Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

I recently saw a tweet complaining that left-wing YIMBYs favored urban containment- a strategy of limiting suburban sprawl by prohibiting new housing at the outer edge of a metropolitan area. (Portland’s urban growth boundaries, I think, are the most widely…

One argument I have run across recently is that the high cost of housing is caused by mysterious corporate investors are buying up real estate and forcing up the cost. The stupidest version of this argument is that investors are hoarding all the real estate. Why is it stupid? Because corporations like to make money, and a corporation that doesn’t sell or rent out real estate is making no money from it. A more sensible version of the argument is that the existence of investors adds demand for housing, and thus that their presence thus increases housing costs.* But even if this true, are these investors really a significant factor in the housing market? In today’s Washington Post, an article supplies data for 40 metro areas. If investors are really the problem, one might think that the most expensive metros have the highest investor share. But this is simply not the case. In San Francisco, only 6 percent of for-sale houses are being purchased by investors (about the same as the 2015 share). In metro New York and Los Angeles, that share is around 10-11 percent. The most investor-heavy markets are in growing, medium-cost Sun Belt markets like Atlanta (25 percent), Charlotte (25 percent), Jacksonville (22 percent) and Phoenix (21 percent). And within those markets, investors are not buying in the most expensive areas. In Atlanta, the highest investor shares are in the lower-income Southside, and low and moderate-income southern and western suburbs. In Jacksonville, the mostly lower-income Northside and the working-class Westside have higher investor shares than the more middle-class Southside. This pattern seems to hold in less investor-heavy metros as well: even though some affluent Manhattan zip codes have high investor shares, most of the high-investor zip codes are in East Harlem, the South Bronx, and other poor […]

One common explanation for high rents is something called “financialization.” Literally, this term of course makes no sense: any form of investment, good or bad, involves finances. But I think that the most common non-incoherent use of the term is something like this: rich people and corporations have decided that real estate is a good investment, and are buying it, thus driving up demand and making it more costly. But if this is true, to blame financialization for high rents and sale prices is to confuse cause and effect. If real estate prices weren’t going up, it wouldn’t make sense to buy buildings as investment. Thus, high housing costs cause financialization, not vice versa. In fact, if government did not restrict housing supply through zoning, financialization would be a force for good. Why? Because instead of buying existing buildings, people with money might be more willing to build new buildings for people to live in- which in turn might hold housing costs down. PS I am running for Borough President of Manhattan, and am gradually creating a Youtube page that addresses anti-housing arguments in more detail.

A recent paper by UCLA researchers discusses 2019-20 literature on the relationship between new construction and rents. The article discusses five papers; four of them found that new housing consistently lowers rents in nearby buildings. For example, Kate Pennington wrote a paper on the relationship between new construction and housing costs in San Francisco. What is unique about this paper is that while other papers focus on a broad sample of new construction, Pennington focuses on one subset of the market: “new construction caused by serious building fires.” Why? Because most new construction is in high-demand areas. Any study that focuses on such construction will be more likely to conclude that the new construction is related to high rents, when in fact the real cause of increased rents is increased demand for certain neighborhoods. Pennington found that rents actually decreased within 500 meters of new buildings- by 2.3 percent, compared to similar blocks without new buildings. Pennington also found 17.1 percent less displacement (which she defines as moves to poorer zipcodes) near the new buildings, and found that landlords were less likely to evict rent-controlled tenants. One paper was a partial exception to the pro-supply trend of recent scholarship: a paper by Anthony Damiano and Chris Frenier found that new buildings in Minneapolis lowered rents for most nearby buildings, but increased rents for the cheapest buildings. But the UCLA researches point out that “Damiano and Frenier do not adjust the rents in their study for inflation, which is an unusual decision, and one that makes the rent increases they report look much larger than they actually were.” Adjusted for inflation, rents near new buildings declined by 7 percent overall, and increased by only 0.2 percent for the cheapest buildings. One point that the UCLA researches do not mention: although the […]

In two previous posts, I’ve raised questions about the competitiveness of missing middle housing. This post is more petty: I want to challenge the design rigidities that Daniel Parolek promotes in Missing Middle Housing. Although petty, it’s not irrelevant, because Parolek recommends that cities regulate to match his design goals, and such regulations could stifle some of the most successful contemporary infill growth. Parolek’s book suffers from his demands that missing middle housing match his own tastes. For instance, he has a (Western?) bias against three-story buildings. Having grown up in the Northeast, I think of three stories as the normal and appropriate height for a house. To each his own – but Parolek’s constant insistence on this point offers aid to neighborhood defenders who will be happy to quote him to make sure three-story middle housing remains missing. The house in the doghouse No form is in Parolek’s doghouse as much as the “tuck-under” townhouse, an attached house with a garage on the first floor. This is clearly a building that builders and buyers love: “If your regulations do not explicitly prohibit it, it will be what most builders will build” (p. 140). In fact, tuck-under townhouses are probably the most successful middle housing type around. In lightly-regulated Houston, builders small and large have been building townhouses, sometimes on courtyards perpendicular to the road. Parking is tucked. Townhouses are usually three stories tall (bad!), sometimes four. A few are even five stories. Their courtyards are driveways (also bad!). In a very different context – Palisades Park, NJ – tuck-under duplexes are everywhere. Their garages are excessive thanks to high parking minimums, but the form has been very successful nonetheless. These examples are not to be dismissed lightly: these are some of the only cases where widespread middle housing is […]

