Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

1. This week at Market Urbanism: Nolan Gray Reclaiming “Redneck” Urbanism: What Urban Planners Can Learn From Trailer Parks Trailer parks remain one of the last forms of housing in US cities provided by the market explicitly for low-income residents. Better still, they offer a working example of traditional urban design elements and private governance. Scott Beyer San Francisco Seeks Public, Not Private, Solutions To Housing Crisis However the biggest problem with San Francisco’s housing policy is that officials and citizens alike are hostile to new buildings, especially tall ones, even when they are built in appropriate locations. Emily Washington and Michael Hamilton Market Urbanism Is Underrated Zoning is not a Georgist tax in which landowners are taxed in proportion to their land’s value; rather, zoning hugely decreases the value of the country’s most valuable land, while it props up the value of land that would be less desirable absent zoning. 2. Where’s Scott? Scott flew early this week from his hometown of Charlottesville, VA to San Antonio. He has been hired by the Center for Opportunity Urbanism to do a profile on the city, including its history, growth, and future prospects. 3. At the Market Urbanism Facebook Group: Todd Litman, of the Victoria Transport Policy Institute, talks about The Disconnect Between Liberal Aspirations and Liberal Housing Policy John Morris says, “Ironic: Portland’s best shot at an equitable, environmentally sound, affordable city is to return to development before “progressive” planning.” Jeff Fong found interesting simulations predicting the promising effect of driverless cars on cities Lot’s of discussion about Tyler Cowen‘s skepticism that the deregulation Market Urbanism advocates won’t actually lower rents. (via Anthony Ling) Alex Tabarrok shared his latest post at Marginal Revolution: Regulatory Arbitrage, Rent-Seeking and the Deal of the Year where 4,000sf of valuable New York real estate had to be destroyed to comply with zoning “An eclectic coalition of residents, business owners, […]

Michael Hamilton and I coauthored this post. Tyler Cowen has two new, self-recommending posts questioning whether or not market urbanist arguments are internally consistent. He argues that if land-use regulations are analogous to a tax on land, then either the benefits of deregulation would go to landowners or the costs of regulation are greatly overstated. The problem with this argument is that zoning is not a Georgist tax in which landowners are taxed in proportion to their land’s value; rather, zoning hugely decreases the value of the country’s most valuable land, while it props up the value of land that would be less desirable absent zoning. This is because zoning only acts as a tax on land to the extent that regulations are actually binding. A 250-foot height limit would create zero costs for the vast majority of the country, but would be devastating in Manhattan. Likewise, the large variation in land-use regulations across localities means that the costs of land-use regulation are imposed unevenly, even though there may be some correlation between land value and the tax imposed by zoning. Their repeal would have complicated and mixed effects. Tyler’s post focuses on desirable neighborhoods within the nation’s most highly-demanded cities because it assumes large increases in Ricardian rents from liberalization, i.e. those places where zoning is often the most binding. A broader view would also consider what would happen outside hip neighborhoods, especially exurban commuter suburbs that mostly exist because workers are excluded from areas closer to city centers. These suburbs could see land values plummet under broad liberalization. Whether these price changes are good or bad is a value judgement, but Tyler’s theoretical distributional concerns should also take potential decreases in land value into account. Empirically, cities with more liberal land-use regimes are more affordable, so the premise of zoning being analogous to a land value tax may not be accurate. Toronto, Houston, Chicago, and […]

