Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

This post was originally published at mises.org and reposted under a creative commons license. It’s no secret that in coastal cities — plus some interior cities like Denver — rents and home prices are up significantly since 2009. In many areas, prices are above what they were at the peak of the last housing bubble. Year-over-year rent growth hits more than 10 percent in some places, while wages, needless to say, are hardly growing so fast. Lower-income workers and younger workers are the ones hit the hardest. As a result of high housing costs, many so-called millennials are electing to simply live with their parents, and one Los Angeles study concluded that 42 percent of so-called millennials are living with their parents. Numbers were similar among metros in the northeast United States, as well. Why Housing Costs Are So High? It’s impossible to say that any one reason is responsible for most or all of the relentless rising in home prices and rents in many areas. Certainly, a major factor behind growth in home prices is asset price inflation fueled by inflationary monetary policy. As the money supply increases, certain assets will see increased demand among those who benefit from money-supply growth. These inflationary policies reward those who already own assets (i.e., current homeowners) at the expense of first-time homebuyers and renters who are locked out of homeownership by home price inflation. Not surprisingly, we’ve seen the homeownership rate fall to 50-year lows in recent years. But there is also a much more basic reason for rising housing prices: there’s not enough supply where it’s needed most. Much of the time, high housing costs come down to a very simple equation: rising demand coupled with stagnant supply leads to higher prices. In other words, if the population (and household formation) is […]

Inclusionary Zoning is an Oxymoron The term “Inclusionary Zoning” gives a nod to the fact that zoning is inherently exclusionary, but pretends to be somehow different. Given that, by definition, zoning is exclusionary, Inclusionary Zoning completely within the exclusionary paradigm is synonymous with Inclusionary Exclusion. What is Inclusionary Zoning? “Inclusionary Zoning” is a policy requiring a certain percentage of units in new developments to be affordable to certain income groups. Sometimes, this includes a slight loosening of restrictions on the overall scale of the development, but rarely enough loosening to overcome the burden of subsidizing units. Many cities, particularly the most expensive ones, have adopted Inclusionary Zoning as a strategy intended to improve housing affordability. Often, demand for below-market units are so high, one must literally win a lottery to obtain a developer-subsidized unit. Economics of Exclusion We must first acknowledge the purpose of zoning is to EXCLUDE certain people and/or businesses from an area. Zoning does this by limiting how buildings are used within a district, as well as limiting the scale of buildings . These restriction cap the supply of built real estate space in an area. As we know from microeconomics, when rising demand runs into this artificially created upward limit on supply, prices rise to make up the difference. As every district in a region competes to be more exclusive than its neighbors through the abuse of zoning, regional prices rise in the aggregate. Since the invention of the automobile, and subsequent government overspending on highways, sprawl has served as the relief valve. We’ve built out instead of up for the last several decades and this sprawl has relieved some of the pressure major metropolitan areas would have otherwise felt. In fact, it’s worked so well–and led to the abuse of zoning rules for such a long time–that exclusionary zoning has become the accepted paradigm. Zoning is the default flavor of […]