In yesterday’s post, I showed that missing middle housing, as celebrated in Daniel Parolek’s new book, may be stuck in the middle, too balanced to compete with single family housing on the one hand and multifamily on the other. But what about all the disadvantages that middle housing faces? Aren’t those cost disadvantages just the result of unfair regulations and financing? Indeed, structures of three or more units are subject to a stricter fire code. It’s costly to set up a condo or homeowners’ association. Small-scale infill builders don’t have economies of scale. Those, and the other barriers to middle housing that Parolek lays out in Chapter 4, seem inherent or reasonable rather than unfair. In particular, most middle housing types cannot, if all units are owner-occupied, use a brilliant legal tradition known as “fee simple” ownership. Fee simple is the most common form of ownership in the Anglosphere and it facilitates clarity in transactions, chain of title, and maintenance. Urbanists should especially favor fee simple ownership of most city parcels because it facilitates redevelopment. Consider a six-plex condominium nearing the end of its useful life: to demolish and redevelop the site requires bringing six owners to agreement on the terms and timing of redevelopment. A single-owner building can be bought in a single arms-length transaction. It’s no coincidence that the type of middle housing with the greatest success in recent years – townhomes – can be occupied by fee-simple owners, combining the advantages of owner-occupancy with the advantages of the fee simple legal tradition. Many middle housing forms enjoy their own structural advantage: one unit is frequently the home of the (fee simple) owner. By occupying one unit, a purchaser can also access much lower interest rates than a non-resident landlord. (This is thanks to FHA insurance, as Parolek […]