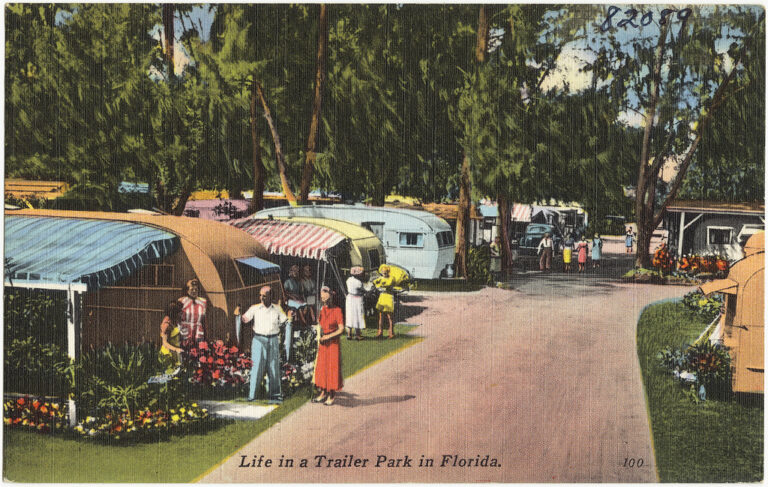

Given that “redneck” and “hillbilly” remain the last acceptable stereotypes among polite society, it isn’t surprising that the stereotypical urban home of poor, recently rural whites remains an object of scorn. The mere mention of a trailer park conjures images of criminals in wifebeaters, moldy mattresses thrown awry, and Confederate flags. As with most social phenomena, there is a much more interesting reality behind this crass cliché. Trailer parks remain one of the last forms of housing in US cities provided by the market explicitly for low-income residents. Better still, they offer a working example of traditional urban design elements and private governance. Any discussion of trailer parks should start with the fact that most forms of low-income housing have been criminalized in nearly every major US city. Beginning in the 1920s, urban policymakers and planners started banning what they deemed as low-quality housing, including boarding houses, residential hotels, and low-quality apartments. Meanwhile, on the outer edges of many cities, urban policymakers undertook a policy of “mass eviction and demolition” of low-quality housing. Policymakers established bans on suburban shantytowns and self-built housing. In knocking out the bottom rung of urbanization, this ended the natural “filtering up” of cities as they expanded outward, replaced as we now know by static subdivisions of middle-class, single-family houses. The Housing Act of 1937 formalized this war on “slums” at the federal level and by the 1960s much of the emergent low-income urbanism in and around many U.S. cities was eliminated. In light of the United States’ century-long war on low-income housing, it’s something of a miracle that trailer parks survive. With an aftermarket trailer, trailer payments and park rent combined average around the remarkably low rents of $300 to $500. Even the typical new manufactured home, with combined trailer payments and park rent, costs […]

1. This week at Market Urbanism: Michael Lewyn So Much For The Foreign Oligarchs One common argument against new housing in high-cost cities is that the rise of global capitalism makes demand for urban housing essentially unlimited: if new apartments in Manhattan or San Francisco are built, they will be taken over by foreign billionaires…But a recent article in Politico New York suggests otherwise. Michael Lewyn Supply-And-Demand Denial And Climate Change Denial Climate change denialists reject climate science; SDD true believers reject economics. Dan Keshet Five Ways To Understand Food Trucks They are an indicator species for land with unmet commercial demand, and where they meet that demand, they incrementally improve our city one taco at a time. Johnny Sanphilippo The Stealth Guide To Nimbyville Hovering somewhere just beyond all the land use zoning regulations, building codes, finance mechanisms, aspirational comprehensive municipal plans, state mandates, and endless NIMBYism lies… reality. Adam Hengels Why No Micro-Apartments in Chicago? Chicago doesn’t have an outright ban on small apartments like New York, but there are four regulatory obstacles in the Chicago zoning code. These are outdated remnants from eras where excluding undesirable people were main objectives of zoning. Scott Beyer The Federal Housing Administration Encourages Sprawl Over Density In the event that HUD and the FHA further ease the condo certification process, they won’t be doing any special favors for aspiring high-density urban builders and dwellers. They will simply be narrowing the advantage long granted to single-family homes. 2. Where’s Scott? After flying to Washington, DC, Scott went to his hometown of Charlottesville, VA, to catch the Tom Tom Founders Festival, a music/innovation fest founded in 2012 by his brother Paul. He reported from there for Forbes on a start-up that wants to become the Airbnb of kitchen rentals: Organizations in a given city who had large, underused kitchen spaces would advertise on […]

