Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

WASHINGTON – David Paitsel, 42, a former FBI agent, and Brian Bailey, 53, a D.C. real estate developer were sentenced today on bribery and conspiracy charges for their role in schemes involving confidential information held by the D.C. Department of Housing and Community Development United States Attorney’s office There are plenty of housing laws you can break. But these grifters were busted only for bribing a city official for information. Otherwise, they used the housing law – the most innocent-sounding of all housing laws – correctly. Washington DC has a strong Tenant Opportunity to Purchase Act (TOPA). When a landlord sells, tenants have the right to match any offer, conceivably buying their own building. That never happens. But TOPA also allows tenants to sell their rights to literally anyone else. The law treats the new owner of the TOPA rights with the same exaggerated deference as a tenant. The TOPA grift goes like this: A TOPA shark, like Paitsel and Bailey, approaches tenants whose building is on the market. The “approach”, as I’ve witnessed it, can be a hand-scrawled note placed in the tenants doors or mailboxes. The tenants rarely know the mechanics of buying a house, let alone utilizing an obscure city-specific TOPA scheme that would have to involve collective action among many tenants. So the sharks offer the tenants a few hundred dollars for their rights. If the offer is accepted, the shark informs the landlord. Now suppose a prospective buyer comes along and offers $1,200,000 for a D.C. sixplex. The landlord must inform the shark, who now has the right to match any bona fide offer on the property. But the shark has no interest in buying – he just demands ten or twenty thousand dollars to surrender the rights. If the landlord resists extortion, the shark […]

Earlier this year, researchers Paavo Monkkonen and Michael Manville at the University of California Los Angeles (UCLA) conducted a survey of 1,300 residents of Los Angeles County to understand the motives behind NIMBYism. As part of the study, they presented respondents with three common anti-development arguments, including the risk of traffic congestion, changes to neighborhood character, and the strain on public services that new developments may bring. But according to their findings, the single most powerful argument motivating opposition to new development was the idea that a developer would make a profit off of the project. At first blush, this finding might seem kind of obvious. People really don’t like developers. As Mark Hogan observed last year on Citylab, classic films from “It’s a Wonderful Life” to “The Goonies” depict developers as money-grubbing villains. But, when you think about it, it’s pretty weird that this is the case. In what other contexts do we actively dislike people who provide essential services, even if they happen to turn a profit? I don’t begrudge the owner of the corner grocery every time I buy a loaf of bread or a gallon of milk, and I hope you don’t either. In fact, most of us are probably happy that folks like doctors and dentists earn a lot for what they do. So why are developers, who provide shelter, any different? One possibility is that developers are often, for lack of a better term, assholes. This is surely the case with at least some developers. Our president is arguably America’s most famous developer, even if he isn’t exactly the master builder he played on television. And President Trump’s defining characteristic in his “Celebrity Apprentice” role—and evidently in real life—is that he is a bit of an asshole. But it isn’t just him. Most cities have […]

The great failing of modern land-use regulation is the failure to allow densities to naturally change over time. Let me explain. Imagine you are trying to sell a property you own in a desirable inner suburban neighborhood in your town. The lot is 4,000 square feet and hosts an old 4,000 square-foot home. There is incredible demand for housing in this area; perhaps the schools are good, or the amenities are nice, or the neighborhood sits adjacent to a major jobs center, meaning that residents can walk to work. I’ll leave the reasons to you. Who do you sell it to? You have at least two options: First, you could sell it to a wealthy individual, who would use the entire property as his home. He is willing to pay the market rate for single-family homes like this, which in this case is $300,000. Under current financing, he would likely have a monthly mortgage payment in the ballpark of $1,300. Second, you could sell it to a developer who intends to subdivide the house into four 1,000 square foot one-bedroom apartments, renting each of them at a market rate of $500 to service workers who commute to downtown. After factoring in expenses, her annual net operating income would be around $20,160. Assuming a multifamily cap rate of 6.0.%, this means that she could pay up to $336,000 for your property. Based on this analysis, who do you sell it to? The answer is obvious: you will sell it to the multifamily developer who will subdivide and rent out the house, not necessarily because you’re a bleeding heart urbanist, but in order to maximize your earnings. As rents in the area rise, the pressure to sell to a buyer who would densify the property will only grow. The prospective mansion buyer […]

