Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Jane Jacobs wasn’t optimistic about the future of civilisation. ‘We show signs of rushing headlong into a Dark Age,’ she declares in Dark Age Ahead, her final book published in 2004. She evidences a breakdown in family and civic life, universities which focus more on credentialling than on actually imbuing knowledge in its participants, broken feedback mechanisms in government and business, and the abandonment of science in favour of ‘pseudo-scientific’ methods. Jacobs’ prose is, as always, rich, convincing and successful in making the reader see the importance of her claims. Yet the argument that we are spiralling into a new Dark Age, similar to that which followed the fall of the Roman Empire, is not quite complete and I remain unconvinced that the areas she identified point towards collapse as opposed to merely things we could, and should, work to improve. Let us start with the idea that families are ‘rigged to fail,’ as she puts it in chapter two. Jacobs, urbanist at heart, cites ‘inhumanely long car commutes’ stemming from the disbanding of urban transit systems, rising housing costs, and a breakdown in ‘community resources’ – the result of increasingly low-dense forms of urban development – as a significant reason why families are now set up for failure. She suggests our days are filled with increasingly vacuous activities, leading to the rise of ‘sitcom families’ which ‘can and do fill isolated hours’ at the expense of ‘live friends.’ That phenomenon has now been replaced by the ‘smartphone family’ where time spent on TikTok, and consuming other forms of digital media have supplanted the ‘sitcom’ family of the past. There has been significant literature on the detrimental effects of digital technologies to our physical and mental health, not least in Jonathan Haidt’s most recent book, The Anxious Generation. A similar picture is painted by Timothy Carney in […]

Continuing this series of book reviews on Jane Jacobs’ works, I now turn to Cities and the Wealth of Nations. But there is already a fantastic piece on the Market Urbanism website, by Matthew Robare, who reviews this book and outlines what Jacobs overlooks in her analysis. So, this piece takes a slightly different angle: inspired by (but not limited to) Jacobs’ ideas, it aims to highlight what mayors, governors and urban policymakers could do differently if they are serious about developing their cities into economic powerhouses. Here are some of the most important takeaways from this book and also how they can be expanded upon. (1) Focus on cultivating import-replacement The economies of cities do not grow out of nothing. They grow by adding productive new forms of work to old ones, by innovating, and by being cultivators of new ideas and techniques. This process of cataclysmic growth – that Jane Jacobs describes as ‘import-replacement – occurs when a city takes its existing imports and builds upon them, either improving its production through lowering costs, increasing quality, or innovating. The market for these additional goods can either be found within the city itself or serves to expand the city’s exports. These exports, in turn, bring in additional resources to either acquire additional imports or be reinvested into fuelling the processes that fuel import-replacement. Not for nothing does Jacobs describe import-replacement as a ‘cataclysmic’ process – these changes often happen over a very short period and can bring about a rapid influx of people, ideas and capital. We see this in New York City, which grew from half a million residents in 1850 to over 3.4 million at the dawn of the twentieth century. Detroit went from having 250,000 residents in 1900 to a peak of 1.8 million by 1950. […]

At the heart of Jane Jacobs’ The Economy of Cities is a simple idea: cities are the basic unit of economic growth. Our prosperity depends on the ability of cities to grow and renew themselves; neither nation nor civilisation can thrive without cities performing this vital function of growing our economies and cultivating new, and innovative, uses for capital and resources. It’s a strikingly simple message, yet it’s so easily and often forgotten and overlooked. Everything we have, we owe to cities. Everything. Consider even the most basic goods: the food staples that sustain life on earth and which in the affluent society in which we now reside, abound to the point where obesity has become one of the leading causes of illness. Obesity sure is a very real problem and one we ought to work to resolve (probably through better education and cutting those intense sugar subsidies). Yet this fact alone is striking! For much of mankind’s collective history, the story looked very different: man (and it usually was a man) would spend twelve or maybe more hours roaming around in the wild to gather sufficient food to survive. Our lives looked no different to the other animals with which we share the earth. An extract from The Economy of Cities: ‘Wild animals are strictly limited in their resources by natural resources, including other animals on which they feed. But this is because any given species of animal, except man, uses directly only a few resources and uses them indefinitely.’ What changed? Anthropologists, economists, and historians will tell you it was the Agricultural Revolution, which occurred when man began to settle in small towns and cultivate the agricultural food staples that continue to make up the bulk of our diet: wheat, barley, rice, corn, and animal food products. But […]

Kevin Erdmann offers a helpful corrective to the “YIMBY triumphalism” of claiming that large relative rent declines in Austin and Minneapolis are results of YIMBY policies. He’s mostly correct, especially about the rhetoric: arguing about housing supply from short term fluctuations is like arguing about climate change based on the week’s weather. Keep your powder dry, promise slow change and long-term stability, and recognize that demand shocks are responsible for most fluctuations. But Erdmann makes a stronger claim: Supply has never and will never cause a collapse of prices and rents. It causes stability. Is that true? In a case like Austin or Phoenix, sure: prices are not too far above the cost of construction, and abundant supply cannot (durably) push the price of new housing below the cost of construction. But YIMBY has more to offer to San Francisco, Auckland, or London. In those cases, prices are far above construction cost. That means that even when demand is relatively soft, there’s money to made in construction. As Erdmann allows: After a decade of more active construction in Auckland, rents appear to be 10% to 15% below the pre-reform trend. That’s a big win. After a decade. That’s what success looks like. That’s the promise – 5 to 15% relative rent declines, decade after decade. But there are several good reasons to believe this won’t happen in an even, steady pattern, at least not all the time. Hopefully by 2040 we’ll have data from several cases and be able to describe the dynamics of market restoration with much more confidence.