Several cities have jumped on the bandwagon of building Micro-apartments, a hot trend in apartment development. San Francisco and Seattle already have them. New York outlawed them, but is testing them on one project, and may legalize them again. Even developers in smaller cities like Denver and Grand Rapids are taking a shot at micro-apartments. At the same time, Chicago is building lots of apartments, and is known for having low barriers to entry for downtown development. Yet we aren’t hearing of much new construction of micro-apartments here. Premier studios are fetching as much as $2,000 a month. Certainly there must be demand for something more approachable to young professionals. In theory, we should expect to see Chicago leading the way in innovative small spaces. Chicago doesn’t have an outright ban on small apartments like New York, but there are four regulatory obstacles in the Chicago zoning code. These are outdated remnants from eras where excluding undesirable people were main objectives of zoning, and combined to effectively prohibit small apartments: 1. Minimum Average Size: Interestingly, there is no explicit prohibition of small units. This is unlike New York City’s zoning, which prohibits units smaller than 400sf. There is, however, a stipulation that the average gross size of apartments constructed within a development be greater that 500sf. Assuming 15% of your floor-plate is taken by hallways, lobbies, stairs, etc; this means for every 300sf unit, you need one 550sf unit to balance it out. Source: 17-2-0312 for residential; 17-4-0408 for downtown 2. Limits on “Efficiency Units”: Zoning stipulates a minimum percentage of “efficiency units” within a development. The highest density areas downtown allow as much as 50%, but these are the most expensive areas where land is most expensive. In areas traditionally more affordable, the ratio is as low as 20% to discourage studios, and encourage […]

Hovering somewhere just beyond all the land use zoning regulations, building codes, finance mechanisms, aspirational comprehensive municipal plans, state mandates, and endless NIMBYism lies… reality. If you happen to want to live in certain parts of coastal California you need to come to grips with a serious supply and demand imbalance. Demand is endless. Supply is highly constrained. And there’s a huge amount of money on the table. Horizontal growth is essentially verboten. A powerful coalition of existing property owners, environmental groups, resource allocation schemes, and multi-tiered government regulations stymie new greenfield development. The personal interests of conservative Republicans and liberal Democrats line up exactly when anyone attempts to build anything near them. “Over my dead body.” It’s understood that if a town accepts endless low density horizontal development the overall quality of the area will decline. You can’t have expansive large scale suburbia without paving over the countryside, creating a great deal of traffic congestion, and inducing strip mall blight. At the same time, no one wants infill development on existing not-so-great property that’s already been paved over and degraded. The neighborhood associations break out the pitch forks and firebrands at the suggestion of multi-story condos or (Heaven forbid) apartment buildings. The population of any older suburb could double or triple without using a single inch of new greenfield land. But that kind of growth is feared and hated. So the aging muffler shops and parking lots linger in the middle of a massive housing crisis. Google Google Google On the other hand there’s radically less regulatory or community push back against expanding and improving existing suburban homes. Google Street View makes it possible to observe how a little post war tract home was transformed into a substantially larger residence. This kind of growth is entirely acceptable. The building […]

Over the last decade, Austin has exploded with a food truck revolution. They are so popular that temporary food truck installations on empty lots are mourned when the lot becomes ready for development and the trucks move on. But, taste aside, why do they do so well? What can we learn from them? 1 Food trucks as small business schools Restaurants are notoriously risky businesses to start. Many people start this way because food is their passion, but discover that making delicious food is only one of many components to running a successful restaurant. Food trucks are an opportunity to start your own restaurant at a smaller scale, and with lower costs. Budding restaurateurs can refine their menu, learn the ropes, and figure out whether they’re cut out for this industry without blowing their entire life savings. 2 Food trucks as proving grounds Lenders know that restaurants fail often; this makes them hesitant to fund new ones. By giving owners a chance to prove themselves and their ability to successfully manage a business, food trucks provide a way for lenders to separate the wheat from the chaff prior to making a large loan. This means some restaurants can get funding that would never have received it otherwise. Austin has seen dozens of restaurants that started as food trucks, before eventually finding brick-and-mortar premises. 3 Food trucks as regulatory hack Food trucks are regulated in how they prepare their food, where they may locate, and what kind of signage they can use. However, their regulations are both lighter and more directly related to their business than the regulations for brick-and-mortar businesses. If a food truck on a small lot with some picnic benches decided they would rather build a permanent building with indoor seating, they not only must still comply with the health and safety regulations the city requires; they would also have to provide parking. […]

