Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

I'm pre-disposed to find reasons to love Gregg Colburn and Clayton Page Aldern's book *Homelessness is a Housing Problem*. But the book moved my priors in the opposite direction than the authors intended.

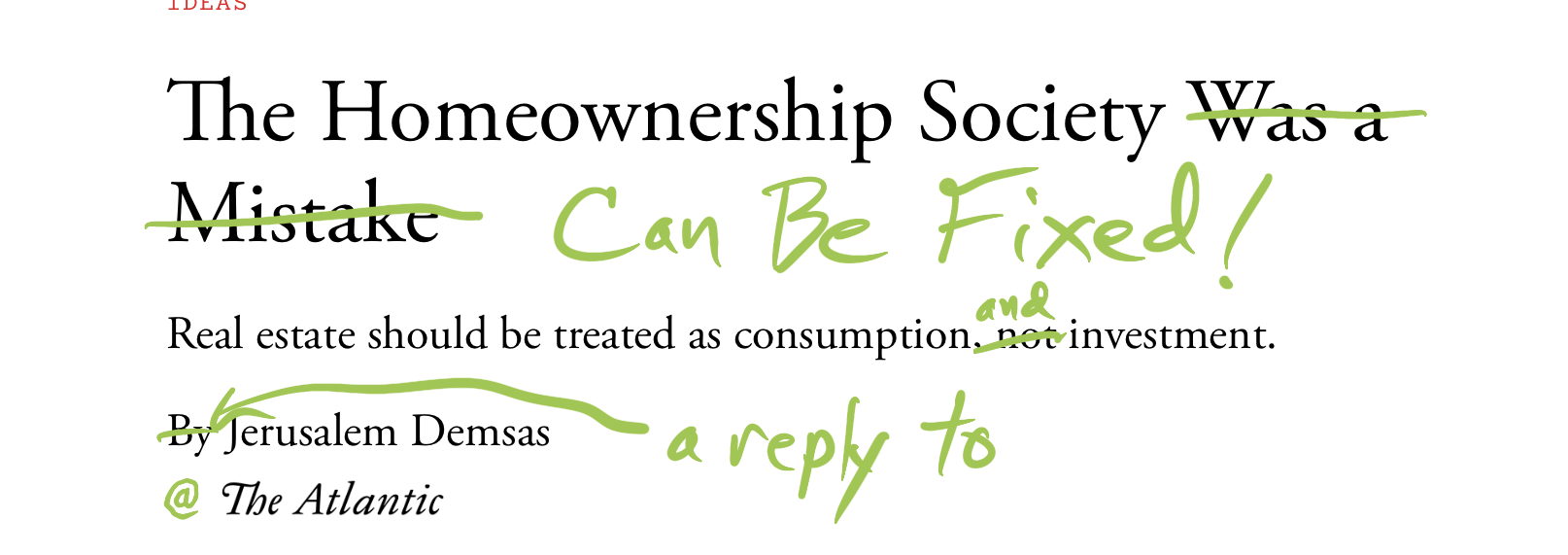

In a recent article, Jerusalem Demsas identified a major housing policy problem but gave an unworkable solution. Michael D. Nahas proposes a workable solution: land-value contracts.

An article in Curbed by Lane Brown has gotten much publicity in Twitter. The article makes two factual claims: 1) New York City is still losing households, and thus there was no reason for rents to go back up in 2021-22; and 2) landlords are conspiring to keep supply down because some apartments are still vacant. Since the city seems extremely busy to me, the first claim seemed a bit insane. But having said that, I live in touristy Midtown Manhattan two blocks from Central Park, so my experience is probably not an argument-settler. Brown relies on U.S. Postal Service change of address data. Brown reasons: more people filed change of address forms to move out of the city than filed change of address forms to move into the city. Thus, the city is continuing to lose people. But as Brown himself admits, change-of-address data misses a lot. He admits that this data “misses [moves] to the city from abroad.” Because of COVID-related travel bans, immigration presumably declined in 2020. But legal immigration has rebounded to pre-COVID levels, and some of that increase may have spilled over into New York. Change-of-address data might not include recent graduates and other people who left their parents elsewhere in the U.S. to move into the city, because those people might still be getting mail at their parents’ houses. Such data also might not reflect people who left the city temporarily in 2020 but didn’t bother with change-of-address requests because they still picked up mail at their old homes. Most importantly, change-of-address trends do not reflect people deciding to leave roommates and get their own apartments, at least not if people changed addresses within the city. This means that even if population is stable or declining, the number of households looking for apartments […]

