Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

We are blessed and cursed to live in times in which most smart people are expected to have an opinion on zoning. Blessed, in that zoning is arguably the single most important institution shaping where we live, how we move around, and who we meet. Cursed, in that zoning is notoriously obtuse, with zoning ordinances often cloaked in jargon, hidden away in PDFs, and completely different city-to-city. Given this unusual state of affairs, I’m often asked, “What should I read to understand zoning?” To answer this question, I have put together a list of books for the zoning-curious. These have been broken out into three buckets: “Introductory” texts largely lay out the general challenges facing cities, with—at most—high-level discussions of zoning. Most people casually interested in cities can stop here. “Intermediate” texts address zoning specifically, explaining how it works at a general level. These texts are best for people who know a thing or two about cities but would like to learn more about zoning specifically. “Advanced” texts represent the outer frontier of zoning knowledge. While possibly too difficult or too deep into the weeds to be of interest to most lay observers, these texts should be treated as essential among professional planners, urban economists, and urban designers. Before I start, a few obligatory qualifications: First, this not an exhaustive list. There were many great books that I left out in order to keep this list focused. Maybe you feel very strongly that I shouldn’t have left a particular book out. That’s great! Share it in the comments below. Second, while these books will give you a framework for interpreting zoning, they’re no substitute for understanding the way zoning works in your specific city. The only way to get that knowledge is to follow your local planning journalists, attend local […]

Elizabeth Warren’s housing bill has received a lot of love from those who favor of land use liberalization. Like Cory Booker’s housing bill, the Warren bill would seek to encourage state and local land use reform using federal grants as an incentive. Warren’s bill would significantly increase funding for the Housing Trust Fund and provide a small increase in allocations for public housing maintenance. However, Warren’s bill also includes new subsidies to homeownership and policies that could reduce the production of new renter-occupied housing relative to owner-occupied housing. There’s a trade off in housing policy between promoting homeownership as a wealth-building tool and promoting affordability that politicians, including Warren, have failed to confront. Rather than promoting housing affordability by rolling back policies that subsidize homeowners at the expense of renters, Warren’s bill seeks to reduce exclusionary, suburban zoning at the same time it introduces new policies to incentivize homeownership. First, Warren’s bill would require most foreclosed homes to be sold to new owner-occupants, rather than to landlords who would rent them out. The intention of the bill is to prevent institutional investors from profiting from foreclosures, but this approach has a strong anti-renter bias. When changes in economic conditions, demographics, or preferences lead to an increase in the proportion of Americans who want to rent rather than own, this policy would stand in the way of homes being adapted to meet new needs. Second, the bill would provide down payment assistance to first-time homebuyers who live in, or were displaced from, historically redlined neighborhoods. All levels of government have played horrific roles in excluding minorities from white neighborhoods and subsidizing wealth-building through home equity for white households alone. The victims of these policies deserve to be compensated for this unfairness. The Justice Department and the Department of Housing and Urban […]

