Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

On March 25, the city council of Burlington, VT, voted to pass a major zoning reform that one observer of Vermont politics (X.com’s pseudonymous @NotaBot) compared to the celebrated overhaul of Minneapolis’s zoning code. Burlington – the largest city in Vermont, at 45,000 inhabitants – has not escaped the housing crisis affecting the country. Burlington was an attractive destination for new residents during the pandemic and the rise of remote work; severe flooding last year put additional pressure on the housing supply. Policymakers statewide were well aware of the challenge and last year passed S.100, a sweeping package of housing reforms. Now Burlington, led by a pro-housing mayor, Miro Weinberger, has taken action at the local level. Burlington’s reform, known as the Neighborhood Code, is a welcome simplification of the city’s zoning. The Neighborhood Code eliminates the city’s ‘waterfront’ zoning districts and a ‘dense housing overlay’, adding a higher-density ‘residential corridor’ district, for a total of four residential zones. There are also significant increases in allowed density across the city. The Neighborhood Code allows up to fourplexes in all residential districts, allows townhouses everywhere but the low-density residential zone, and expands the option to create a cottage court or add a second freestanding unit on the same lot. The new code also limits requirements for minimum lot size, lot coverage, and setbacks. The reforms took some haircuts before final passage in response to pushback from organized groups of residents, but remain a meaningful change. In their report presenting the Neighborhood Code, Burlington’s city planning department reviews the city’s history. Planners explain that much of Burlington’s housing stock predates its zoning code, and in particular many existing lots are smaller than the official minimum lot size. Also, in Burlington’s first era of zoning, the city had a single residential district which […]

A friend asked what are the best papers supporting land use liberalization. That’s a broad question, but here are some of my answers. Affordability The basic case for zoning reform, across the political spectrum, is that the rent is too damn high. Michael Manville, Michael Lens, and Paavo Monkkonen give a combative and accessible review of the evidence in their Urban Studies paper (2020). The principal drawback is that it is rapidly becoming dated, as evidence and research come in from more recent reforms. The most important of those may be Auckland’s, which Ryan Greenaway-McGrevy has reported in a few papers, including this Economic Policy Center working paper (2023). Using a synthetic control method (which is not perfect, to be sure), Greenaway-McGrevy finds that upzoned areas had 21 to 33 percentage points less rent growth. A new candidate for the best review of the evidence on zoning reform and affordability is Vicki Been, Ingrid Gould Ellen, and Katherine M. O’Regan’s late 2023 working paper, “Supply Skepticism Revisited.” Racial integration Many authors from different disciplines have shown that both the intent and effect of zoning as practiced in the U.S. were racist and classist. That is, zoning policies have separated people by race, homeownership status, and income more than would have occurred in an unregulated market. Allison Shertzer, Tate Twinam, and Randall Walsh’s review of the evidence in Regional Science and Urban Economics (2022) is concise and helpful. However, fewer authors have attempted to show that removing specific zoning restrictions reduces existing patterns of segregation. One is Edward Goetz, in Urban Affairs Review (2021). He makes a qualitative argument. I’m unaware of a good causal, quantitative paper showing how broad upzoning impacts local integration (but I would happily commission it if anyone wants to write it!) Environment & climate Along some […]

I recently ran across an interesting discussion on Twitter about housing costs. Someone praised Chicago’s low housing costs, and someone else responded that because Chicago’s most troubled neighborhoods are so unusually dangerous and disinvested (compared to the most troubled parts of a safer city like New York), the low costs of these areas artificially deflated citywide averages. To put it another way, to compare Chicago and New York you should look at comparable neighborhoods rather than regionwide averages. For example, one reasonable comparison might be between Chicago’s reasonably desirable inner suburbs and New York’s. I picked four suburbs that I have visited and that are reasonably close to city boundaries: Great Neck and Cedarhurst on the New York Side, Skokie and Evanston on the Chicago side. According to Trulia.com, the cheapest two bedroom condo* (other than one that clearly needs major renovations) in Evanston sells for $115,000 and the cheapest in Skokie for $165,000. By contrast, Great Neck condos start at around $350,000, and Cedarhurst prices are similar. Similarly, elite intown areas are cheaper in Chicago. I looked at Chicago’s Lakeview, where I spent part of my honeymoon five years ago; two-bedroom units there start at $235,000. By contrast, in Manhattan’s Upper West Side such units start at $730,000 (not counting units that require extensive renovation or are income-restricted). To sum up: regional averages do seem to reflect the reality of housing costs, at least in these two cities. *I picked two bedroom condos for the somewhat arbitrary reason that I currently live in a two-bedroom apartment. *

