Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

If investors and hedge funds are a major cause of high housing costs, why do they seem to be most common in cheap cities?

In response to David Albouy & Jason Faberman’s new NBER paper, Skills, Migration and Urban Amenities over the Life Cycle, Lyman Stone asks if this means that cities will always have lower fertility? I think the answer is probably yes, but that’s extrapolating beyond the paper at hand. What this paper shows is that there will always be some regions that are a better (worse) deal for parents relative to non-parents. The paper First, here’s Albouy & Faberman’s abstract, with emphasis added. TL;DR: there’s no point paying to live in Honolulu if you’re going to stay at home and watch Bluey every night. We examine sorting behavior across metropolitan areas by skill over individuals’ life cycles. We show that high-skill workers disproportionately sort into high-amenity areas, but do so relatively early in life. Workers of all skill levels tend to move towards lower-amenity areas during their thirties and forties. Consequently, individuals’ time use and expenditures on activities related to local amenities are U-shaped over the life cycle. This contrasts with well-documented life-cycle consumption profiles, which have an opposite inverted-U shape. We present evidence that the move towards lower-amenity (and lower-cost) metropolitan areas is driven by changes in the number of household children over the life cycle: individuals, particularly the college educated, tend to move towards lower-amenity areas after having their first child. We develop an equilibrium model of location choice, labor supply, and amenity consumption and introduce life-cycle changes in household compo! sition that affect leisure preferences, consumption choices, and required home production time. Key to the model is a complementarity between leisure time spent going out and local amenities, which we estimate to be large and significant. Ignoring this complementarity and the distinction between types of leisure misses the dampening effect child rearing has on urban agglomeration. Since the […]

I recently read about an interesting logical fallacy: the Morton’s fork fallacy, in which a conclusion “is drawn in several different ways that contradict each other.” The original “Morton” was a medieval tax collector who, according to legend, believed that someone who spent lavishly you were rich and could afford higher taxes, but that someone who spent less lavishly had lots of money saved and thus could also afford higher taxes. In other words, every conceivable set of facts leads to the same conclusion (that Morton’s victims needed to pay higher taxes). To put the arguments more concisely: heads I win, tails you lose. It seems to me that attacks on new housing based on affordability are somewhat similar. If housing is market-rate, some neighborhood activists will oppose it because it is not “affordable” and thus allegedly promotes gentrification. If housing is somewhat below market-rate, it is not “deeply affordable” and equally unnecessary. If housing is far below market-rate, neighbors may claim that it will attract poor people who will bring down property values. In other words, for housing opponents, housing is either too affordable or not affordable enough. Heads I win, tails you lose. Another example of Morton’s fork is the use of personal attacks against anyone who supports the new urbanism/smart growth movements (by which I mean walkable cities, public transit, or any sort of reform designed to make cities and suburbs less car-dominated). Smart growth supporters who live in suburbs or rural areas can be attacked as hypocrites: they preach that others should live in dense urban environments, yet they favor cars and sprawl for themselves. But if (like me) they live car-free in Manhattan, they can be ridiculed as eccentrics who do not appreciate the needs of suburbanites. Again, heads I win, tails you lose.

A review of a book that endorses more flexible zoning, but doesn't reject zoning entirely.

Delete all Seattle's highways. Invent new neighborhoods. Explain macroeconomic trends with home size. Money flows uphill to water. Do NIMBYs really hate density? Urban economics is on a tear.

Kevin Erdmann argues that mortgage credit standards are too tight. Others say the federal government is subsidizing homeownership. Can they both be right?