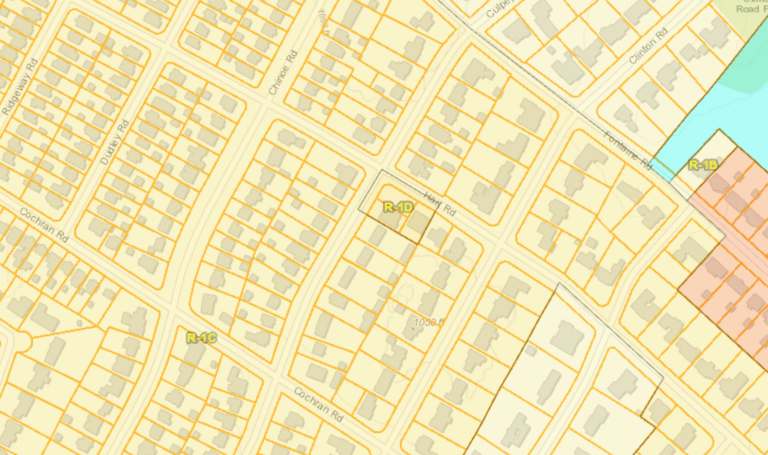

As zoning has become more restrictive over time, the need for “safety valve” mechanisms—which give developers flexibility within standard zoning rules—has grown exponentially. U.S. zoning officially has two such regulatory relief mechanisms: variances and special permits. Variances generally provide flexibility on bulk rules (e.g. setbacks, lot sizes) in exceptional cases where following the rules would entail “undue hardship.” Special permits (also called “conditional use permits”) generally provide flexibility on use rules in cases where otherwise undesirable uses may be appropriate or where their impacts can be mitigated. An extreme grade change is one reason why a lot might receive a variance, as enforcing the standard setback rules could make development impossible. Parking garages commonly require special use permits, since they can generate large negative externalities if poorly designed. Common conditions for permit approval include landscaping or siting the entrance in a way that minimizes congestion. (Wikipedia/Steve Morgan) In addition to these traditional, formal options, there’s a third, informal relief mechanism: spot zoning. This is the practice of changing the zoning map for an individual lot, redistricting it into another existing zone. Spot zonings are typically administered where the present zoning is unreasonable, but the conditions needed for a variance, special permit, or a full neighborhood rezoning aren’t. In many states, spot zonings are technically illegal. The thinking is that they are arbitrary in that they treat similarly situated lots differently. But in practice, many planning offices tolerate them, usually bundling in a few nearby similarly situated lots to avoid legal challenge. An example of a spot zoning. Variances, special permits, and spot zonings are generally considered to be the standard outlets for relief from zoning. But there’s a fourth mechanism that, to my knowledge, hasn’t been recognized: let’s call it the “spot text amendment.” Like spot zonings, spot text amendments […]

Anti poverty programs have been taking center stage as the 2020 Democratic primary heats up. Proposals from Kamala Harris and Corey Booker target high housing costs for renters and make for an interesting set of ideas. These plans, however, have major shortcomings and fail to address the fundamental problem of supply constraints in high cost housing markets. Harris and Booker on Housing Both the Harris and Booker plans call for direct subsidies to renters via the tax code. Harris’ Rent Relief Act (RRA) is a refundable tax credit for renters making $100,000 or less and spending more than 30% of their income on rent. The credit would be worth a percentage of the delta between the recipient’s rent (capped at 150% of area fair market rent) and 30% of their income. Actual benefits would be bigger or smaller depending on the size of the gap. Booker’s Housing, Opportunity, Mobility, and Equity (HOME) Act is also designed as a refundable tax credit for renters paying more than 30% of their income in rent. Unlike Harris’ RRA, there’s no sliding scale for benefits. The credit covers the entire difference between 30% of the recipients income and their rent (also capped by area fair market rent). Both programs are in the same vein as other democratic anti-poverty proposals which use the tax code to affect transfer payments. The others, though, are expansions of the federal Earned Income Tax Credit (EITC) whereas these two proposals more narrowly target housing. Devils in the Details Housing costs are a major impediment to financial stability for many, so it’s good to see reducing them called out as a poverty reduction strategy. And transfer payments (as opposed direct government provisioning or price fixing) make for better social safety nets. However, as Tyler Cowen points out, juicing the demand side […]

Over the past few years, Japanese zoning has become popular among YIMBYs thanks to a classic blog post by Urban kchoze. It’s easy to see why: Japanese zoning is relatively liberal, with few bulk and density controls, limited use segregation, and no regulatory distinction between apartments and single-family homes. Most development in Japan happens “as-of-right,” meaning that securing permits doesn’t require a lengthy review process. Taken as a whole, Japan’s zoning system makes it easy to build walkable, mixed-use neighborhoods, which is why cities like Tokyo are among the most affordable in the developed world. But praise for Japanese zoning skirts an important meta question: Why did U.S. zoning end up so much more restrictive than Japanese zoning? To frame the puzzle a different way, why did U.S. and Japanese land-use regulation—which both started off quite liberal—diverge so dramatically in terms of restrictiveness? I will suggest three factors; the first two set out the “why” for restrictive zoning and the third sets out the “how.” Any YIMBY efforts to liberalize cities in the long term must address these three factors. First, the U.S. privileges real estate as an investment where Japan does not, incentivizing voters to prohibit new supply with restrictive zoning. Second, most public services in the U.S. are administered at the local level, driving local residents to use exclusionary zoning to “preserve” public service quality. Third, the U.S. practice of near-total deference to local land-use planning and widespread use of discretionary permitting creates a system in which local special interests can capture zoning regulation and remake it around their interests. At the outset, why might Americans voters demand stricter zoning than their Japanese counterparts? One possibility is that they are trying to preserve the value of their only meaningful asset: their home. In the U.S., we use housing […]

Many readers of this blog know that government subsidizes driving- not just through road spending, but also through land use regulations that make walking and transit use inconvenient and dangerous. Gregory Shill, a professor at the University of Iowa College of Law, has written an excellent new paper that goes even further. Of course, Shill discusses anti-pedestrian regulations such as density limits and minimum parking requirements. But he also discusses government practices that make automobile use far more dangerous and polluting than it has to be. For example, environmental regulations focus on tailpipe emissions, but ignore environmental harm caused by roadbuilding and the automobile manufacturing process. Vehicle safety regulations make cars safer, but American crashworthiness regulations do not consider the safety of pedestrians in automobile/pedestrian crashes. Speeding laws allow very high speeds and are rarely enforced. If you don’t want to read the 100-page article, a more detailed discussion is at Streetsblog.

