Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

I recently read about an interesting logical fallacy: the Morton’s fork fallacy, in which a conclusion “is drawn in several different ways that contradict each other.” The original “Morton” was a medieval tax collector who, according to legend, believed that someone who spent lavishly you were rich and could afford higher taxes, but that someone who spent less lavishly had lots of money saved and thus could also afford higher taxes. In other words, every conceivable set of facts leads to the same conclusion (that Morton’s victims needed to pay higher taxes). To put the arguments more concisely: heads I win, tails you lose. It seems to me that attacks on new housing based on affordability are somewhat similar. If housing is market-rate, some neighborhood activists will oppose it because it is not “affordable” and thus allegedly promotes gentrification. If housing is somewhat below market-rate, it is not “deeply affordable” and equally unnecessary. If housing is far below market-rate, neighbors may claim that it will attract poor people who will bring down property values. In other words, for housing opponents, housing is either too affordable or not affordable enough. Heads I win, tails you lose. Another example of Morton’s fork is the use of personal attacks against anyone who supports the new urbanism/smart growth movements (by which I mean walkable cities, public transit, or any sort of reform designed to make cities and suburbs less car-dominated). Smart growth supporters who live in suburbs or rural areas can be attacked as hypocrites: they preach that others should live in dense urban environments, yet they favor cars and sprawl for themselves. But if (like me) they live car-free in Manhattan, they can be ridiculed as eccentrics who do not appreciate the needs of suburbanites. Again, heads I win, tails you lose.