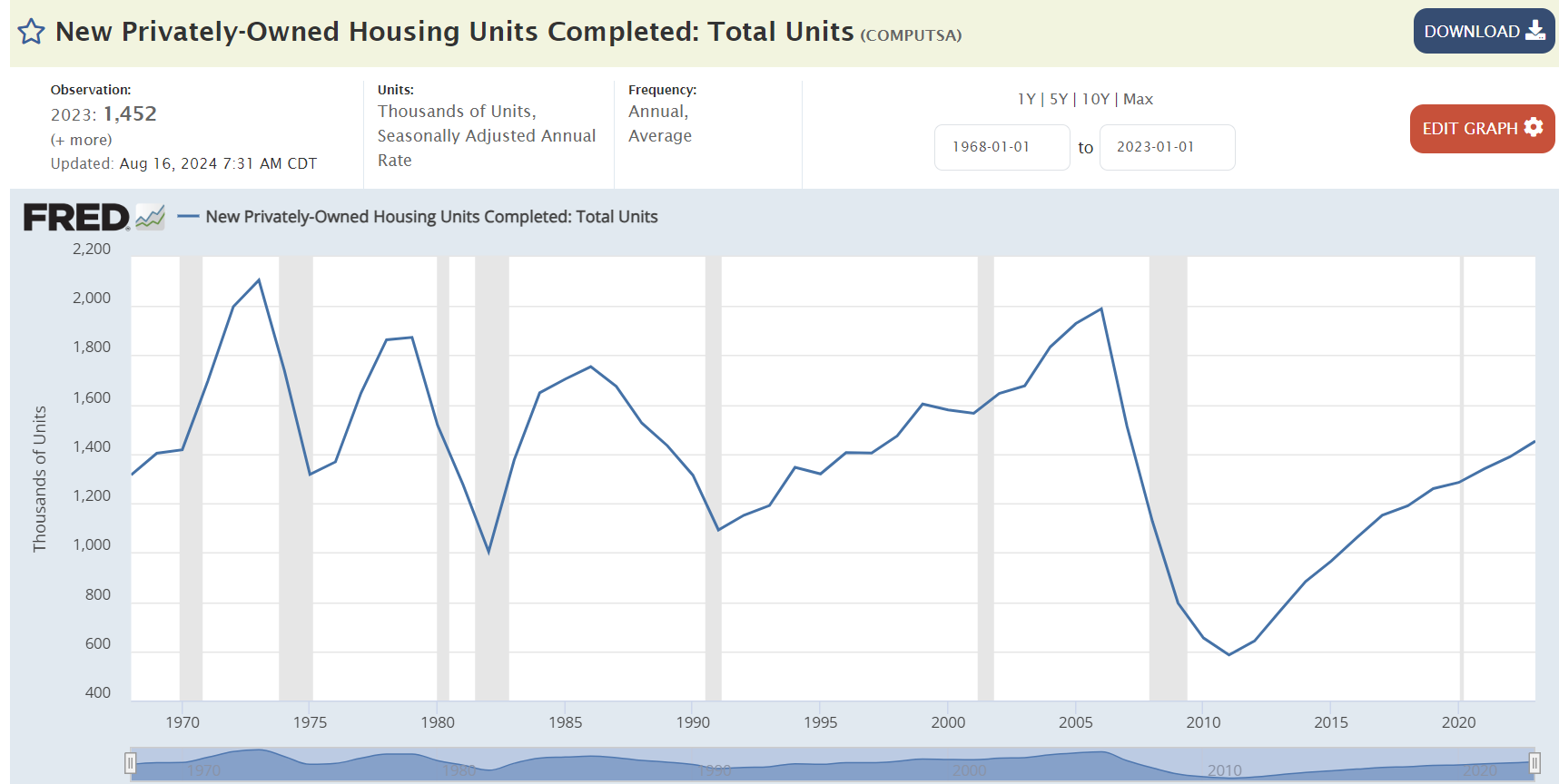

Kamala Harris has pledged to build 3 million new housing units. Setting aside the methods, what does that mean? And, would it "end America's housing shortage"?

