Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

In a tweet this week, the Welcoming Neighbors Network recommended that pro-housing advocates keep supply-and-demand arguments in their back pockets and emphasize simpler housing composition arguments: This advice makes an economist’s mind race. We know, after all, that supply and demand work. But we’re not so sure about composition changes. If “affordability” is achieved by building units that people don’t want (in bad locations, too small, lacking valued attributes), then the price-per-unit can be low without actually benefiting people on their own terms. Even if existing homes are bigger than many people want, at least some of the price decline from building smaller homes is the “you get what you pay for” effect. (Incidentally, this is the opposite concern from that held by econ-skeptics concerned about gentrification: they worry that new housing will be too good or that investment will upscale neighborhoods. This inverts the trope that economists “only care about money”.) A few days later, a Maryland state senator asked me that very supply-and-demand question: “What’s the evidence that large-scale upzoning leads to affordability?” This is a tough question. First, large-scale upzonings are very scarce. Second, even if one occurs, it’s not in an experimental vacuum. Three kinds of affordability Let’s specify that an upzoning likely promotes affordability in three ways: Supply and demand You get what you pay for Only pay for what you want The first channel is obvious – it explains why Cleveland is cheaper than Boston. The second source of affordability is valuable for people at risk of homelessness, but doesn’t make most people better off. The third source – what WNN recommends advocates emphasize – is that many regulations require people to pay for more housing (or pricey attributes) that they don’t want. In a lot of cases, the last two effects will go […]

In an encouraging post this morning, Matt Yglesias – one of the O.G. YIMBYs – summed up 10 years of success since his book, The Rent Is Too Damn High, was published. If you’d asked me, I’d have guessed that Too Damn High was published in 2015 or 2016, when YIMBY was in its infancy and researchers like me were starting to nose around zoning as a major regulatory cost. Yglesias was several years ahead of the curve. In his post, Yglesias gives free marketers a lot of credit for being for upzoning before it was cool. Market urbanists will certainly accept the compliment, and the legacies of Bernard Siegan and Bob Ellickson (1972…2022 – incredible!) are undeniable. But there’s another major part of the pre-YIMBY world that’s missing in this story, which is the progressive critics of suburban zoning. One of the graphs that keeps me up at night is the Google n-gram showing that “exclusionary zoning” was less a part of the discourse in the 2010s than it was throughout the 70s and 80s… and yet the activists of the time accomplished so little! The progressive critics of zoning, such as Paul Davidoff and Myron Orfield, were focused on allowing multifamily housing – especially if subsidized – in the suburbs. Urban housing markets were pretty slack at the time, and adding affordable housing in central cities risked concentrating poverty. A great book that covers a specific housing battle spanning the 1990s is Lawrence Lanahan’s The Lines Between Us. Alongside YIMBY As I understand it, these activists’ energy became formalized in the affordable housing industry. A lot of those institutions – and individuals – are still active. They have a mixed relationship with the YIMBY movement. In some cities and states, they’re enthusiastic participants. In others, they’re antagonistic. It […]

Rent control has devalued property so badly that you could make a million dollars by tearing down a nice 12-unit building in my neighborhood.

Two new estimates of the national housing shortfall offer a seeming contradiction. But we can synthesize the demand and supply models to get close to the truth: High-priced places should build much more housing than Up For Growth estimates and moderate-priced places will build much less housing than the JEC predicts.

In his new book Arbitrary Lines, Nolan Gray points out that Tokyo is more affordable than many U.S. cities because its zoning policies are less restrictive. One common counterargument is that because Tokyo is a population-losing city in a population-losing city, it simply lacks the demand to have high housing prices, and is thus more comparable to the low-cost Rust Belt than to high-cost cities like New York. But a short look at my World Almanac suggests otherwise. On page 730, it lists the world’s largest urban areas. It shows that between 2000 and 2021 , Tokyo actually grew by 8.4 percent. By contrast, metropolitan New York-Newark grew by 5.7 percent, and Los Angeles by 5.6 percent. In other words, Tokyo’s population actually grew more rapidly than high-cost U.S. cities.

One reason local governments are often hostile to Airbnb and similar home-sharing websites is that politicians believe that the interests of short-term renters and long-term renters are opposed- that is, that Airbnb wastes housing units that could be used by long-term renters. This claim is of course based on the assumption that the interests of long-term renters are more important, because short-term renters are usually rich tourists with plenty of money to spend. If short-term rents were always as high as those of fancy hotels, this argument might make sense. But in fact, some Airbnb rents are comparable to rents in the long-term market, and some Airbnb landlords in fact will rent property for months. I discovered this while playing around with Airbnb listings in New York City. In particular, I looked at rentals for the entire month of August. I found rents as low as $827 per month (for a furnished room in Hollis, Queens). Even after limiting my search to full-fledged apartments (as opposed to sharing a room in someone’s house) I found some listings that were comparable to those in the long-term rental market. I found a listing for $1800 in Staten Island, and $1826 in Midwood (in southern Brooklyn) – far less than what I pay. The cheapest Manhattan listing (a walk-up in Murray Hill) was $2400, about what I paid before I got married. I did another search for 3-month tenacies (from Aug 1-Oct 1) and found comparable results: the cheapest fully private space rented for $1752 (in East New York) and the cheapest Manhattan listing rented for $2453. The cheapest roommate arrangement was $736- in Bensonhurst. In sum, it appears that if you can afford a traditional apartment, you can probably afford a low-end Airbnb listing- despite the regulatory obstacles that government uses against […]

