Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

I frequently reference my post summarizing the interesting research at last year’s Urban Economics Association conference. This year was as insight rich as ever. And the Montreal setting was truly special – it’s a city that’s as European as any…

Jane Jacobs wasn’t optimistic about the future of civilisation. ‘We show signs of rushing headlong into a Dark Age,’ she declares in Dark Age Ahead, her final book published in 2004. She evidences a breakdown in family and civic life, universities which focus more on credentialling than on actually imbuing knowledge in its participants, broken feedback mechanisms in government and business, and the abandonment of science in favour of ‘pseudo-scientific’ methods. Jacobs’ prose is, as always, rich, convincing and successful in making the reader see the importance of her claims. Yet the argument that we are spiralling into a new Dark Age, similar to that which followed the fall of the Roman Empire, is not quite complete and I remain unconvinced that the areas she identified point towards collapse as opposed to merely things we could, and should, work to improve. Let us start with the idea that families are ‘rigged to fail,’ as she puts it in chapter two. Jacobs, urbanist at heart, cites ‘inhumanely long car commutes’ stemming from the disbanding of urban transit systems, rising housing costs, and a breakdown in ‘community resources’ – the result of increasingly low-dense forms of urban development – as a significant reason why families are now set up for failure. She suggests our days are filled with increasingly vacuous activities, leading to the rise of ‘sitcom families’ which ‘can and do fill isolated hours’ at the expense of ‘live friends.’ That phenomenon has now been replaced by the ‘smartphone family’ where time spent on TikTok, and consuming other forms of digital media have supplanted the ‘sitcom’ family of the past. There has been significant literature on the detrimental effects of digital technologies to our physical and mental health, not least in Jonathan Haidt’s most recent book, The Anxious Generation. A similar picture is painted by Timothy Carney in […]

Continuing this series of book reviews on Jane Jacobs’ works, I now turn to Cities and the Wealth of Nations. But there is already a fantastic piece on the Market Urbanism website, by Matthew Robare, who reviews this book and outlines what Jacobs overlooks in her analysis. So, this piece takes a slightly different angle: inspired by (but not limited to) Jacobs’ ideas, it aims to highlight what mayors, governors and urban policymakers could do differently if they are serious about developing their cities into economic powerhouses. Here are some of the most important takeaways from this book and also how they can be expanded upon. (1) Focus on cultivating import-replacement The economies of cities do not grow out of nothing. They grow by adding productive new forms of work to old ones, by innovating, and by being cultivators of new ideas and techniques. This process of cataclysmic growth – that Jane Jacobs describes as ‘import-replacement – occurs when a city takes its existing imports and builds upon them, either improving its production through lowering costs, increasing quality, or innovating. The market for these additional goods can either be found within the city itself or serves to expand the city’s exports. These exports, in turn, bring in additional resources to either acquire additional imports or be reinvested into fuelling the processes that fuel import-replacement. Not for nothing does Jacobs describe import-replacement as a ‘cataclysmic’ process – these changes often happen over a very short period and can bring about a rapid influx of people, ideas and capital. We see this in New York City, which grew from half a million residents in 1850 to over 3.4 million at the dawn of the twentieth century. Detroit went from having 250,000 residents in 1900 to a peak of 1.8 million by 1950. […]

At the heart of Jane Jacobs’ The Economy of Cities is a simple idea: cities are the basic unit of economic growth. Our prosperity depends on the ability of cities to grow and renew themselves; neither nation nor civilisation can thrive without cities performing this vital function of growing our economies and cultivating new, and innovative, uses for capital and resources. It’s a strikingly simple message, yet it’s so easily and often forgotten and overlooked. Everything we have, we owe to cities. Everything. Consider even the most basic goods: the food staples that sustain life on earth and which in the affluent society in which we now reside, abound to the point where obesity has become one of the leading causes of illness. Obesity sure is a very real problem and one we ought to work to resolve (probably through better education and cutting those intense sugar subsidies). Yet this fact alone is striking! For much of mankind’s collective history, the story looked very different: man (and it usually was a man) would spend twelve or maybe more hours roaming around in the wild to gather sufficient food to survive. Our lives looked no different to the other animals with which we share the earth. An extract from The Economy of Cities: ‘Wild animals are strictly limited in their resources by natural resources, including other animals on which they feed. But this is because any given species of animal, except man, uses directly only a few resources and uses them indefinitely.’ What changed? Anthropologists, economists, and historians will tell you it was the Agricultural Revolution, which occurred when man began to settle in small towns and cultivate the agricultural food staples that continue to make up the bulk of our diet: wheat, barley, rice, corn, and animal food products. But […]

