Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

One argument against Manhattan’s congestion pricing plan is that it merely redistributes congestion and pollution to nearby neighborhoods and suburbs, as drivers choose alternative routes that avoid midtown and downtown Manhattan. If this was true, air quality would decrease citywide…

I frequently reference my post summarizing the interesting research at last year’s Urban Economics Association conference. This year was as insight rich as ever. And the Montreal setting was truly special – it’s a city that’s as European as any…

In Chapters 2 and 3, Ellsworth tries to argue for supply skepticism- that is, the idea that new housing (or at least the high-end towers that she opposes)* will not reduce rents or housing costs. She has made some effort…

If investors and hedge funds are a major cause of high housing costs, why do they seem to be most common in cheap cities?

In response to David Albouy & Jason Faberman’s new NBER paper, Skills, Migration and Urban Amenities over the Life Cycle, Lyman Stone asks if this means that cities will always have lower fertility? I think the answer is probably yes, but that’s extrapolating beyond the paper at hand. What this paper shows is that there will always be some regions that are a better (worse) deal for parents relative to non-parents. The paper First, here’s Albouy & Faberman’s abstract, with emphasis added. TL;DR: there’s no point paying to live in Honolulu if you’re going to stay at home and watch Bluey every night. We examine sorting behavior across metropolitan areas by skill over individuals’ life cycles. We show that high-skill workers disproportionately sort into high-amenity areas, but do so relatively early in life. Workers of all skill levels tend to move towards lower-amenity areas during their thirties and forties. Consequently, individuals’ time use and expenditures on activities related to local amenities are U-shaped over the life cycle. This contrasts with well-documented life-cycle consumption profiles, which have an opposite inverted-U shape. We present evidence that the move towards lower-amenity (and lower-cost) metropolitan areas is driven by changes in the number of household children over the life cycle: individuals, particularly the college educated, tend to move towards lower-amenity areas after having their first child. We develop an equilibrium model of location choice, labor supply, and amenity consumption and introduce life-cycle changes in household compo! sition that affect leisure preferences, consumption choices, and required home production time. Key to the model is a complementarity between leisure time spent going out and local amenities, which we estimate to be large and significant. Ignoring this complementarity and the distinction between types of leisure misses the dampening effect child rearing has on urban agglomeration. Since the […]

I recently read about an interesting logical fallacy: the Morton’s fork fallacy, in which a conclusion “is drawn in several different ways that contradict each other.” The original “Morton” was a medieval tax collector who, according to legend, believed that someone who spent lavishly you were rich and could afford higher taxes, but that someone who spent less lavishly had lots of money saved and thus could also afford higher taxes. In other words, every conceivable set of facts leads to the same conclusion (that Morton’s victims needed to pay higher taxes). To put the arguments more concisely: heads I win, tails you lose. It seems to me that attacks on new housing based on affordability are somewhat similar. If housing is market-rate, some neighborhood activists will oppose it because it is not “affordable” and thus allegedly promotes gentrification. If housing is somewhat below market-rate, it is not “deeply affordable” and equally unnecessary. If housing is far below market-rate, neighbors may claim that it will attract poor people who will bring down property values. In other words, for housing opponents, housing is either too affordable or not affordable enough. Heads I win, tails you lose. Another example of Morton’s fork is the use of personal attacks against anyone who supports the new urbanism/smart growth movements (by which I mean walkable cities, public transit, or any sort of reform designed to make cities and suburbs less car-dominated). Smart growth supporters who live in suburbs or rural areas can be attacked as hypocrites: they preach that others should live in dense urban environments, yet they favor cars and sprawl for themselves. But if (like me) they live car-free in Manhattan, they can be ridiculed as eccentrics who do not appreciate the needs of suburbanites. Again, heads I win, tails you lose.

A review of a book that endorses more flexible zoning, but doesn't reject zoning entirely.

Delete all Seattle's highways. Invent new neighborhoods. Explain macroeconomic trends with home size. Money flows uphill to water. Do NIMBYs really hate density? Urban economics is on a tear.

Kevin Erdmann argues that mortgage credit standards are too tight. Others say the federal government is subsidizing homeownership. Can they both be right?