In recent years, I have thought of Herbert Hoover as sort of an urban policy villian, thanks to his promotion of zoning. But I recently ran across one of his memoirs in our school’s library. (Hoover’s memoirs were a multivolume set, and this particular volume related to his service as Secretary of Commerce and President). Hoover devotes less than a page zoning, noting that it was designed “to protect home owners from business and factory encroachment into residential areas.” He doesn’t mention the parts of zoning that have stunted housing supply in recent decades, such as the prohibition of apartments in homeowner zones, and minimum lot sizes. In fact, he brags about increases in housing construction when he was Secretary of Commerce, writing that “The period of 1922-28 showed an increase in detached homes and in better apartments unparalleled in American history prior to that time.” In particular, he notes that 449,000 dwelling units were built in 1921, and that this number rose to 753,000 in 1928. He claims some of the credit for this, primarily because the Commerce Department helped formulate a standard building code which he believed would be less costly than existing local codes, and because the Department sought to lower interest rates on second mortgages. One common argument against new housing is that because some new housing has been built, therefore there has been a building boom sufficient to meet demand. By contrast, Hoover was not a believer in the idea that any housing construction equals enough housing construction; he notes that “The normal minimum need of the country to replace worn-out or destroyed dwellings and to provide for increased population was estimated by the Department at 400,000-500,000 dwelling units per annum.”* *By the way you might be wondering how these numbers compare to current levels […]

The pro-housing movement (more colloquially known as “YIMBYs” as an acronym for “Yes In My Back Yard” can’t catch a break from either the Left or the Right. On the Left, pundits like to “expose” them as supporters of big business. But conservatives don’t always embrace YIMBYs either; both on this page and on Planetizen I have discussed conservatives who are lukewarm about zoning reform. So are YIMBYs liberals or libertarians? I have been at least somewhat active in New York’s YIMBY group, Open New York, for the past few years. There are some center-right people in the group, but my sense is that the membership tends to be more liberal than not, and that many members are more likely than I am to support regulations designed to protect tenants from landlords. Why might this be? First, New York City is to the left of the nation, and the most expensive and highly educated parts of the city (i.e. Manhattan and Brownstone Brooklyn) are especially liberal. So naturally, any organization (other than one focused on conservative policies) is going to have more liberals than conservatives. If there were YIMBY groups in more conservative places, they would probably be less liberal-dominated. Second, Open New York tends to be dominated by people under 50; older people are more likely to have purchased houses or condos, and thus aren’t really that interested in lower rents. In recent decades, younger voters have been well to the Left of older voters. So naturally, our group leans a bit left. Third, New York is dominated by the Democratic Party, and our city’s Democrats have arguably swung to the left over the past decade or so; a group that takes conservative positions is not going to find it easy to build coalitions or to get the attention […]

During the Trump Administration, liberals sometimes criticized conservatives for being anti-anti-Trump: that is, not directly championing Trump’s more obnoxious behaviour, but devoting their energies to criticizing people who criticized him. Similarly, I’ve seen some articles recently that were anti-anti-NIMBY*: they acknowledge the need for new housing, but they try to split the difference by focusing their fire on YIMBYs.** A recent article in Governing, by Aaron Renn, is an example of this genre. Renn agrees with “building more densely in popular areas like San Francisco and the north side of Chicago, in other cities along commercial corridors, near commuter rail stops, and in suburban town centers.” Since I am all for these things, I suspect I agree with Renn far more than I disagree. But then he complains that YIMBYs “have much bigger aims” because they “want to totally eliminate any housing for exclusively single-family districts- everywhere.” What’s wrong with that? First, he says (correctly) that this would require state preemption of local zoning. And this is bad, he says, because it “would completely upend this country’s traditional approach to land use.” Here, Renn is overlooking most of American history: zoning didn’t exist for roughly the first century and a half of American history, and in some places has become far more restrictive over the last few decades. Thus, YIMBY policies are not a upending of tradition, but a return to a tradition that was destroyed in the middle and late 20th century. To the extent state preemption gives Americans more rights to build more type of housing, it would actually recreate the earlier tradition that was wiped out. Moreover, even if the status quo was a “tradition”, that doesn’t make it the best policy for the 21st century. For most of the 20th century, housing was far cheaper than […]