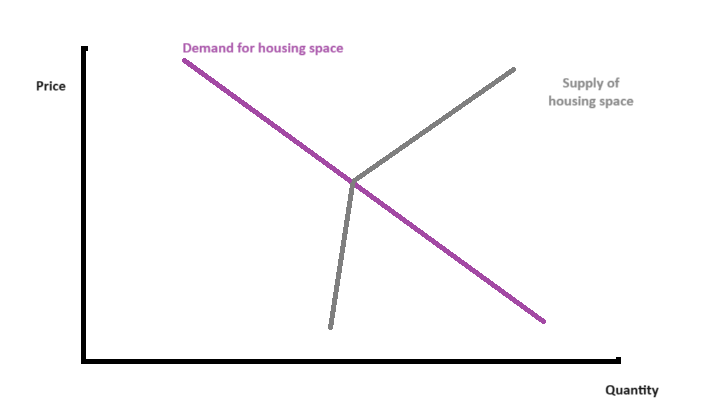

Should YIMBYs support or oppose greenfield growth? Two basic values animate most YIMBYs: housing affordability and urbanism. Sprawl puts those values into tension. Let’s take as a given that sprawl is “bad” urbanism, mediocre at best. Realistically, it’s rarely going to be transit-oriented, highly walkable, or architecturally profound. So the question is whether outward, greenfield growth is necessary to achieve affordability. And the answer from urban economics is yes. You can’t get far in making a city affordable without letting it grow outward. Model 1: All hands on deck Let’s start with a nonspatial model where people demand housing space and it’s provided by both existing and new housing. Existing housing doesn’t easily disappear, so the supply curve is kinked. A citywide supply curve is the sum of a million little property-level supply curves. We can split it into two groups: infill and greenfield, which we add horizontally. If demand rises to the new purple line, you can see that the equilibrium point where both infill & greenfield are active is at a lower price & higher quantity than the infill-only line. The only way to get some infill growth to replace some greenfield growth, in this model, is to raise the overall price level. And even then, the replacement is less than 1-for-1. Of course, this is just a core YIMBY idea reversed! In most U.S. cities, greenfield growth has been allowed and infill growth sharply constrained, so that prices are higher, total growth is lower, and greenfield growth is higher than if infill were also allowed. At the most basic level, greenfield growth is simply one of the ways to meet demand. With fewer pumps working, you’ll drain less of the flood. Model 2: Paying for what you demolish Now let’s look at a spatial model where people […]

How much should we blame planning for the degree to which cities sprawl? As much time as we (justifiably) spend here on this blog explaining how conventional U.S. planning drives excessive sprawl, it’s worth periodically remembering that, at the end of the day, the actual extent of the horizontal expansion of cities is largely outside the control of urban planning. Consider Houston. Whenever I say anything nice about Houston’s relatively liberal approach to land-use regulation, someone invariably comments some variation of the following: “Yes, that’s all well and good in theory. But in practice, heavily regulated cities like Boston are far more urban and walkable, so maybe relaxed land-use regulations aren’t so great.” Indeed, most of Houston is classic sprawl. But this begs the question: to what extent can urban planning policy be blamed for sprawl? The urban economist Jan Brueckner, drawing on an extensive literature, distinguishes between the “fundamental forces” that naturally drive urban growth outward and the market failures that push this growth beyond what might occur in an appropriately regulated market. (For the purposes of this post, I’ll be using “sprawl” and “horizontal urban expansion” interchangeably. In the same paper, Brueckner thoughtfully distinguishes the two.) The latter, urban planners can address. The former, not so much. Let’s look first at the “fundamental” variables that planners have little to no control over. Brueckner identifies three: population growth, rising income, and falling commuting costs. The first variable is obvious: as cities grow, demand for all housing goes up, and some of that housing goes out on the periphery regardless of planning policy. Metropolises like Houston, Dallas, and Atlanta are currently experiencing 2% population growth every year, meaning they are on track to double in population in the next 35 years. You would expect a lot of horizontal expansion, all else […]

