Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

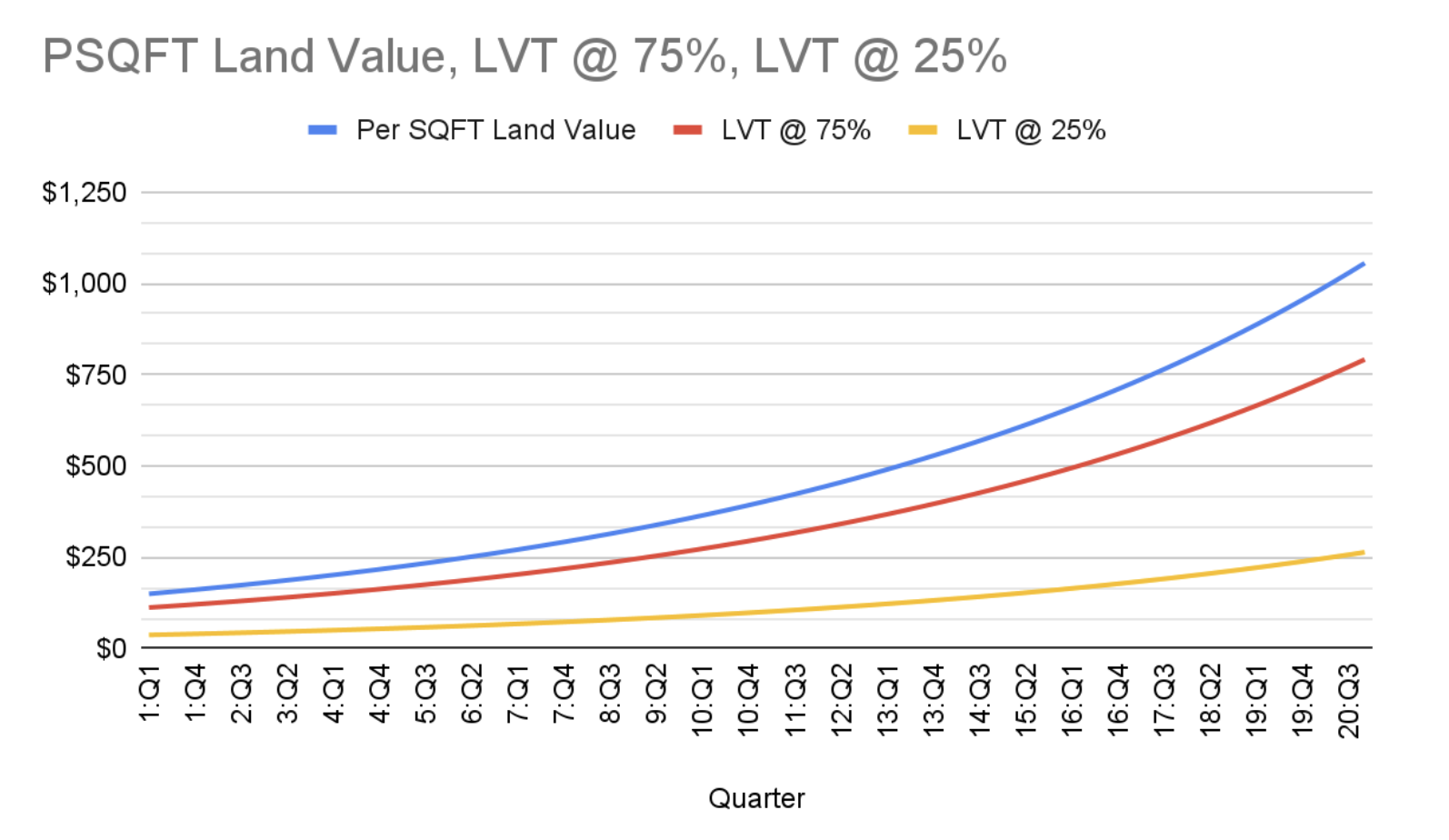

Georgists assert that a Land Value Tax (LVT) ensures land is always put to its most efficient use. They claim that increased carrying costs deter speculation. And if valuable land is never held out of use, society is better off. I think the story about incentives is correct. But I question whether pulling development forward in time is definitionally more efficient. In a world with transaction costs, tradeoffs abound and it’s worth thinking through the implications of an LVT. A Tale of Two Cities Picture a growing local economy with increasing land values and an LVT. Now suppose we split the time stream and create two parallel universes with different tax rates. In scenario A, we apply an LVT at 75%; in scenario B the LVT is set at 25%. There are two important questions here: 1) When will a given parcel be forced into development? 2) What intensity of development will the parcel support at the moment it’s put into productive use? To answer our first question, we look at the tax curves and make some assumptions. Suppose carrying costs push land into productive use at $250 psqft in LVT costs, scenario (a)’s parcel goes into development around year 9 at a $331 psqft. Scenario (b)’s parcel doesn’t see development until year 20 and a ~$1K psqft value. Given the delta between year 9 and year 20’s psqft valuations, we could expect to see different intensities of development. We’re now left with the question of whether a duplex in nine years is better than a mid-rise in twenty. Appropriating the full rental value of land would pull development forward, but that doesn’t definitionally lead to it being put to its highest and best use. Highest and best is contingent upon what time scale we’re optimizing for and that choice […]