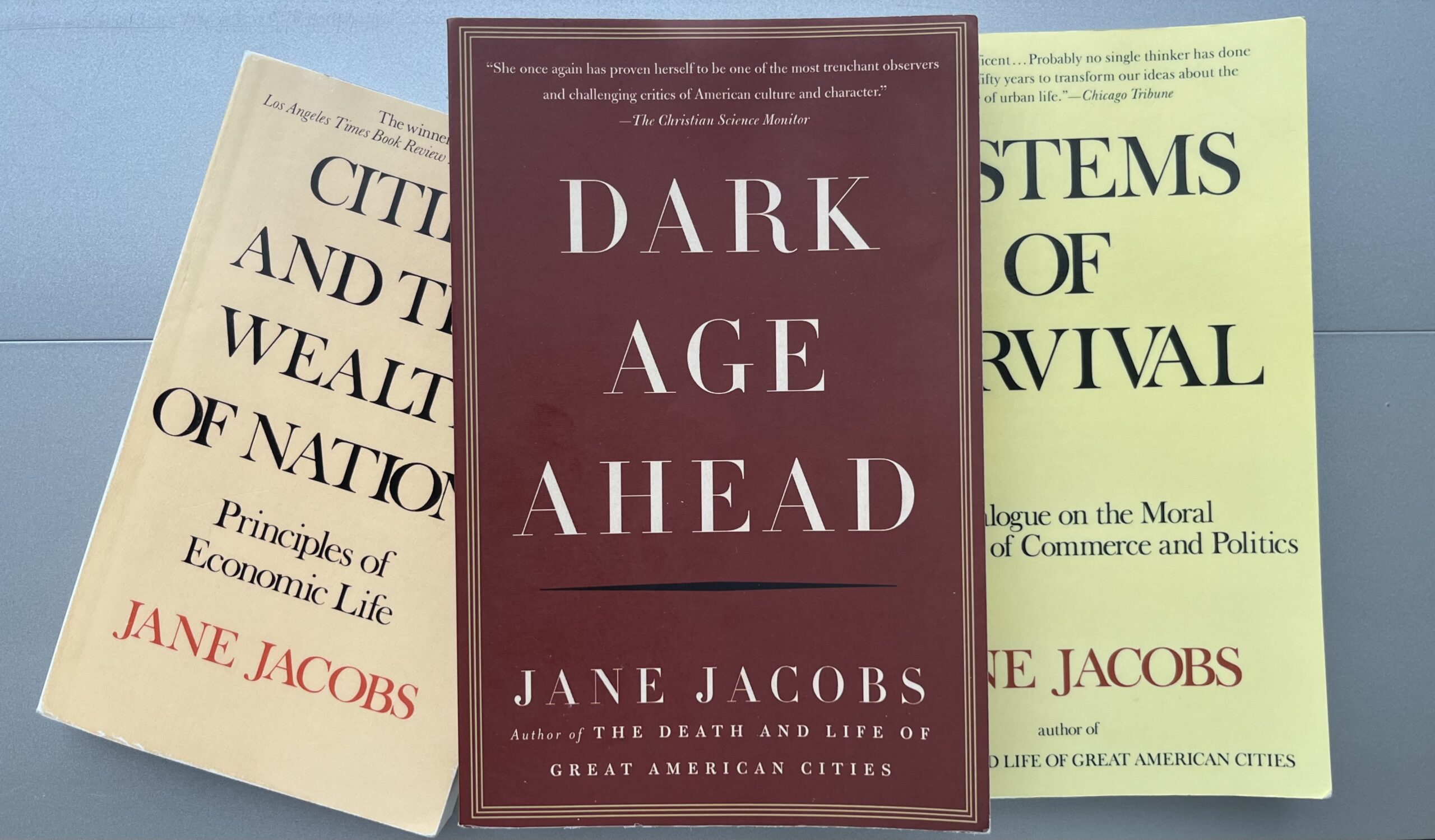

Jane Jacobs wasn’t optimistic about the future of civilisation. ‘We show signs of rushing headlong into a Dark Age,’ she declares in Dark Age Ahead, her final book published in 2004. She evidences a breakdown in family and civic life, universities which focus more on credentialling than on actually imbuing knowledge in its participants, broken feedback mechanisms in government and business, and the abandonment of science in favour of ‘pseudo-scientific’ methods. Jacobs’ prose is, as always, rich, convincing and successful in making the reader see the importance of her claims. Yet the argument that we are spiralling into a new Dark Age, similar to that which followed the fall of the Roman Empire, is not quite complete and I remain unconvinced that the areas she identified point towards collapse as opposed to merely things we could, and should, work to improve. Let us start with the idea that families are ‘rigged to fail,’ as she puts it in chapter two. Jacobs, urbanist at heart, cites ‘inhumanely long car commutes’ stemming from the disbanding of urban transit systems, rising housing costs, and a breakdown in ‘community resources’ – the result of increasingly low-dense forms of urban development – as a significant reason why families are now set up for failure. She suggests our days are filled with increasingly vacuous activities, leading to the rise of ‘sitcom families’ which ‘can and do fill isolated hours’ at the expense of ‘live friends.’ That phenomenon has now been replaced by the ‘smartphone family’ where time spent on TikTok, and consuming other forms of digital media have supplanted the ‘sitcom’ family of the past. There has been significant literature on the detrimental effects of digital technologies to our physical and mental health, not least in Jonathan Haidt’s most recent book, The Anxious Generation. A similar picture is painted by Timothy Carney in […]

Continuing this series of book reviews on Jane Jacobs’ works, I now turn to Cities and the Wealth of Nations. But there is already a fantastic piece on the Market Urbanism website, by Matthew Robare, who reviews this book and outlines what Jacobs overlooks in her analysis. So, this piece takes a slightly different angle: inspired by (but not limited to) Jacobs’ ideas, it aims to highlight what mayors, governors and urban policymakers could do differently if they are serious about developing their cities into economic powerhouses. Here are some of the most important takeaways from this book and also how they can be expanded upon. (1) Focus on cultivating import-replacement The economies of cities do not grow out of nothing. They grow by adding productive new forms of work to old ones, by innovating, and by being cultivators of new ideas