Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

In the WSJ, Jeff Yass & Steve Moore play the world’s smallest violin for the poor homeowners who are sitting on more than half a million dollars of nominal capital gains and therefore cannot sell. If only that tiny number…

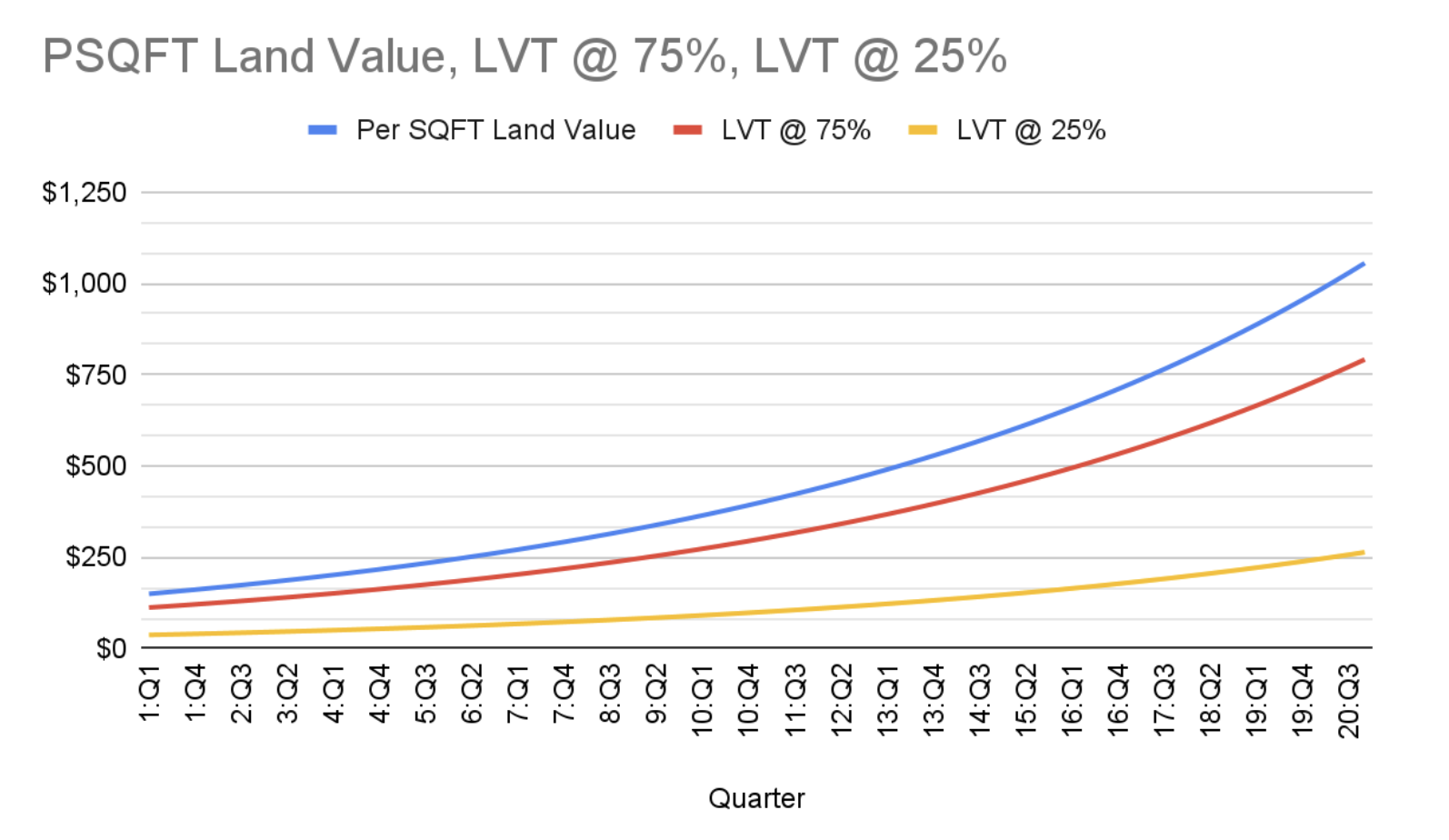

Georgists assert that a Land Value Tax (LVT) ensures land is always put to its most efficient use. They claim that increased carrying costs deter speculation. And if valuable land is never held out of use, society is better off. I think the story about incentives is correct. But I question whether pulling development forward in time is definitionally more efficient. In a world with transaction costs, tradeoffs abound and it’s worth thinking through the implications of an LVT. A Tale of Two Cities Picture a growing local economy with increasing land values and an LVT. Now suppose we split the time stream and create two parallel universes with different tax rates. In scenario A, we apply an LVT at 75%; in scenario B the LVT is set at 25%. There are two important questions here: 1) When will a given parcel be forced into development? 2) What intensity of development will the parcel support at the moment it’s put into productive use? To answer our first question, we look at the tax curves and make some assumptions. Suppose carrying costs push land into productive use at $250 psqft in LVT costs, scenario (a)’s parcel goes into development around year 9 at a $331 psqft. Scenario (b)’s parcel doesn’t see development until year 20 and a ~$1K psqft value. Given the delta between year 9 and year 20’s psqft valuations, we could expect to see different intensities of development. We’re now left with the question of whether a duplex in nine years is better than a mid-rise in twenty. Appropriating the full rental value of land would pull development forward, but that doesn’t definitionally lead to it being put to its highest and best use. Highest and best is contingent upon what time scale we’re optimizing for and that choice […]

One reason for California’s high housing costs might be Proposition 13. This law, passed by referendum in the 1970s, may discourage housing production in two significant ways. First, under Proposition 13, all housing- even vacant land- is taxed at its original purchase price rather than its current value. By artificially capping taxes on vacant land, this part of Proposition 13 ensures that a landowner does not suffer as much from keeping land vacant as it would under another tax system. Second, by reducing local property taxes, Proposition 13 forced municipalities to rely on other sources of revenue, such as sales taxes. Because retail shops bring in more sales tax revenue than residential uses, this law gave California towns an incentive to favor