to fight back. Rich, entitled, white areas get down-zoned. Less-affluent, disempowered, minority […]

I noticed an interestingly ironic thing today. The usual argument for the necessity of use-based zoning is that it protects homeowners in residential area from uses that would potentially create negative externalities – ie: smelting factory, garbage dump, or Sriracha factory. Urban Economics teaches us that such an event happening is highly unlikely in today’s marketplace. (nevermind the fact that nuisance laws should resolve these disputes) The business owner who is looking for a site for a stinky business would be foolish to look in a residential area where land costs are significantly higher. However, as Aaron Renn pointed out in the comments of my last post on Planned Manufacturing Districts, the inverse of this is happening in many cities as residential uses begin to outbid other uses in industrial areas: I think part of the rationale in this is that once you allow residential into a manufacturing zone, the new residents will start issuing loud complaints about the byproducts of manufacturing: noise, smells, etc. I know owners of businesses in Chicago who have experienced just that. They’ve been there for decades but now are getting complaints from people who live in residential buildings that didn’t even exist when the manufacturer located there. This puts those businesses under a lot of pressure to leave as officials will almost always side with residents who vote rather than businesses who don’t get to. It’s clear this is a more relevant defense of use-based zoning than the one we usually hear. Of course, I’d argue that segregating uses through zoning isn’t a just way to resolve these disputes, and my last post discusses some of the detrimental consequences for cities. It seems ironic, because it inverts the usual argument in-favor of zoning. Residents are choosing to move near established industrial firms, and PMDs are a tool […]