The great failing of modern land-use regulation is the failure to allow densities to naturally change over time. Let me explain. Imagine you are trying to sell a property you own in a desirable inner suburban neighborhood in your town. The lot is 4,000 square feet and hosts an old 4,000 square-foot home. There is incredible demand for housing in this area; perhaps the schools are good, or the amenities are nice, or the neighborhood sits adjacent to a major jobs center, meaning that residents can walk to work. I’ll leave the reasons to you. Who do you sell it to? You have at least two options: First, you could sell it to a wealthy individual, who would use the entire property as his home. He is willing to pay the market rate for single-family homes like this, which in this case is $300,000. Under current financing, he would likely have a monthly mortgage payment in the ballpark of $1,300. Second, you could sell it to a developer who intends to subdivide the house into four 1,000 square foot one-bedroom apartments, renting each of them at a market rate of $500 to service workers who commute to downtown. After factoring in expenses, her annual net operating income would be around $20,160. Assuming a multifamily cap rate of 6.0.%, this means that she could pay up to $336,000 for your property. Based on this analysis, who do you sell it to? The answer is obvious: you will sell it to the multifamily developer who will subdivide and rent out the house, not necessarily because you’re a bleeding heart urbanist, but in order to maximize your earnings. As rents in the area rise, the pressure to sell to a buyer who would densify the property will only grow. The prospective mansion buyer […]

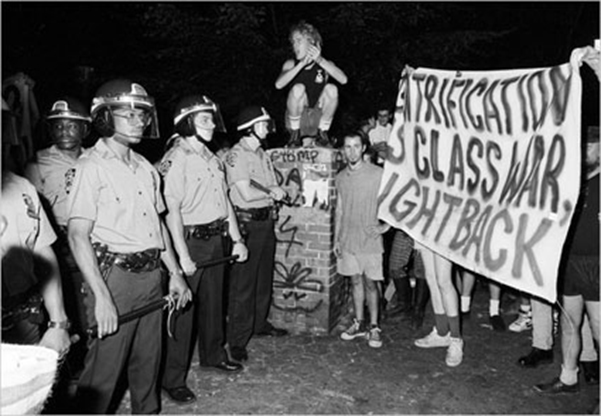

Gentrification is the result of powerful economic forces. Those who misunderstand the nature of the economic forces at play, risk misdirecting those forces. Misdirection can exasperate city-wide displacement. Before discussing solutions to fighting gentrification, it is important to accept that gentrification is one symptom of a larger problem. Anti-capitalists often portray gentrification as class war. Often, they paint the archetypal greedy developer as the culprit. As asserted in jacobin magazine: Gentrification has always been a top-down affair, not a spontaneous hipster influx, orchestrated by the real estate developers and investors who pull the strings of city policy, with individual home-buyers deployed in mopping up operations. Is Gentrification a Class War? In a way, yes. But the typical class analysis mistakes the symptom for the cause. The finger gets pointed at the wrong rich people. There is no grand conspiracy concocted by real estate developers, though it’s not surprising it seems that way. Real estate developers would be happy to build in already expensive neighborhoods. Here, demand is stable and predictable. They don’t for a simple reason: they are not allowed to. Take Chicago’s Lincoln Park for example. Daniel Hertz points out that the number of housing units in Lincoln Park actually decreased 4.1% since 2000. The neighborhood hasn’t allowed a single unit of affordable housing to be developed in 35 years. The affluent residents of Lincoln Park like their neighborhood the way it is, and have the political clout to keep it that way. Given that development projects are blocked in upper class neighborhoods, developers seek out alternatives. Here’s where “pulling the strings” is a viable strategy for developers. Politicians are far more willing to upzone working class neighborhoods. These communities are far less influential and have far fewer resources with which to fight back. Rich, entitled, white areas get down-zoned. Less-affluent, disempowered, minority […]

Wow! This market is a mess. As a great follow up to his posts at CafeHayek on government’s intervention in the housing market, Russell Roberts discusses the situation and bailout with reason.tv: Also… Here’s the video from an Economics forum discussion at MIT (my Alma mater) on Wednesday: The US Financial Crisis What Happened? What’s Next? And another forum at USC. [HT Richard’s Real Estate and Urban Economics Blog]