the former. * New York’s Gov. Cuomo has recently proposed a tax cut that buys popularity for state lawmakers on the backs of municipalities. In 2011, the state passed a law to limit local governments’ property tax increases to 2 percent or the rate of inflation, whichever is lower. This cap was originally temporary, but Cuomo now proposes to make it permanent. A bill implementing Cuomo’s proposal was recently passed by the State Senate, but has yet to be voted on by the State Assembly. Historically, the cap has not included high-cost New York City, but that may change. If the cap does include New York City, will it have the same results as Proposition 13? Probably not, for two reasons. First, the tax cap, unlike Proposition 13, does not artificially favor property purchased long ago, and thus does not discourage people from selling their property. Second, New York State has to consent to sales tax increases, so municipalities don’t have as much of an incentive as their California counterparts to favor land uses that bring in lots […]

Housing has a lot going against it in the California. But amidst all the legal, political, and regulatory roadblocks, there’s one law that sneaks by largely unnoticed: Prop 98. Prop 98 guarantees a minimum level of state spending on education each year. Sacramento pools most city, county, and special district property taxes into special education funds to meet this commitment. The localities only get to keep a small part of the property tax revenues for their own general budgets. This system creates a disincentive for cities to permit housing. New housing brings in new residents who need city services. But it doesn’t bring in a commensurate increase in property taxes since most of that revenue gets scooped up by Sacramento. Commercial development, though, brings in taxes a city gets to keep. Sales and hotel taxes are significant revenue streams. And they don’t cause the kinds of strain on city services that new residential does. Reforming Prop 98 might be low hanging fruit. Changing the formula to appropriate a broader stream of city revenues might help ease the bias against housing. And it might even be possible to amend the law without having to fight the California Teachers Association. As long as there’s no net decrease in education funding, of course. It’s tough to say exactly how much new housing Prop 98 actually prevents. Different cities get to keep different amounts of their property taxes, so the disincentive differs case to case. And there are plenty of other things like CEQA and Prop 13 which put a drag on new construction as well. But where CEQA and Prop 13 make it easier for residents who are already NIMBYs to gum up the works, Prop 98 is a reason in itself for a city to avoid residential development. So while we can’t do […]