It is well known that rent control is not particularly effective in controlling rents; cities like New York and San Francisco have rent control and yet are quite expensive. Supporters of rent control, however, often argue that rent control is valuable for a different reason: it makes housing more stable, by making it more difficult for a tenant to be evicted for nonpayment of rent. But it seems to me that there’s an assumption hidden behind this idea: that the neediest people are the ones who are ordinarily most stable, and thus do not suffer from rising housing costs as long as they are protected by rent control or similar measures. For example, law professor Richard Schragger complains that pro-housing zoning reform will “redound to the benefits of investors and developers and not to those residents with limited resources who seek to afford to remain in place.” (emphasis added) In the next sentence, he adds that “those in the market for housing- including middle-class families, recent college graduates, and young families– are often priced out of high-cost urban markets. But reforms should be careful not to equate their interests with those of the working class and especially minority poor…” (emphasis added)* In other words, the “working class” and “minority poor” and people “in the market for housing” are somehow two separate groups. This assumption might be persuasive if poor people moved less often than other people. But neither common sense nor data support this idea. If you are poor, you might be less likely to have steady employment, which means that your income is likely to be unstable. Thus, you are more likely than other Americans to be evicted or to move voluntarily even if rents are stable. Even if you rely on government transfer payments, you are at risk […]

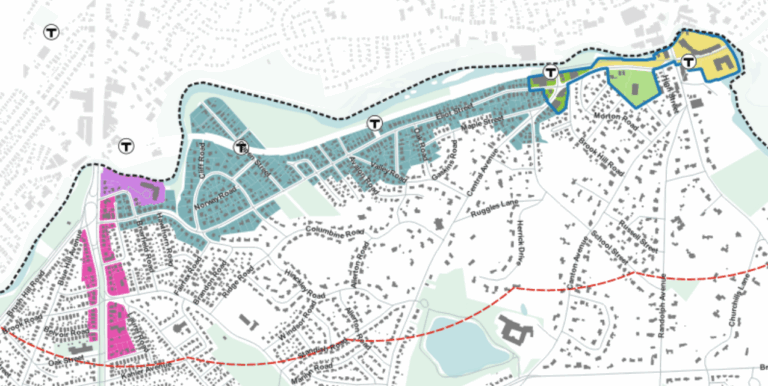

“Wow!” the reporter said, “I knew you from Milton, but I didn’t know you were from East Milton. Tell me what it feels like?” Well, until last week it was not that dramatic. East Milton is an old railroad-commuter neighborhood favored by affluent Boston Irish. It’s separated from the City of Boston by the Neponset River estuary and from the rest of Milton by a sunken interstate highway that makes it more congested and big-city than the rest of town. MBTA Communities In January 2021, Massachusetts passed the first transit-oriented upzoning law of the YIMBY era, now called “MBTA Communities,” “MTBA-C”, or “Section 3A”. Implementing regulations assigned a multifamily zoning capacity to each town. Milton was always going to be one of the toughest cases for MBTA Communities. The northern edge of town is served by the Mattapan Trolley, which John Adams rode to the Boston Tea Party links up to the Red Line at Ashmont. The trolley makes Milton a “rapid transit community”, which means it has to zone for multifamily units equal to 25% of its housing stock. Among the dozen towns in the rapid transit category, Milton is the only one where less than a quarter of current housing units are multifamily; it also has few commercial areas to upzone. East Milton dissents East Milton voters went to the polls on Wednesday and led a referendum rebuke of the plan. In Ward 7, it wasn’t close: 82% opposed the rezoning. The Boston Globe offered a helpful breakdown of the surprisingly varied voting: There are several hypotheses as to why the neighborhood went against rezoning so hard, all probably played a role. East Milton was assigned more than half the net new multifamily zoning capacity despite lacking good transit access. The neighborhood has been in a contentious, multiyear […]