The traditional model of cities proves useful yet again - even when researchers neglect their discipline's roots.

Research shows that the implementation of an eviction moratorium significantly disadvantaged African Americans in the housing search process.

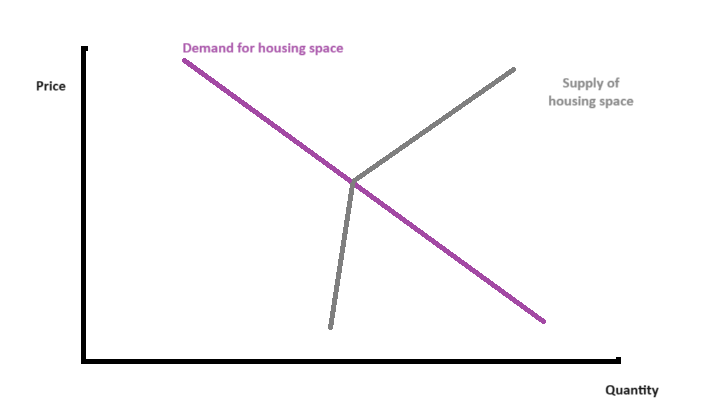

Should YIMBYs support or oppose greenfield growth? Two basic values animate most YIMBYs: housing affordability and urbanism. Sprawl puts those values into tension. Let’s take as a given that sprawl is “bad” urbanism, mediocre at best. Realistically, it’s rarely going to be transit-oriented, highly walkable, or architecturally profound. So the question is whether outward, greenfield growth is necessary to achieve affordability. And the answer from urban economics is yes. You can’t get far in making a city affordable without letting it grow outward. Model 1: All hands on deck Let’s start with a nonspatial model where people demand housing space and it’s provided by both existing and new housing. Existing housing doesn’t easily disappear, so the supply curve is kinked. A citywide supply curve is the sum of a million little property-level supply curves. We can split it into two groups: infill and greenfield, which we add horizontally. If demand rises to the new purple line, you can see that the equilibrium point where both infill & greenfield are active is at a lower price & higher quantity than the infill-only line. The only way to get some infill growth to replace some greenfield growth, in this model, is to raise the overall price level. And even then, the replacement is less than 1-for-1. Of course, this is just a core YIMBY idea reversed! In most U.S. cities, greenfield growth has been allowed and infill growth sharply constrained, so that prices are higher, total growth is lower, and greenfield growth is higher than if infill were also allowed. At the most basic level, greenfield growth is simply one of the ways to meet demand. With fewer pumps working, you’ll drain less of the flood. Model 2: Paying for what you demolish Now let’s look at a spatial model where people […]

A friend asked what are the best papers supporting land use liberalization. That’s a broad question, but here are some of my answers. Affordability The basic case for zoning reform, across the political spectrum, is that the rent is too damn high. Michael Manville, Michael Lens, and Paavo Monkkonen give a combative and accessible review of the evidence in their Urban Studies paper (2020). The principal drawback is that it is rapidly becoming dated, as evidence and research come in from more recent reforms. The most important of those may be Auckland’s, which Ryan Greenaway-McGrevy has reported in a few papers, including this Economic Policy Center working paper (2023). Using a synthetic control method (which is not perfect, to be sure), Greenaway-McGrevy finds that upzoned areas had 21 to 33 percentage points less rent growth. A new candidate for the best review of the evidence on zoning reform and affordability is Vicki Been, Ingrid Gould Ellen, and Katherine M. O’Regan’s late 2023 working paper, “Supply Skepticism Revisited.” Racial integration Many authors from different disciplines have shown that both the intent and effect of zoning as practiced in the U.S. were racist and classist. That is, zoning policies have separated people by race, homeownership status, and income more than would have occurred in an unregulated market. Allison Shertzer, Tate Twinam, and Randall Walsh’s review of the evidence in Regional Science and Urban Economics (2022) is concise and helpful. However, fewer authors have attempted to show that removing specific zoning restrictions reduces existing patterns of segregation. One is Edward Goetz, in Urban Affairs Review (2021). He makes a qualitative argument. I’m unaware of a good causal, quantitative paper showing how broad upzoning impacts local integration (but I would happily commission it if anyone wants to write it!) Environment & climate Along some […]

In a Maryland neighborhood. rent control caused condo conversions of 15 percent of multifamily buildings. The county council might inflict the same fate on the entire region.

Why are Max Holleran's book, Richard Schragger's law review article, and randos on Twitter all misinterpreting one important research article?