Recently I’ve been delaying posting a few things because I wanted to wait till I had more time to cover them, but I’m realizing that I’ll probably have new things to write about on the 15th (which is when regular posting will hopefully resume), so have at it – your first ever premium link list: 1. The Bowles-Simpson Plan is out (but apparently it’s not the final plan that will be presented to Obama), and it looks like a great deal for market urbanism. Their “Zero Plan” is a broad base, low rate approach that eliminates all tax deductions and credits, including not only the mortgage-interest rate deduction that we’ve discussed earlier, but also the tax break that businesses get for providing employees with parking that Shoup criticized a few weeks ago. (By the way, that first linked TPM article is by far the most comprehensive and concise outline of the plan that I’ve seen in the media so far.) 2. Cap’n Transit gives an overview of his local community group’s proposal for eliminating parking minimums in a politically-palatable way. Spoiler: it involves everybody’s favorite transit maps – frequency maps! People involved in DC’s recent moves towards parking reform should especially take note, since the success of their plan depends on the definition of “good transit service.” 3. Reinventing Parking has a post on illegal parking extortion in developing countries. In India and Bangladesh, which Paul Barter discusses, the problem is parking contractors illegally raising prices. In Bucharest, though, where I used to live, the “extortionists” were much less organized, usually gypsy street kids, who didn’t do much to stop you from parking, don’t actually provide protection for the car, and probably aren’t going to do anything to your car but guilt trip you if you don’t pay them. In either […]

Urbanism doesn’t get a lot of breaking news (that is, unless Eric Fidler’s prediction pans out), but this might be an exception: the WSJ is reporting that Obama’s (bipartisan?) deficit commission is considering cutting the mortgage-interest tax deduction. The reports are all very speculative, but it looks like they’re definitely not considering eliminating the tax break entirely. While most libertarians have advocated eliminating the tax break (and in fact all tax breaks) completely and adjusting the general tax rates to make the measure revenue-neutral, it looks like this (along with cuts to the child tax credit, among others) is a cost-saving measure. As I discussed earlier today, the tax credit is just one of many highly regressive government advantageous to wealthy homeowners – the vast majority of Americans don’t even itemize their tax returns, and therefore don’t benefit at all from the tax break. Still, in spite of its regressiveness, it’s enormously popular among voters. Leaving aside considerations of whether the savings should be used to pay down the deficit or to lower marginal rates, any move to limit this deduction would be a good thing for urbanism. While the American ideal of the homeowner involved in a positive way in their community and schools is prevalent, I fear that the greater effect of increasing homeownership above the market equilibrium is to encourage NIMBYism by making people look at their home, rather than their wider community, as their biggest asset. Furthermore, it puts people in the awkward position of desiring a rise in cost for one of life’s most essential needs, which clearly played a large role in the policies that led up to the subprime crash. While this proposed change is certain to encounter fierce resistance from America’s real estate industry and wealthy, entrenched suburban interests, it is only a […]

Matt Yglesias has been on a roll lately with the urbanism posts, all of which have a heavy “market urbanist” slant, but it’s this post about parking reform in/around Boston (riffing off of this Boston Globe article) that seals the deal for me: Regulators pushing developers to build less parking than they want is much, much, much better than the near-universal practice of regulators mandating minimum levels of parking. But I do think the message is clearer and the potential political coalition bigger if parking reformers just stick to the idea that this should be left up to the market. Cars are useful, and people who have cars need to park them. So there’s nothing wrong with building parking. But urban space is expensive, and parking spaces take up space, so people should weigh the costs and benefits of building/buying more parking against other possibilities. Getting to market-determined levels of parking construction and parking space pricing would be a huge victory, and it’s not particularly necessary to go beyond that. I guess the only thing I’d have to add is that while I think these sort of parking maximums and general density-forcing rules are of minor import compared to the massively anti-density status quo, they do give rhetorical ammo to people like Randal O’Toole and other self-proclaimed libertarian types who like to claim that what planners really want is to banish cars entirely from cities. The sad truth is that they’re right – New Urbanism/Smart Growth might have some libertarian issues at heart, but at the end of the day, they’re out to put us all on trains/buses/bikes/our own two feet, not to set the market right. Now again, I think that O’Toole & Co. vastly overestimate the influence of density-forcing regulations, but they do have somewhat of a point. […]