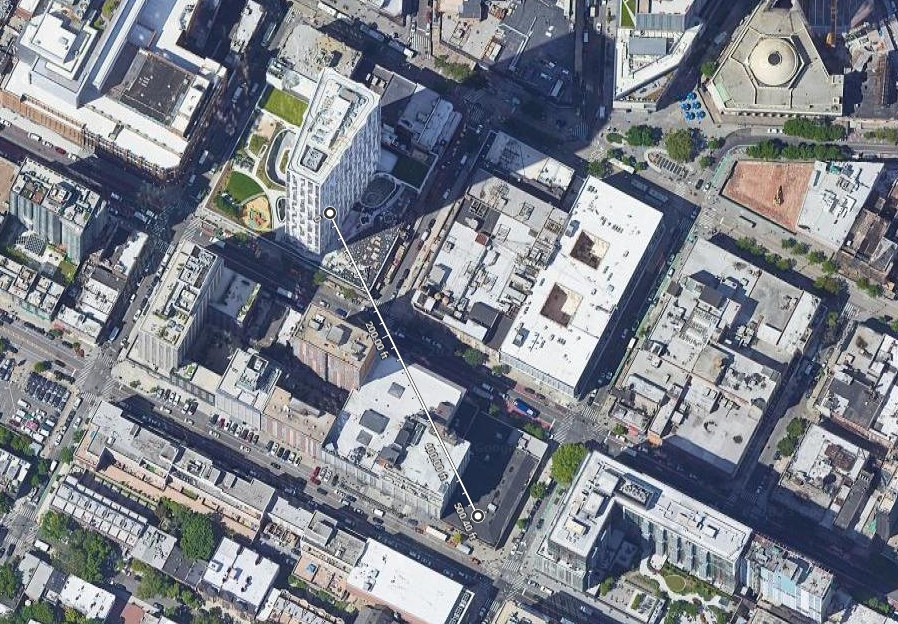

In New York City, one common argument against congestion pricing (or in fact, against any policy designed to further the interests of anyone outside an automobile) is that because outer borough residents are all car-dependent suburbanites, only Manhattanites would benefit. For example, film critic John Podhoretz tweeted: “Yeah, nothing easier that taking the subway from Soundview or Gravesend or Valley Stream.” Evidently, Podhoretz thinks these three areas are indistinguishable from the outer edges of suburbia: places where everyone drives everywhere. But let’s examine the facts. Soundview is a neighborhood in the Southeast Bronx, a little over 8 miles from my apartment in Midtown Manhattan near the northern edge of the congestion pricing zone. There are three 6 train subway stops in Soundview: Elder Avenue, Morrison Avenue, and St. Lawrence Avenue. Soundview zip codes include 10472 and 10473. In zip code 10472* only 25.7 percent of workers drove or carpooled to work according to 2023 census data; 59.6 percent use a bus or subway, and the rest use other modes (including walking, cycling, taxis and telecommuting). 10473, the southern half of Soundview, is a bit more car-oriented- but even there only 45 percent of workers drive alone or carpool. 41 percent of 10473 workers use public transit- still a pretty large minority by American standards, and more than any American city outside New York. In the two zip codes combined there are just 45,131 occupied housing units, and 24,094 (or 53 percent) don’t have a vehicle. In other words, not only do most Soundview residents not drive to work, most don’t even own a car. Gravesend, at the outer edge of Brooklyn over 12 miles from my apartment, is served by three subway stops on the F train alone: Avenue P, Avenue U and Avenue X. It is also served by […]

We can all understand the distinction between individual and systemic causes of homelessness. Can we apply the same rigor to potential solutions?

A new paper proposes that increasing diversity explains 90% of the recent decline in birthrates. Lyman Stone says it's nonsense.

As proposed, Moreno's 15-minute city has no chance of implementation, because economic and financial realities constrain the location of jobs, commerce, and community facilities. No planner can redesign a city by locating shops and jobs according to their own whims.

Promotors of recently developed cities ranging from Nusantara, the freshly built capital of Indonesia, to Neom, Saudi Arabia’s futurist urban paradise, advertise them as breakthroughs in urban living. But does the world need new cities?

Kevin Erdmann offers a helpful corrective to the “YIMBY triumphalism” of claiming that large relative rent declines in Austin and Minneapolis are results of YIMBY policies. He’s mostly correct, especially about the rhetoric: arguing about housing supply from short term fluctuations is like arguing about climate change based on the week’s weather. Keep your powder dry, promise slow change and long-term stability, and recognize that demand shocks are responsible for most fluctuations. But Erdmann makes a stronger claim: Supply has never and will never cause a collapse of prices and rents. It causes stability. Is that true? In a case like Austin or Phoenix, sure: prices are not too far above the cost of construction, and abundant supply cannot (durably) push the price of new housing below the cost of construction. But YIMBY has more to offer to San Francisco, Auckland, or London. In those cases, prices are far above construction cost. That means that even when demand is relatively soft, there’s money to made in construction. As Erdmann allows: After a decade of more active construction in Auckland, rents appear to be 10% to 15% below the pre-reform trend. That’s a big win. After a decade. That’s what success looks like. That’s the promise – 5 to 15% relative rent declines, decade after decade. But there are several good reasons to believe this won’t happen in an even, steady pattern, at least not all the time. Hopefully by 2040 we’ll have data from several cases and be able to describe the dynamics of market restoration with much more confidence.