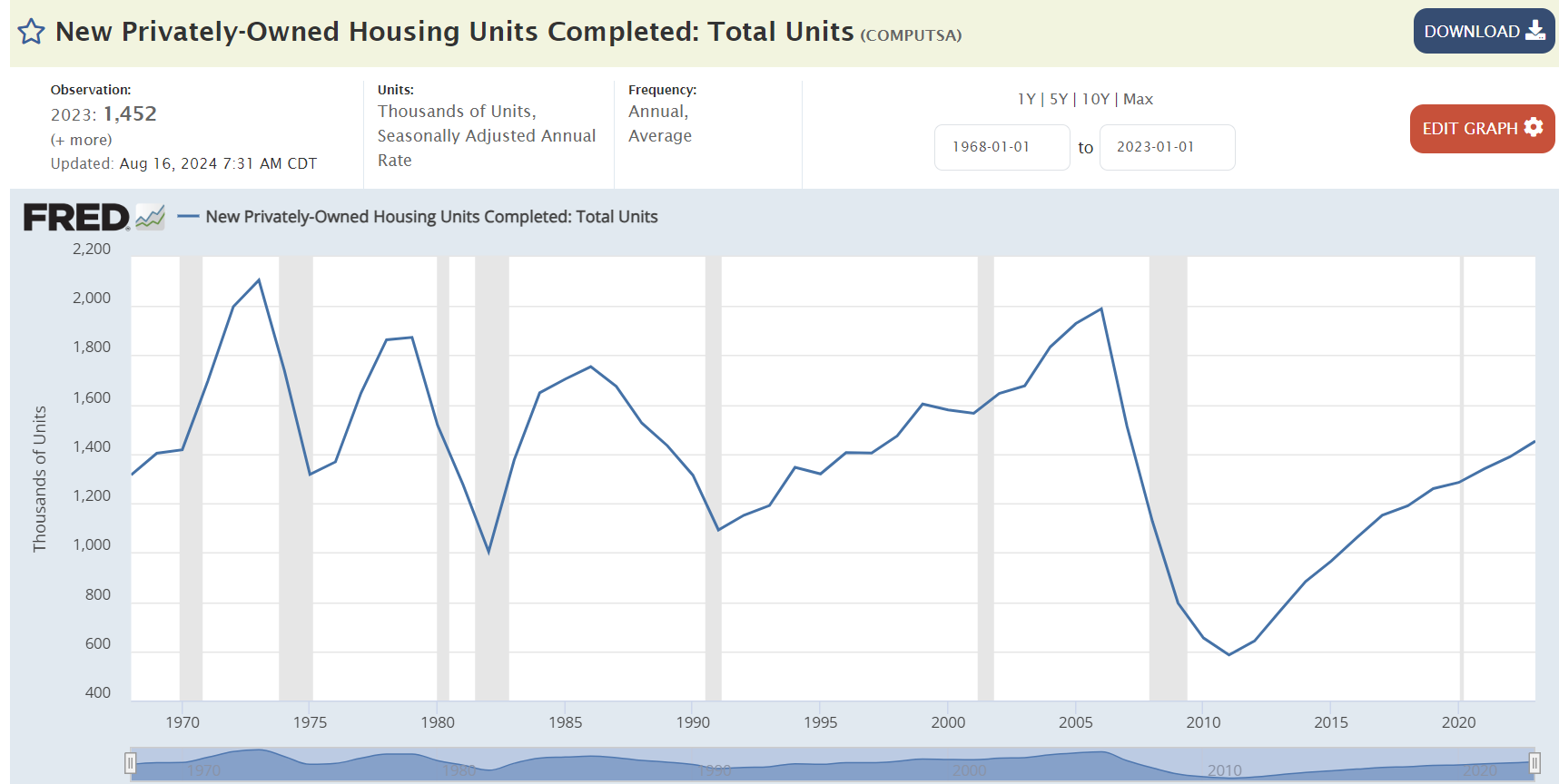

Kamala Harris has pledged to build 3 million new housing units. Setting aside the methods, what does that mean? And, would it "end America's housing shortage"?