In December, I was asked to testify at a House Subcommittee on Housing and Insurance hearing on government barriers to housing construction and affordability. I provided examples of reforms to land regulations that have facilitated increased housing supply, particularly relatively low-cost types of housing, including multifamily, small-lot single-family, and accessory dwelling units. Following the hearing, I received a good question from Congresswoman Sylvia Garcia. She points out that, as in the country as a whole, the share of cost burdened renters has increased in recent years in Houston, in spite of land use liberalization. She asked what local policymakers could do to improve affordability for low-income residents. When market-oriented housing researchers point to Houston’s relatively light-touch land use regulations as a model for other U.S. localities to learn from, its declining affordability may cause skepticism. Houston, however, has fared better than many other cities in housing affordability for both renters and homebuyers. While Houston is the only major U.S. city without use zoning, it does have land use regulations that appear in zoning ordinances elsewhere, including minimum lot size, setback, and parking requirements. These rules drive up the minimum cost of building housing in Houston. However, Houston has been a nationwide leader in reforming these exclusionary rules over the past 25 years. Houston policymakers have enacted rule changes to enable small-lot development and, in parts of the city, they have eliminated parking requirements. In part as a result, Houston’s affordability is impressive compared to peer regions. As the chart below shows, Houston has the lowest share of cost-burdened renter households among comparable Sun Belt markets for households earning 81% to 100% of the area median income. Only San Antonio and Austin have lower rates of rent burden among households earning 51% to 80% of the area median income. At the […]

Updated 1/11/24 to add 3 new papers, Wegmann, Baqai, and Conrad (2023), Dobbels & Tavakalov (2023), and Hamilton (2024). The original post was published 3/14/23. A concerted research effort has brought minimum lot sizes into focus as a key element in city zoning reform. Boise is looking at significant reforms. Auburn, Maine, and Helena, Montana, did away with minimums in some zones. And even state legislatures are putting a toe in the water: Bills enabling smaller lots have been introduced [in 2023] in Arizona, Massachusetts, Montana, New York, Texas, Vermont, and Washington. The bipartisan appeal of minimum lot size reform is reflected in Washington HB 1245, a lot-split bill carried by Rep. Andy Barkis (R-Chehalis). It passed the Democratic-dominated House of Representatives by a vote of 94-2 and has moved on to the Senate. City officials and legislators are, reasonably, going to have questions about the likely effects of minimum lot size reductions. Fortunately, one major American city has offered a laboratory for the political, economic, and planning questions that have to be answered to unlock the promise of minimum lot size reforms. Problem, we have a Houston Houston’s reduced minimum lot sizes from 5,000 to 1,400 square feet in 1998 (for the city’s central area) and 2013 (for outer areas). This reform is one of the most notable of our times – and thus has been studied in depth. For a summary treatment, see Emily Hamilton’s 2023 case study. To bring all the existing scholarship into one place, I’ve compiled this annotated bibliography covering the academic papers and some less-formal but informative articles that have studied Houston’s lot size reform. Please inform me of anything I’m missing – I’ll add it. Political economy of Houston’s reform M. Nolan Gray & Adam Millsap (2020). Subdividing the Unzoned City: An Analysis […]