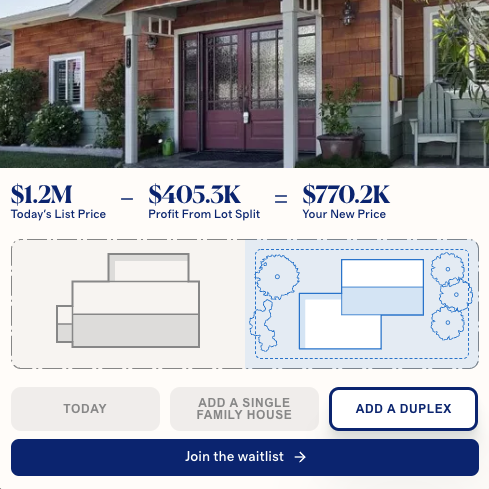

Discussions about land use reform focus on policy – as they should. Overcoming NIMBYism will require deep legal, political, and regulatory reform. That said, entrepreneurs may be helping to short circuit the perverse incentives that give rise to NIMBYism in the first place. New companies may be encouraging homeowners to embrace density and helping to break the tie between homeownership and anti-deveolpment attitudes in the process. Creating Demand for Density Belong is an early stage startup making it easier for homeowners to rent out their single family home. The main use case is that of a homeowner renting (instead of selling) after a move. A lot goes into becoming a landlord and Belong’s elevator pitch is that they simplify the process. The company’s customers access insurance, connect to contractors for repair and renovation, get help with listing, and find anything else they need all in one place. To the extent they’re successful, they’ll be creating a class of small scale landlords with every reason to develop missing middle housing. Transforming the family home from a speculative asset to one producing a monthly stream of revenue makes ADUs and duplexes more attractive. More units mean more tenants and therefore better monthly returns. And once an owner is no longer an owner-occupier, “neighborhood character” concerns become less salient as well. That said, this is admittedly speculative. Whether single property landlords will be as YIMBY as I suspect is an empirical question for the future. More immediate, though, are the incentives another new startup is creating for homeowners across California. Densification as the Path to Homeownership Homestead is a property developer that’s using legislation like California’s SB9 and SB10 to build housing. They work with homeowners interested in the upside of doing a lot split and adding housing like a duplex or an […]

Legislators in Colorado and Tennessee have introduced bills modeled on Arizona’s Private Property Rights Protection Act, a law that requires municipal governments to compensate landowners when new land use regulations make land less valuable. Both states already have areas with housing affordability problems due in part to land use regulations that are already on the books. Requiring local policymakers to compensate property owners for downzoning going forward won’t do anything to reduce existing barriers to housing construction, but they can at least help prevent the problem from getting worse. Though the Fifth and Fourteenth Amendments to the Constitution state that Americans must be compensated when private property is taken by the government, the Supreme Court has long held that state and municipal governments generally don’t have to compensate property owners when land use restrictions reduce their property values, even the rules eliminate nearly the entire value of the property in question. In 1926, the Supreme Court ruled in Euclid v. Ambler that local governments’ police powers, delegated to them by their states, give them the authority to restrict real estate development. The 1978 decision Penn Central v. New York further entrenched this authority. The Court found that land use restrictions are not takings requiring compensation for property owners so long as the property maintains any economic value at all. In Smyth v. Falmouth, the Court held that even a building permit denial that reduced a property’s value by 91% didn’t require the locality to compensate the owner. Law professor Ilya Somin points out that it wasn’t always this way. The District Court that heard Euclid prior to the Supreme Court determined that local governments were required to compensate property owners for regulatory takings just as with eminent domain. Their opinion stated: The argument supporting this ordinance proceeds, it seems to […]