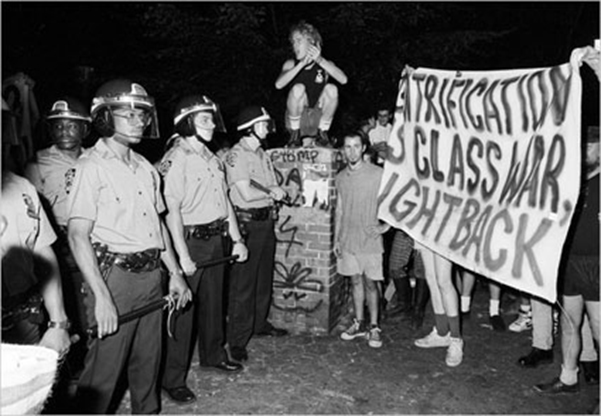

Gentrification is the result of powerful economic forces. Those who misunderstand the nature of the economic forces at play, risk misdirecting those forces. Misdirection can exasperate city-wide displacement. Before discussing solutions to fighting gentrification, it is important to accept that gentrification is one symptom of a larger problem. Anti-capitalists often portray gentrification as class war. Often, they paint the archetypal greedy developer as the culprit. As asserted in jacobin magazine: Gentrification has always been a top-down affair, not a spontaneous hipster influx, orchestrated by the real estate developers and investors who pull the strings of city policy, with individual home-buyers deployed in mopping up operations. Is Gentrification a Class War? In a way, yes. But the typical class analysis mistakes the symptom for the cause. The finger gets pointed at the wrong rich people. There is no grand conspiracy concocted by real estate developers, though it’s not surprising it seems that way. Real estate developers would be happy to build in already expensive neighborhoods. Here, demand is stable and predictable. They don’t for a simple reason: they are not allowed to. Take Chicago’s Lincoln Park for example. Daniel Hertz points out that the number of housing units in Lincoln Park actually decreased 4.1% since 2000. The neighborhood hasn’t allowed a single unit of affordable housing to be developed in 35 years. The affluent residents of Lincoln Park like their neighborhood the way it is, and have the political clout to keep it that way. Given that development projects are blocked in upper class neighborhoods, developers seek out alternatives. Here’s where “pulling the strings” is a viable strategy for developers. Politicians are far more willing to upzone working class neighborhoods. These communities are far less influential and have far fewer resources with which to fight back. Rich, entitled, white areas get down-zoned. Less-affluent, disempowered, minority […]

Alain Bertaud is probably the most interesting urbanist you’ve haven’t heard about. He is a senior researcher at the NYU Stern Urbanization Project next to names such as Paul Romer and Solly Angel. Bertaud used to be the lead urbanist at the World Bank, and Ed Glaeser has said that everything he knows about land use restrictions in developing countries he has learned from Alain. Bertaud has also worked as a consultant and/or resident urbanist in cities such as Bangkok, San Salvador, Port-au-Prince, Sana’a, New York, Paris, Tlemcen and Chandigarh. Our Brazilian collaborator Anthony Ling, editor of Caos Planejado, met Bertaud at the NYU DRI conference last year entitled “Cities and Development: Urban Determinants of Success”, who gave us the following interview: AL: You are currently writing a book tentatively titled “Order Without Design”, which in some way relates to the title of our website, “Planned Chaos”. What do you mean by the title of your next book – what should readers expect of it? AB: “Order without design” is a quotation from Hayek that he uses in a different context in “The Fatal Conceit”: “Order generated without design can far outstrip plans men consciously contrive”. In the context of cities it means that cities themselves are mostly self generated by simple rules and norms applied to immediate neighbors but with overall design concept designed by one person or a group of designers. The spatial structure of large cities is a mix of top-down design and spontaneous order created by markets. Spontaneous order appears in the absence of a designer’s intervention when markets and norms regulate relationships between immediate neighbors. Most evolving natural structures, from coral reefs to starlings’ swarms, are created by spontaneous order. The objective of my book is to show that top-down design should be reduced to a minimum and much more room should […]

Pretty interesting article in the NYT today about the Gotham West development that recently broke ground on Manhattan‘s far west side. But I think the part about affordable housing could use some context: But the bulk of the project will be affordable units, 682 of them, or more than half the total homes….

Apparently I’m not the only one who thinks London’s Shard skyscraper (shameless article-I-wrote-about-London-skyscrapers plug) looks like Pyongyang’s Ryugyong Hotel. Koryo Tours, the only tour group that offers westerners package to North Korea, plays up the similarities on its blog: To the eyes of us all at Koryo Tours it looks like Renzo Piano has been copying Pyongyang… (Note the following is not 100% accurate – but close!…

Earlier today Urban Photo Blog tweeted earlier today a link to an article about Hong Kong’s latest land reclamation project, with an obviously sarcastic “because it worked so well in Dubai!” tacked on at the end. Not to pick on Urban Photo Blog – actually, his Twitter account is definitely one of the best I follow – but I think that some of boomtime Dubai’s real estate projects, among them the infamous Palm Islands, give land reclamation a bad rap. …

Enormous viaducts like this are one reason for the project's ballooning cost estimates Well, the other shoe has finally dropped: the California High-Speed Rail Peer Review Group is recommending that the state legislature not authorize the issue of $2.7 billion in bonds to begin paying for the state’s planned $98.5 billion high-speed rail line….

London’s Shard tower, soon to be the tallest in Europe, is, financially speaking, a bit puzzling. Europe is in the midst of an economic crisis, and London’s Southwark, across from the skyscraper-crazed City of London, is gentrifying, but not the safest place for a massive real estate investment. The developers have yet to sign a major office tenant, and nobody is expecting the project to turn much of a profit. …