1. Recently at Market Urbanism Any Green New Deal Must Tackle Zoning Reform by Nolan Gray According to the Environmental Protection Agency (EPA), transportation and electricity account for more than half of the US’ greenhouse gas emissions. As David Owen points out in his book “Green Metropolis,” city dwellers drive less, consume less electricity, and throw out less trash than their rural and suburban peers. This means that if proponents of the Green New Deal are serious about reducing carbon emissions, they will have to help more people move to cities. New York State’s Property Tax Cap by Michael Lewyn New York’s Gov. Cuomo has recently proposed a tax cut that buys popularity for state lawmakers on the backs of municipalities. In 2011, the state passed a law to limit local governments’ property tax increases to 2 percent or the rate of inflation, whichever is lower. This cap was originally temporary, but Cuomo now proposes to make it permanent. What Should YIMBY’s Learn from 2018? by Nolan Gray Believe it or not, the YIMBY movement won a lot in 2018. And rolling into 2019, elected officials at every level of California government—from the state’s new Democratic governor to San Diego’s Republican mayor—are singing from the YIMBY hymn sheet. All in all, it wasn’t a bad year for a movement that’s only five years old. But what really made 2018 such an unexpected success for YIMBYs? Yimbyism: the Evolution of an Idea by Jeff Fong Five years ago everything in California felt like a giant (land use policy) dumpster fire. Fast forward to today we live in a completely different world. Yimby activists have pushed policy, swayed elections, and dramatically shifted the overton window on California housing policy. And through this process of pushing change, Yimbyism itself has evolved as well. Evidence that home-sharing doesn’t raise rents by Michael Lewyn […]

While reading someone else’s work, I recently ran across an article by David Cay Johnston of the New York Times, claiming that overseas oligarchs turning apartments all over the world into unused “ghost apartments”. In this article, Johnston writes: “In Paris, for instance, one apartment in four sits empty most of the time.” This claim struck me as so astonishing that as to be implausible, for the simple reason that in other “global” cities vacancy rates are much lower. For example, in New York only 9 percent of housing units are vacant, and most of those units are currently for sale or rent.* Even this vacancy level should not be particularly astonishing, since cheaper American cities often have higher vacancy rates. For example, Houston has an 11 percent vacancy rate, and Atlanta has an 18 percent vacancy rate. After googling “one in four paris apartments vacant” I found an article claiming that 26 percent of apartments in four Paris arrondisements (neighborhoods) is vacant- a much narrower claim, comparable to an assertion that one in four midtown Manhattan apartments is vacant. One would think that a journalist as distinguished as Johnston would know the difference between “Paris” and “some parts of Paris.” A more recent article claims that only 7.5 percent of Paris apartments are vacant- a lower vacancy rate than that of New York. Moreover, we don’t know what the local media means by “vacant.” Does this category limited to apartments that are unused 365 days a year? What about units that are rented out now and then through Airbnb? Or units that are currently being advertised for rent or sale? I suspect that the true number of “ghost apartments” is far lower than 7.5 percent, since in London (another “global city”) less than 1 percent of housing units are […]

A common argument against Airbnb and similar home-sharing companies is that they raise rents, because every apartment used for short-term rentals could be used for long-term rentals. A recent paper by a Spanish Ph.D. candidate suggests otherwise. The paper focused on Santa Monica, California where, in 2015, the city adopted an ordinance restricting home-sharing. This city’s ordinance was successful in reducing Airbnb listings- especially listings of complete apartments, which cities are most likely to regulate (as opposed to spare rooms in a residence used by an Airbnb host). If the anti-home sharing argument was valid, rents should have gone down. Instead, rents rose in Santa Monica by the same amount as they rose in other Los Angeles suburbs that do not regulate home-sharing to the same extent.

Five years ago everything in California felt like a giant (land use policy) dumpster fire. Fast forward to today we live in a completely different world. Yimby activists have pushed policy, swayed elections, and dramatically shifted the overton window on California housing policy. And through this process of pushing change, Yimbyism itself has evolved as well. Learning by Listening Yimbys started out with a straightforward diagnosis of the housing crisis in California. They said, “…housing prices are high because there’s not enough housing and if we want lower prices, we need more housing”. And they were, of course, completely right…at least with regards to the specific problem-space defined by supply, demand, and the long run. As Yimby’s started coalition building, though, they began recognizing related, but fundamentally different concerns. For anti-displacement activists, the problem was not defined by long-run aggregate prices. It was instead all about the immediate plight of economically vulnerable communities. Increasing supply was not an attractive proposal because of the long time horizons (years, decades) and ambiguous benefit for their specific constituencies. Yimbyism as Practical Politics Leaders in the Yimby movement could have thrown up their hands and walked away. But they didn’t. Instead they listened and developed a yes and approach. The Yimby platform still embraces the idea that, long run, we need to build more housing, but it now also supports measures to protect those who’ll fall off the housing ladder tomorrow without a helping hand today. Scott Weiner’s SB50 is a great example of this attitude in action. If passed, the bill will reduce restrictions on housing construction across the state. It targets transit and job rich areas and builds in eviction protections to guard against displacement. At a high level, it sets up the playing field so that renters in a four story […]