and techniques. This process of cataclysmic growth – that Jane Jacobs describes as ‘import-replacement – occurs when a city takes its existing imports and builds upon them, either improving its production through lowering costs, increasing quality, or innovating. The market for these additional goods can either be found within the city itself or serves to expand the city’s exports. These exports, in turn, bring in additional resources to either acquire additional imports or be reinvested into fuelling the processes that fuel import-replacement. Not for nothing does Jacobs describe import-replacement as a ‘cataclysmic’ process – these changes often happen over a very short period and can bring about a rapid influx of people, ideas and capital. We see this in New York City, which grew from half a million residents in 1850 to over 3.4 million at the dawn of the twentieth century. Detroit went from having 250,000 residents in 1900 to a peak of 1.8 million by 1950. […]

At the heart of Jane Jacobs’ The Economy of Cities is a simple idea: cities are the basic unit of economic growth. Our prosperity depends on the ability of cities to grow and renew themselves; neither nation nor civilisation can thrive without cities performing this vital function of growing our economies and cultivating new, and innovative, uses for capital and resources. It’s a strikingly simple message, yet it’s so easily and often forgotten and overlooked. Everything we have, we owe to cities. Everything. Consider even the most basic goods: the food staples that sustain life on earth and which in the affluent society in which we now reside, abound to the point where obesity has become one of the leading causes of illness. Obesity sure is a very real problem and one we ought to work to resolve (probably through better education and cutting those intense sugar subsidies). Yet this fact alone is striking! For much of mankind’s collective history, the story looked very different: man (and it usually was a man) would spend twelve or maybe more hours roaming around in the wild to gather sufficient food to survive. Our lives looked no different to the other animals with which we share the earth. An extract from The Economy of Cities: ‘Wild animals are strictly limited in their resources by natural resources, including other animals on which they feed. But this is because any given species of animal, except man, uses directly only a few resources and uses them indefinitely.’ What changed? Anthropologists, economists, and historians will tell you it was the Agricultural Revolution, which occurred when man began to settle in small towns and cultivate the agricultural food staples that continue to make up the bulk of our diet: wheat, barley, rice, corn, and animal food products. But […]