I have criticized the idea that the law of supply and demand no longer applies to big-city housing (or, as I call it, supply-and-demand denialism, or “SDD” for short). It just occurred to me that there are a few similarities between supply-and-demand denialists and those who deny climate change. To name a few: *Rejection of science. Climate change denialists reject climate science; SDD true believers reject economics. *Paranoid fantasies about foreigners. Some climate change denialists treat worldwide concern over climate change as a conspiracy by Europeans or Chinese to destroy the U.S. economy; SDD believers are obsessed with foreigners purchasing U.S. or Canadian real estate. *Obsessive fear of change. Climate change denialists assume that any possible limit on fossil fuel emissions will destroy the U.S. economy (despite the fact that we already have lots of taxes and regulations and somehow maintain a more-or-less First World standard of living). I suspect (though I realize this is conjecture) that SDD believers are often NIMBYs who fear, without any obvious basis in reality, that new housing will turn their neighborhood into a slum or into a playground for the rich. *Self-interest generating these fears. Climate change denialists get information from politicians funded by the fossil fuel industry (and media outlets that support those politicians), which has a strong interest in limiting regulation of fossil fuel pollution. NIMBYs are sometimes homeowners who have a financial interest in limiting new housing in order to keep prices and rents high, or housing activists who can more effectively argue for government-subsidized housing if housing prices are high.

One common argument against new housing in high-cost cities is that the rise of global capitalism makes demand for urban housing essentially unlimited: if new apartments in Manhattan or San Francisco are built, they will be taken over by foreign billionaires in quest of American real estate, who will use the apartments as banks rather than actually living in them or renting them out. It seems to me that this argument would be more likely to be true if a huge percentage of New York’s housing was used by foreign billionaires. But a recent article in Politico New York suggests otherwise. The article says that 89,000 New York apartments are owned by absentee owners (many of whom presumably rent them out). However, most of these apartments are not owned by Russian oligarchs or other global capitalists; for example, the co-op unit I rented a few years ago in Forest Hills (market value around $300K) was owned not by a foreign oligarch, but by the building’s former super. Presumably, the condos and houses likely to be owned by wealthy foreigners are the most expensive ones. So how many of these units were worth $5 million or more. Only 1554- a drop in the bucket in a city of 8 million people. And how many of the units were worth over $25 million? Only 445. So super-rich absentee owners are few and far between, and thus probably do not affect housing supply very much.

1. This week at Market Urbanism: Tory Gattis has an interesting take on the restaurant scene in Houston Cities like to hype amenities like museums and performing arts, but really, how often do you go to a museum or an arts performance? A few times a year? How often do you eat out? Hopefully more than a few times a year Calib Malik explains why Rent Control Is Bad For Both Landlords And Tenants Void of analysis, rent control sounds utopian. Yet, the effects are unfortunate: tenants face limited housing stocks that are either run-down or unaffordable; landlords lose money, and ultimately stop investing and building altogether. And yet it is a policy now being flirted with in cities like Seattle, San Diego, and Richmond, California. The potential economic effect in those cities could be dire. Johnny Sanphilippo wrote his predictions on the future of driverless cars Here’s a little heads up for those of you who think you know how driver-less cars will play out in the culture and economy. Asher Meyers recently moved to Brussels, and reports how the urban fabric fared after the terror attack. The atrocity raises some interesting questions in regards to urbanism—are there certain urban designs that can prevent or discourage terrorism? Should the threat of terrorism influence the design of our cities? How would it? Dan Keshet explains the 9 Barriers To Building Housing In Central City Austin Austin, like most cities, has rules that prevent new housing from getting centrally built. That makes it easier to buy and build on virgin land in the suburbs. Here are some of those rules. Scott Beyer continues his America’s Progressive Developers series in New Orleans with Sean Cummings and Steve Dumez In the process of building this expensive waterfront, [the city] avoided any value capture strategy, and in fact downzoned adjacent properties from 75′ to 55′. […]