Progressives often argue that American cities should imitate Vienna’s 1920s strategy of building enormous amounts of public housing while controlling rents paid to private landlords. But a look at the birth of Vienna’s public housing system shows why that system is not easily replicated. A book supported by the city government points out that the city had an enormous housing shortage after World War I, and that the working classes “began reclaiming the land surrounding the cities” (p. 13). The city then “offered its support in the form of the redesignation and purchase of sites”. Settlers received housing in return for committing to work on the building site (id.) Obviously, this strategy cannot be replicated today; there is not a huge amount of unowned or extremely cheap land that people can just commandeer and build on, and I am not sure many people can easily become construction workers in exchange for housing. In addition, the city financed housing in ways that are not easily replicated today. The book notes that tax revenue for housing came from a 1923 “tax on housing development .. a simple working-class apartment was taxed at an average annual rate of 2.083% of its pre-war rentable value, this went up to 36.4 for luxury homes.” This might have worked in 1923 because city residents had no suburbs to flee to; however, today, city residents can easily respond to large tax increases by moving. Moreover, in 1923 there was no zoning or environmental review or “community engagement” to give Not In My Back Yard (NIMBY) activists a chance to delay or prevent housing construction. Today, even if government can afford to build new housing somewhere, the bureaucratic obstacles to such housing might made it politically impossible to build in some places, or expensive and time-consuming to build […]

In a tweet this week, the Welcoming Neighbors Network recommended that pro-housing advocates keep supply-and-demand arguments in their back pockets and emphasize simpler housing composition arguments: This advice makes an economist’s mind race. We know, after all, that supply and demand work. But we’re not so sure about composition changes. If “affordability” is achieved by building units that people don’t want (in bad locations, too small, lacking valued attributes), then the price-per-unit can be low without actually benefiting people on their own terms. Even if existing homes are bigger than many people want, at least some of the price decline from building smaller homes is the “you get what you pay for” effect. (Incidentally, this is the opposite concern from that held by econ-skeptics concerned about gentrification: they worry that new housing will be too good or that investment will upscale neighborhoods. This inverts the trope that economists “only care about money”.) A few days later, a Maryland state senator asked me that very supply-and-demand question: “What’s the evidence that large-scale upzoning leads to affordability?” This is a tough question. First, large-scale upzonings are very scarce. Second, even if one occurs, it’s not in an experimental vacuum. Three kinds of affordability Let’s specify that an upzoning likely promotes affordability in three ways: Supply and demand You get what you pay for Only pay for what you want The first channel is obvious – it explains why Cleveland is cheaper than Boston. The second source of affordability is valuable for people at risk of homelessness, but doesn’t make most people better off. The third source – what WNN recommends advocates emphasize – is that many regulations require people to pay for more housing (or pricey attributes) that they don’t want. In a lot of cases, the last two effects will go […]

Two new estimates of the national housing shortfall offer a seeming contradiction. But we can synthesize the demand and supply models to get close to the truth: High-priced places should build much more housing than Up For Growth estimates and moderate-priced places will build much less housing than the JEC predicts.

One reason local governments are often hostile to Airbnb and similar home-sharing websites is that politicians believe that the interests of short-term renters and long-term renters are opposed- that is, that Airbnb wastes housing units that could be used by long-term renters. This claim is of course based on the assumption that the interests of long-term renters are more important, because short-term renters are usually rich tourists with plenty of money to spend. If short-term rents were always as high as those of fancy hotels, this argument might make sense. But in fact, some Airbnb rents are comparable to rents in the long-term market, and some Airbnb landlords in fact will rent property for months. I discovered this while playing around with Airbnb listings in New York City. In particular, I looked at rentals for the entire month of August. I found rents as low as $827 per month (for a furnished room in Hollis, Queens). Even after limiting my search to full-fledged apartments (as opposed to sharing a room in someone’s house) I found some listings that were comparable to those in the long-term rental market. I found a listing for $1800 in Staten Island, and $1826 in Midwood (in southern Brooklyn) – far less than what I pay. The cheapest Manhattan listing (a walk-up in Murray Hill) was $2400, about what I paid before I got married. I did another search for 3-month tenacies (from Aug 1-Oct 1) and found comparable results: the cheapest fully private space rented for $1752 (in East New York) and the cheapest Manhattan listing rented for $2453. The cheapest roommate arrangement was $736- in Bensonhurst. In sum, it appears that if you can afford a traditional apartment, you can probably afford a low-end Airbnb listing- despite the regulatory obstacles that government uses against […]