Arbitrary Lines is the newest must read book on zoning by land use scholar and Market Urbanism contributor, Nolan Gray. The book is split into three sections, starting with what zoning is and where it comes from followed by chapters on its varied negative effects, and ending with recommendations for reform. For even deep in the weeds YIMBYs, it’s well worth picking up. There’s nothing dramatically controversial here, but give it a thorough read and you’re guaranteed to learn something new. In particular, the book’s third section on reforms is outstanding. It starts with a slate of policy proposals typical to this kind of text, but quickly goes much farther afield. After suggested policy changes, we’re invited to consider a world without zoning via an in-depth look at Houston’s land use regime. Here we’re treated to both an explanation of how it works and the unique political history that left the city unsaddled with zoning. Nolan goes on to close his recommendations with a call to reimagine what a city planner could be in a post-zoning American city; a call that, as a former New York City planner, he is uniquely fit to make. Aside from the content, this book deserves points for prose. Arbitrary Lines is blessedly readable. The writing flows and the varied anecdotes interspersed throughout the book make it feel less like a policy tract and more like a conversation with your favorite professor during office hours. For those already initiated, buy the book and enjoy nodding your head and learning a couple new things. And for those trying to share the good news of land use reform, consider making Arbitrary Lines that one thing you get friends or family to read. It’s among the most accessible books on land use I’ve ever read, and it’s a […]

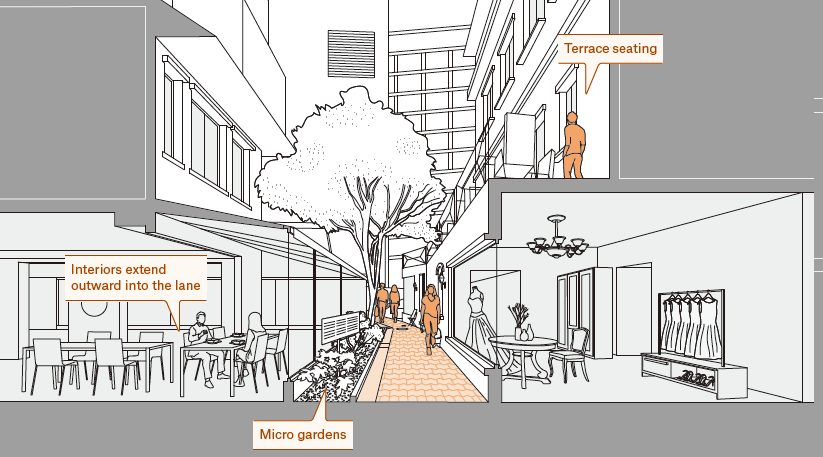

As foreigners, we are mesmerized by zakkyo buildings or yokocho, but within Japan, scholars, and authorities often ignore and neglect them as urban subproducts. In spite of their conspicuous presence and popularity, the official discourse still considers most of Emergent Tokyo as unsightly, dangerous, or underdeveloped. The book offers the Japanese readership a fresh view of their own everyday life environment as a valuable social, spatial, and even aesthetic legacy from which they could envision alternative futures.

American YIMBYs point to Tokyo as proof that nationalized zoning and a laissez faire building culture can protect affordability. But a great deal of that knowledge can be traced back to a classic 2014 Urban Kchoze blog post. As the YIMBY movement matures, it's time to go books deep into the fascinating details of Japan's land use institutions.

In Homelessness is a Housing Problem, Prof. Gregg Colburn and data scientist Clayton Page Aldern seek to answer the question: why is homelessness much more common in some cities than in others? They find that only two factors are significant: 1) overall rents and 2) rental vacancy rates. Where housing is scarce and rents are high, lots of people are homeless. Where rents are lower, fewer people are homeless, even in very poor places. (In fact, high city incomes correlate positively with homelessness, because more and better jobs lead to higher demand for housing). By contrast, many other factors that one might think are related to homelessness in fact are not correlated on a citywide basis. For example, since homeless people are generally poor, one might think that places with high poverty rates or high unemployment rates have lots of homelessness. The authors show that this is not the case. Where most people are poor, there is less demand for housing, which translates into lower rents and less homelessness. One might also think that places with warm weather have lots of homelessness, because homeless people might be attracted to them. But high-rent cold cities like Boston have above-average levels of homelessness, while cheaper warm-weather cities like Orlando and Charlotte do not. However, homeless people are more likely to have temporary shelter in cold cities than in expensive warm-weather cities like San Diego- either because city governments are less motivated to build homeless shelters when no one is at risk of freezing to death, or because the homeless themselves are less eager to use shelters. I suspect that if the authors focused only on highly visible unsheltered homelessness, they might have found a stronger correlation with weather). It might be argued that shelters themselves (or other social services) attract the destitute. […]