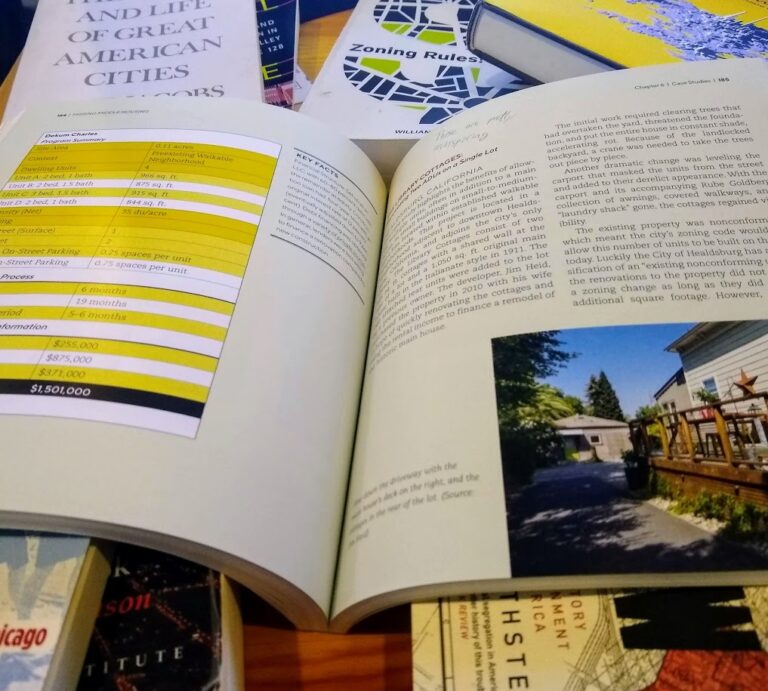

Everybody loves missing middle housing! What’s not to like? It consists of neighborly, often attractive homes that fit in equally well in Rumford, Maine, and Queens, New York. Missing middle housing types have character and personality. They’re often affordable and vintage. Daniel Parolek’s new book Missing Middle Housing expounds the concept (which he coined), collecting in one place the arguments for missing middle housing, many examples, and several emblematic case studies. The entire book is beautifully illustrated and enjoyable to read, despite its ample technical details. Missing Middle Housing is targeted to people who know how to read a pro forma and a zoning code. But there’s interest beyond the home-building industry. Several states and cities have rewritten codes to encourage middle housing. Portland’s RIP draws heavily on Parolek’s ideas. In Maryland, I testified warmly about the benefits of middle housing. I came to Missing Middle Housing with very favorable views of missing middle housing. Now I’m not so sure. Parolek’s case for middle housing relies so much on aesthetics and regulation that it makes me wonder whether middle housing deserves all the love it’s currently getting from the YIMBY movement. Can middle housing compete? Throughout the book, Parolek makes the case that missing middle construction cannot compete, financially, with either single-family or multifamily construction. That’s quite contrary to what I’ve read elsewhere. In a chapter called “The Missing Middle Housing Affordability Solution”, Daniel Parolek and chapter co-author Karen Parolek write: The economic benefits of Missing Middle Housing are only possible in areas where land is not already zoned for large, multiunit buildings, which will drive land prices up to the point that Missing Middle Housing will not be economically viable. (p. 56) On page 81, we learn, It’s a fact that building larger buildings, say a 125-150 unit apartment […]

The Manhattan Institute, a conservative (by New York standards) think tank, recently published a survey of New York residents; a few items are of interest to urbanists. A few items struck me as interesting. One question (p.8) asked “If you could live anywhere, would you live…” in your current neighborhood, a different city neighborhood, the suburbs, or another metro area. Because of Manhattan’s high rents, high population density, and the drumbeat of media publicity about people leaving Manhattan, I would have thought that Manhattan had the highest percentage of people wanting to leave. In fact, the opposite is the case. Only 29 percent of Manhattanites were interested in leaving New York City. By contrast, 36 percent of Brooklynites, and 40-50 percent of residents in the other three outer boroughs, preferred a suburb or different region. Only 23 percent of Bronx residents were interested in staying in their current neighborhood, as opposed to 48 percent of Manhattanites and between 34 and 37 percent of residents of the other three boroughs. Manhattan is the most dense, transit-dependent borough- and yet it seems to have the most staying power. So this tells me that people really value the advantages of density, even after months of COVID-19 shutdowns and anti-city media propaganda. Conversely, Staten Island, the most suburban borough, doesn’t seem all that popular with its residents, who are no more eager to stay than those of Queens or Brooklyn. Having said that, there’s a lot that this question doesn’t tell us. Because no identical poll has been conducted in the past, we don’t know if this data represents anything unusual. Would Manhattan’s edge over the outer boroughs have been equally true a year ago? Ten years ago? I don’t know. Another question asked people to rate ten facets of life in New York […]

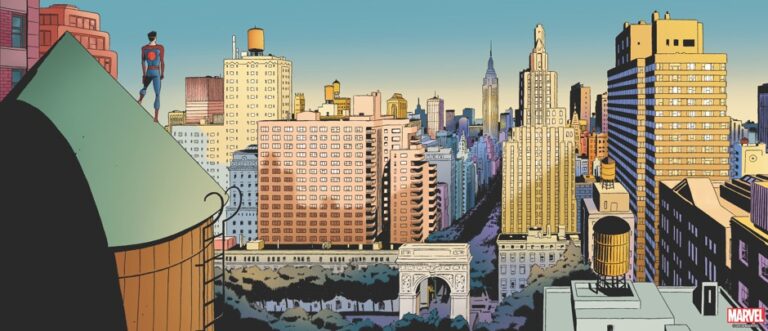

Nolan Gray plunges into the Sam Raimi "Spider-Man" trilogy to uncover the housing problems (and solutions) of expensive cities like New York.

This book, available from solimarbooks.com, is a set of very short essays (averaging about three to five pages) on topics related to urban planning. Like me, Stephens generally values walkable cities and favors more new housing in cities. So naturally I am predisposed to like this book. But there are other urbanist and market books on the market. What makes this one unique? First, it focuses on Southern California, rather than taking a nationwide or worldwide perspective (though Stephens does have a few essays about other cities). Second, the book’s short-essay format means that one does not have to read a huge amount of text to understand his arguments. Because the book is a group of short essays, it doesn’t have one long argument. However, a few of the more interesting essays address: The negative side effects of liquor license regulation. Stephens writes that the Los Angeles zoning process gives homeowners effective veto power over new bars. As a result, the neighborhood near UCLA has no bars, which in turn causes UCLA students go to other neighborhoods to drink, elevating the risk to the public from drunk driving. The Brooklyn Dodgers’ move to Los Angeles; Los Angeles facilitated the transfer by giving land to the Dodgers- but only after a referendum passed with support from African-American and Latino neighborhoods. On the other hand, the construction of Dodger Stadium displaced a Latino community. To me, this story illustrates that arguments about “equity” can be simplistic. Los Angeles Latinos were both more likely than suburban whites to support Dodger Stadium, yet were more likely to be displaced by that stadium. So was having a stadium more equitable or less equitable than having no stadium? (On the other hand, a stadium that displaced no one might have been more equitable than either outcome). […]