Don Boudreaux to the Washington Times: LETTER TO EDITOR: Roads don’t need new taxes Thursday, July 24, 2008 Upset that Virginians’ taxes were not recently raised to construct more roads, State Delegate Brian J. Moran, Alexandria and Fairfax Democrat, declares that “Government has an important role to play in strengthening our infrastructure, developing our economy and creating new jobs” (“Virginia’s transportation conundrum,” Op-Ed, Tuesday). Not so fast. Infrastructure that we today naively suppose must be supplied by government has in the past often been supplied by the private sector – supplied so well, indeed, that these private-infrastructure projects helped to spark the Industrial Revolution in 18th-century Britain. Harvard University historian David S. Landes explains: “At the same time, the British were making major gains in land and water transport. New turnpike roads and canals, intended primarily to serve industry and mining, opened the way to valuable resources, linked production to markets, facilitated the division of labor. Other European countries were trying to do the same, but nowhere were these improvements so widespread and effective as in Britain. For a simple reason: nowhere else were roads and canals typically the work of private enterprise, hence responsive to need (rather than to prestige and military concerns) and profitable to users…. These roads (and canals) hastened growth and specialization.” DONALD J. BOUDREAUX Chairman Economics Department George Mason University Fairfax Also, Cafe Hayek – Infrastructure and the State (by Don Boudreaux) for some good discussion in the comments.

Welcome to the final post in the series discussing the consequences of rent control. Thank you to the subscribers who have patiently awaited each new post. I hope everyone found it enlightening. If you haven’t read the entire series, you can catch up with these links: Rent Control Part One: Microeconomics Lesson and Hording Rent Control Part Two: Black Market, Deterioration, and Discrimination Rent Control Part Three: Mobility, Regional Growth, Development, and Class Conflict Conclusion Rent control is not just a simple price control setting the price at which willing renters and landlords are permitted to do business, it is much worse. It is a coercive act that gives landlords no legal option, but to rent to a tenant against his will, often at a financial loss. Rent control adds a non-voluntary burden to landlords which deepens over time because landlords do not have the option to rent to a tenant at below market rates. Not only does rent control cause huge distortions in the housing market, but the burdens fall disproportionately on the poor and underprivileged people it was intended to benefit. Although particular people are able to live with the comfort of low rent payments, even those renters will see their living conditions deteriorate as landlords neglect repairs and maintenance. As the situation gets worse, middle class residents are able to move away, leaving behind the poorest residents who have become reliant on the reduced rent. In effect, rent control grants property rights to renters, that originally belonged to the original property owners. Rent control becomes a redistribution of wealth to rent control tenants away from apartment owners, market apartment renters, and newcomers to the area. Nonetheless, over time the quality of life decreases for all residents of a city where rent control is imposed. Solutions So, it […]

Part One of this series was a refresher on the Microeconomics of Rent Control and touched on how it encourages hoarding Part Two discussed rent controls influence on the black market for apartments, rental property deterioration and housing discrimination. Here in Part Three, we will discuss how rent control hampers mobility, regional growth, tax revenue, apartment development, and becomes a catalyst for class conflict. Mobility As mentioned in Rent Control Part One, duration of residence in a rent-controlled apartment has been observed to be three times as long as duration at market-rate apartments. One can see that the incentive to hoard rent-controlled apartments is also disincentive to relocate. The mobility of both the tenants and newcomers are drastically hampered by rent control. Unless the tenant has the money to rent a second apartment (or Governor’s mansion), it will be difficult for him to relocate closer to better employment. The tenant may rather endure a very long commute in order to maintain the rent-controlled apartment. As Walter Block put it, "They are, in a sense, trapped by the gentle and visible hand that keeps them where they are rather than where they might do better." Difficulties are multiplied if the local economy takes a turn for the worse. A downturn in local employment would not be relieved by people relocating for jobs, thus making the unemployment and poverty situation worse. Employees looking to relocate in the city with rent control are hurt the worst as they will have a difficult time finding available apartments. The drawbacks to the local economy are discussed in the section on regional growth and adaptation. The reduction in mobility is especially burdensome on families with children, since public schools tend to be local. If the local school is under performing, a family under rent-control will lose […]