I don’t know how successful artificial intelligence will be. But let’s agree, for the moment, to consider a reasonably optimistic case where AI delivers significant productivity gains across a broad range of tasks – but not in a way that radically alters our Newtonian constraints. What would happen to housing economics and, consequently, housing politics? TL;DR Construction won’t be much affected by AI. Consumers will be richer and spend a bigger share of their incomes on housing. The stakes around housing policy will only grow. Inscriptibility Karl Marx divided the economic world into capital and labor. More recent economists have frequently (and self-regardingly) divided labor into low-skill and high-skill. In an AI world, we need to start talking about inscriptible and uninscriptible labor. I’m using a circular definition on purpose – AI will replace inscriptible labor because inscriptible labor is the type that AI is good at replacing – because I have only a fuzzy idea what AI will be good at. (A diversion) (Why inscriptible rather than legible, in a James C. Scott sense? I thank Bard for the suggestion. Think about visual art – AI is probably no better than humans at guessing what nuances a human artist intended, but it can produce human-quality visual art rich with nuance. Since AI’s value is partly predicated on repetition speed, it will thrive in arenas where failures are costless. Thus, AI may be formulating 99% of new drugs in a few years even if nobody trusts it to perform a simple surgery. That’s an inscriptibility difference, not a legibility difference. The most inscriptible human tasks are presumably those that simpler software replaced long ago, usually called “routine.” The big surprise of 2023 AI was the advances that software made with tasks we have considered creative. The “routine” concept was valuable […]

WASHINGTON – David Paitsel, 42, a former FBI agent, and Brian Bailey, 53, a D.C. real estate developer were sentenced today on bribery and conspiracy charges for their role in schemes involving confidential information held by the D.C. Department of Housing and Community Development United States Attorney’s office There are plenty of housing laws you can break. But these grifters were busted only for bribing a city official for information. Otherwise, they used the housing law – the most innocent-sounding of all housing laws – correctly. Washington DC has a strong Tenant Opportunity to Purchase Act (TOPA). When a landlord sells, tenants have the right to match any offer, conceivably buying their own building. That never happens. But TOPA also allows tenants to sell their rights to literally anyone else. The law treats the new owner of the TOPA rights with the same exaggerated deference as a tenant. The TOPA grift goes like this: A TOPA shark, like Paitsel and Bailey, approaches tenants whose building is on the market. The “approach”, as I’ve witnessed it, can be a hand-scrawled note placed in the tenants doors or mailboxes. The tenants rarely know the mechanics of buying a house, let alone utilizing an obscure city-specific TOPA scheme that would have to involve collective action among many tenants. So the sharks offer the tenants a few hundred dollars for their rights. If the offer is accepted, the shark informs the landlord. Now suppose a prospective buyer comes along and offers $1,200,000 for a D.C. sixplex. The landlord must inform the shark, who now has the right to match any bona fide offer on the property. But the shark has no interest in buying – he just demands ten or twenty thousand dollars to surrender the rights. If the landlord resists extortion, the shark […]

Since 1973, the US Census Bureau has administered the American Housing Survey (AHS) in odd-numbered years. Surveyors ask questions about the quality and value of respondents’ housing, and have a battery of questions for the subset of respondents who moved recently, asking about their search process. The AHS regularly adds new questions and rephrases old ones from year to year. In 2021, they rolled out a group of three new questions. One asks recent movers whether they spent more or less than a month searching for their new home. This is the AHS’s first-ever variable dealing with search time. The other two, which are similar to questions asked in previous years, ask about search scope: whether respondents looked for housing in neighborhoods besides the one they ended up moving to, and whether they looked at other housing units in the same neighborhood they moved to. In analyzing these new questions within the largest 15 metro areas in the US, I found a curious and hard-to-explain relationship. Search time – the binary variable of taking more or less than a month to look for a home – seems to be predicted by the population of a metropolitan area (with r=0.57 and p > |t| = 0.026), whereas search scope in the sense of looking at multiple neighborhoods or multiple units within a neighborhood seems to be predicted by the cost of housing as gathered from 2021 Zillow data (for looking at multiple neighborhoods, r=0.65 and p > |t| = 0.009; for looking at multiple units, r=0.68 and p > |t| = 0.007). The inverse set of relationships are much weaker. Price and likelihood of taking over a month to search are positively correlated, but the relationship is not statistically significant; the same is true of the relationship between metro population and […]