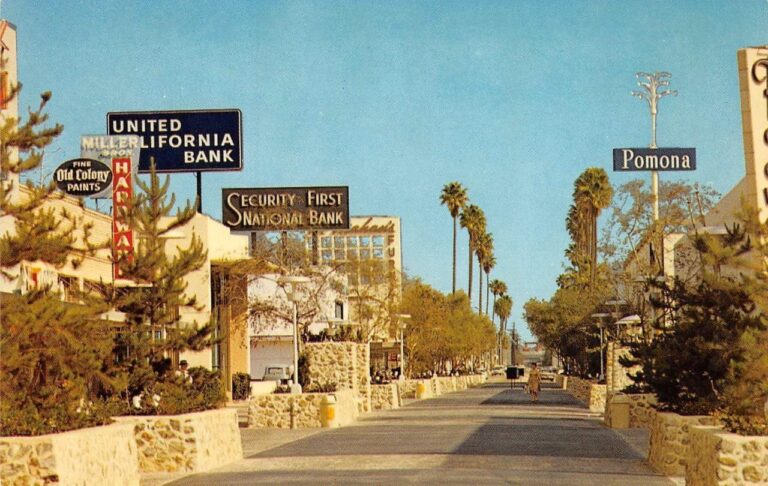

Urbanists love to celebrate, and replicate great urban spaces – and sometimes can’t understand why governments don’t: But what’s important to recall – especially for those of us under, uh, 41 – is that pedestrianized streets aren’t a new concept coming into style, they’re an old one that’s been in a three-decade decline. Samantha Matuke, Stephan Schmidt, and Wenzheng Li tracked the rise and decline of the pedestrian mall up to the onset of the pandemic. Even in the urbanizing 2000s and 2010s, 14 pedestrian malls were “demalled” against 4 streets that were pedestrianized: In a 1977 handbook promoting pedestrianization, Roberto Brambilla and Gianni Longo admit that some of the earliest “successes” had already failed: In Pomona, California, the first year [1962] the mall received nationwide press coverage as a successful model of urban revitalization; there was a 40 percent increase in sales. But the mall was slowly abandoned by its patrons, and now, after fifteen years of operation, it is almost totally deserted. A Handbook for Pedestrian Action, Roberto Brambilla and Gianni Longo, p. 25 One obvious reason for the failure of many other pedestrianized streets is that they were too little, too late. The pedestrian mall was one of several strategies against the overwhelming ebb tide of retail from downtowns in the postwar era. They weren’t seen as alternatives to driving, but destinations for drivers, who could park in the new, convenient downtown lots that replaced dangerous, defunct factories. A minority of the postwar-era malls survived. The predictors of survival are sort of obvious in hindsight: tourism, sunny weather, and lots of college students, among other things. Some of the streets which were “malled” and “demalled” have rebounded nicely in the 2000s. The slideshow below shows Sioux Falls’ Phillips Avenue in 1905, 1934, c. 1975, and 2015. The […]

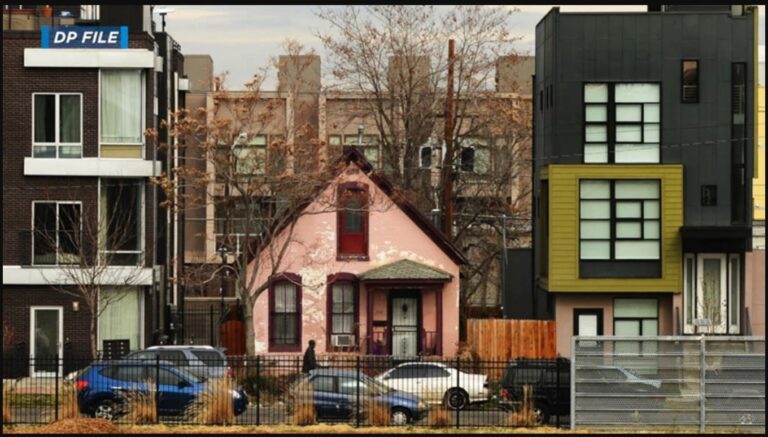

In many cities, poor people occupy valuable urban land close to downtown jobs, amenities, and transit. They can afford to live there because the housing stock in inner areas is usually older. If it hasn’t been completely renovated, the result can be quite cheap, even if the land is pretty valuable. In areas where there’s already some gentrification pressure, landlords face a timing problem: they can renovate (or sell to a developer) now, and cash out. Or they can hoard the property and wait until prices rise, supplying low-cost housing in the meantime. Land value taxes are specifically designed to penalize the hoard-and-wait approach by raising the annual tax cost of sitting on valuable land. It is specifically designed to accelerate neighborhood change. That’s the point. That’s what it says on the tin. Gentrification isn’t the only urban problem, and maybe it’s a small enough urban problem that a land value tax is a good idea anyway. But I think most of the benefits of Georgism can be unlocked with George-ish schemes (like renovation abatements or vacant land taxes) that are more narrowly designed.

Why are Max Holleran's book, Richard Schragger's law review article, and randos on Twitter all misinterpreting one important research article?