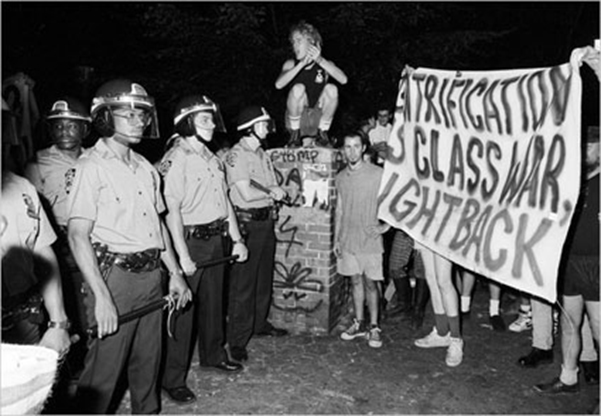

Gentrification is the result of powerful economic forces. Those who misunderstand the nature of the economic forces at play, risk misdirecting those forces. Misdirection can exasperate city-wide displacement. Before discussing solutions to fighting gentrification, it is important to accept that gentrification is one symptom of a larger problem. Anti-capitalists often portray gentrification as class war. Often, they paint the archetypal greedy developer as the culprit. As asserted in jacobin magazine: Gentrification has always been a top-down affair, not a spontaneous hipster influx, orchestrated by the real estate developers and investors who pull the strings of city policy, with individual home-buyers deployed in mopping up operations. Is Gentrification a Class War? In a way, yes. But the typical class analysis mistakes the symptom for the cause. The finger gets pointed at the wrong rich people. There is no grand conspiracy concocted by real estate developers, though it’s not surprising it seems that way. Real estate developers would be happy to build in already expensive neighborhoods. Here, demand is stable and predictable. They don’t for a simple reason: they are not allowed to. Take Chicago’s Lincoln Park for example. Daniel Hertz points out that the number of housing units in Lincoln Park actually decreased 4.1% since 2000. The neighborhood hasn’t allowed a single unit of affordable housing to be developed in 35 years. The affluent residents of Lincoln Park like their neighborhood the way it is, and have the political clout to keep it that way. Given that development projects are blocked in upper class neighborhoods, developers seek out alternatives. Here’s where “pulling the strings” is a viable strategy for developers. Politicians are far more willing to upzone working class neighborhoods. These communities are far less influential and have far fewer resources with which to fight back. Rich, entitled, white areas get down-zoned. Less-affluent, disempowered, minority […]

Pretty interesting article in the NYT today about the Gotham West development that recently broke ground on Manhattan‘s far west side. But I think the part about affordable housing could use some context: But the bulk of the project will be affordable units, 682 of them, or more than half the total homes….

Apparently I’m not the only one who thinks London’s Shard skyscraper (shameless article-I-wrote-about-London-skyscrapers plug) looks like Pyongyang’s Ryugyong Hotel. Koryo Tours, the only tour group that offers westerners package to North Korea, plays up the similarities on its blog: To the eyes of us all at Koryo Tours it looks like Renzo Piano has been copying Pyongyang… (Note the following is not 100% accurate – but close!…

There’s been a lot of handwringing by American lefties over the austerity plans that Germany is asking indebted eurozone governments like Italy and Greece to implement in exchange for bailouts, but many aspects of the plans – especially labor market deregulation – are long overdue no matter which side if the aisle you sit on (in the US, at least). In searching for information on the deregulatory aspects of Prime Minister Mario Monti’s “Save Italy” austerity plan, I came upon this interesting bit on transport deregulation in Corriere della Sera. I’ve never actually studied or spoken Italian, but hopefully this is a workable translation, if a bit literal: The recipe that the Antitrust Authority has chosen for taxi liberalization will double the number of licenses, but with each driver receiving a second one as compensation….

Scrapping viaducts like this would make California HSR cheaper, faster to build, and easier to maintain, without a loss in quality The recent peer review report recommending that California delay construction on the first segment of its high-speed rail project has caused a bit of consternation in the transit twittosphere. Blogger The Overhead Wire wrote, “Sorry, but defunding HSR won’t make local agencies $10b richer.” I replied, “But it might start a long-overdo convo on costs,” and he responded (and many agreed): “and then nothing will get done in my lifetime and costs won’t matter….

Are America's private railroading glory days gone forever? The folks at Freakonomics have asked me to contribute to a “Quorum” on Amtrak and whether it can ever be profitable. Maybe I was a sucker, but it looks like I hewed closer to the question that some of the other contributors….

Cornell-Technion has released another “fly-over” video, this one focused on the interior. But it does shed a bit more light on what the development will look like from the ground, and it ain’t pretty – the campus will be laid out in a fairly Corbusian plan, replete with lots of concrete plazas and grassy knolls (especially near the campus’ northern gateway to the rest of the island), and no retail space in sight. The empty spaces in the video are packed with students milling around, admiring the beautiful grassy fields and sloping moss interiors. But anyone who’s ever been to one of New York‘s many towers-in-a-park high-rises or zoning code-enabled privately-owned public spaces knows better than to believe that what New Yorkers really want is a bunch of grass and concrete to hang out on….

The sky's the limit for Dumbo! Last night I wrote a blog post about tech development in New York City, arguing that before the city pours money into a science campus for Cornell on Roosevelt Island, its planners should make more room for entrepreneurs in existing tech hubs like Union Square and Dumbo. …