Over the past week, the press was chock full of 2020-style headlines like “Census Bureau Confirms Pandemic Exodus from SF.” That’s because according to the Census Bureau, virtually every urban county in the U.S. (even urban counties in growing metros like Dallas and Atlanta) lost population between July 2020 and July 2021. But is the hype justified? I suspect not, for a variety of reasons. First of all, Census Department estimates have, in recent years, tended to underestimate urban populations, at least in some cities. For example, in 2019 the Census estimated Manhattan’s population as 1.628 million, while the actual count of 2020 showed 1.694 million residents- an underestimation of over 65,000 people. The Census estimated Brooklyn’s population at 2.559 million, but the actual count showed 2.736 million- an underestimate of over 150,000. (On the other hand, the 2020 population count was actually a bit lower than the 2019 estimates for Washington and San Francisco). Second, even the 2020 Census probably undercounted cities more than it undercounted suburbs. How do we know this? Because according to the Census Bureau itself, it undercounted Blacks by 3 percent and Hispanics by 5 percent, while slightly overcounting whites. These groups tend to be more urban than suburban (at least compared to whites) – so if the Census undercounted these groups, it probably undercounted urban population generally. Third, the timing of the Census Bureau’s estimates does not quite make sense to me. By July 2021, rents had already began to rise in Manhattan; the low rents of February and March were already disappearing. This suggests that by July, population (and thus demand) was increasing. Fourth, even if the Census Bureau’s population estimates were valid for the summer of 2021, they certainly aren’t valid any more. How do we know? It seems pretty obvious that […]

Are there diverse places in the U.S. where racial differences among residents are small enough to be undetectable to a typical resident? Places where Roger Starr's ideal of "integration without tears" might be a reality, where people of different races socialize as equals, share culture and priorities, and work in the same range of occupations?

At a recent webinar, Prof. Christopher Serkin of Vanderbilt Law School made an interesting argument. He pointed out that a) Sun Belt cities tend to have less restrictive zoning than northern cities; b) Sun Belt cities also have more homeowners’ associations (HOAs) with restrictive rules; and therefore (c) perhaps zoning reform will fail because homeowners will react to restrictive zoning by creating more HOAs, which will limit density and housing supply just as much as zoning. It seems to me that this argument has some weak links. The most obvious is that it is not clear that the correlation he points out really exists. Admittedly, northern and midwestern states have fewer HOAs than the rest of the nation. In the Northeast, only 29 percent of new homes are part of HOAs, as opposed to 47 percent in the Midwest, and 2/3 in the South. But not all southern and western states are the same- and if we go state-by-state, the correlation between HOAs and strict zoning starts to disappear. In particular, California metros are notorious for strict land use regulation and high housing costs. But 64.9% of California homeowners belong to an HOA, well above the national average. In fact, only three states (Vermont, DC and Florida) have higher HOA participation rates than California. On the other hand, Texas metros tend to be less restrictive, but only 1/3 of Texas homeowners belong to a HOA. Similarly, only 15 percent of Tenneseee homeowners belong to an HOA. So its not quite clear that metros with lower housing costs and/or less zoning have higher HOA participation rates. ( On the other hand, this data would be more useful if we were able to a) distinguish between new subdivisions and the rest of the housing market, b) distinguish between HOA participation rates for […]

Urbanist and YIMBY Twitter had a field day dunking on Nathan J. Robinson, whose essay in his publication Current Affairs called for building new cities in California. But California really could use some new cities - and we need to think about them in primarily economic terms.

A trip to Houston reveals how a city can design without shame, urbanize around cars, and achieve privacy in a context of radical integration.

One argument I have run across recently is that the high cost of housing is caused by mysterious corporate investors are buying up real estate and forcing up the cost. The stupidest version of this argument is that investors are hoarding all the real estate. Why is it stupid? Because corporations like to make money, and a corporation that doesn’t sell or rent out real estate is making no money from it. A more sensible version of the argument is that the existence of investors adds demand for housing, and thus that their presence thus increases housing costs.* But even if this true, are these investors really a significant factor in the housing market? In today’s Washington Post, an article supplies data for 40 metro areas. If investors are really the problem, one might think that the most expensive metros have the highest investor share. But this is simply not the case. In San Francisco, only 6 percent of for-sale houses are being purchased by investors (about the same as the 2015 share). In metro New York and Los Angeles, that share is around 10-11 percent. The most investor-heavy markets are in growing, medium-cost Sun Belt markets like Atlanta (25 percent), Charlotte (25 percent), Jacksonville (22 percent) and Phoenix (21 percent). And within those markets, investors are not buying in the most expensive areas. In Atlanta, the highest investor shares are in the lower-income Southside, and low and moderate-income southern and western suburbs. In Jacksonville, the mostly lower-income Northside and the working-class Westside have higher investor shares than the more middle-class Southside. This pattern seems to hold in less investor-heavy metros as well: even though some affluent Manhattan zip codes have high investor shares, most of the high-investor zip codes are in East Harlem, the South Bronx, and other poor […]

The narrow choice of city versus suburb is a balance of cost and amenities. But the bigger question – in which region should I make my home? – requires one to look on a higher plane.