Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

In a Maryland neighborhood. rent control caused condo conversions of 15 percent of multifamily buildings. The county council might inflict the same fate on the entire region.

I'm pre-disposed to find reasons to love Gregg Colburn and Clayton Page Aldern's book *Homelessness is a Housing Problem*. But the book moved my priors in the opposite direction than the authors intended.

Market Urbanism is proud to welcome Michael Nahas as a new writer who will bring an Austin perspective to the blog. Michael’s Twitter handle is @MichaelDNahas, and he also blogs at City Econ. Here’s a short interview we did over email. Emily: How did you become interested in cities? Michael: A coincidence back in 2018 got me to look into cities. I had read a pop science article about how zoning policy in San Francisco was driving up the price of homes. The article stuck with me, because I’m fascinated by economics and it was so strange. I had always rented and didn’t know how regulated housing was. Then, at a party, I happened to mention this curious article in a conversation. The person I mentioned it to was Josiah Stevenson, an influential member in AURA, Austin’s YIMBY organization. He quickly recruited me into AURA and got me to look at cities. And once I started looking into cities, I wondered why economists haven’t studied them more! Cities are where they gather. They’re where information and goods are gathered. In cities, the biggest economic decisions get made and the most goods trade hands. Fission reactors work by bringing refined uranium into a tight space, causing an energy-producing chain reaction. Likewise, when you bring people into a tight space (with the right conditions), it causes the bright glow of economic activity. I believe that making that economic glow brighter will improve my life and everyone else’s life too. That’s what made me so interested in cities. Emily: What cities have you lived in? Michael: Ordered by the time I’ve spent as an adult: New York, Austin, Charlottesville (Virginia), Minneapolis, London (UK), Berkeley, and Nijmegen (NL). I have a great love for Philadelphia, having grown up an hour away, but I never […]

Market Urbanism is proud to welcome Szymon Pifczyk as a new writer. Here's a short interview we conducted over email.

Ever wondered how you could make your urbanism hobby a full-time job? Come work with me & Emily Hamilton at the Mercatus Center’s Urbanity project: Are you a gritty, liberty-minded researcher who is passionate about cities? This is a unique opportunity for an aspiring scholar to develop a portfolio of research in urban economics, planning, housing affordability, and land use regulations with talented scholars and staff at the world’s premier university source for market-oriented ideas. The ideal candidate will think like an economist, deftly handle complex datasets, and express himself or herself clearly in writing. This position reports to the program manager of the Urbanity Project. Responsibilities Include:•Collaborate with research fellows on quantitative research projects using GIS and data analysis software.•Read, understand and summarize scholarship in urban economics, planning, and land use law.•Translate and promote research through media and outreach engagement.•Support Mercatus scholars and affiliated fellows in consultations with city and state policymakers. Requirements Include:•Degree or equivalent knowledge in economics, urban & regional planning, or a related field•Experience with either a GIS or a statistical software package such as Stata and R; familiarity with and willingness to master the other•Strong verbal, written, and interpersonal communication skills •Enthusiasm for collaboration and adaptability to a varying mix of responsibilities•A strong interest in the Mercatus Center’s mission, with a specific focus on cities and liberty https://us63.dayforcehcm.com/CandidatePortal/en-US/mercatus/Posting/View/732

Rent control has devalued property so badly that you could make a million dollars by tearing down a nice 12-unit building in my neighborhood.

As foreigners, we are mesmerized by zakkyo buildings or yokocho, but within Japan, scholars, and authorities often ignore and neglect them as urban subproducts. In spite of their conspicuous presence and popularity, the official discourse still considers most of Emergent Tokyo as unsightly, dangerous, or underdeveloped. The book offers the Japanese readership a fresh view of their own everyday life environment as a valuable social, spatial, and even aesthetic legacy from which they could envision alternative futures.

American YIMBYs point to Tokyo as proof that nationalized zoning and a laissez faire building culture can protect affordability. But a great deal of that knowledge can be traced back to a classic 2014 Urban Kchoze blog post. As the YIMBY movement matures, it's time to go books deep into the fascinating details of Japan's land use institutions.

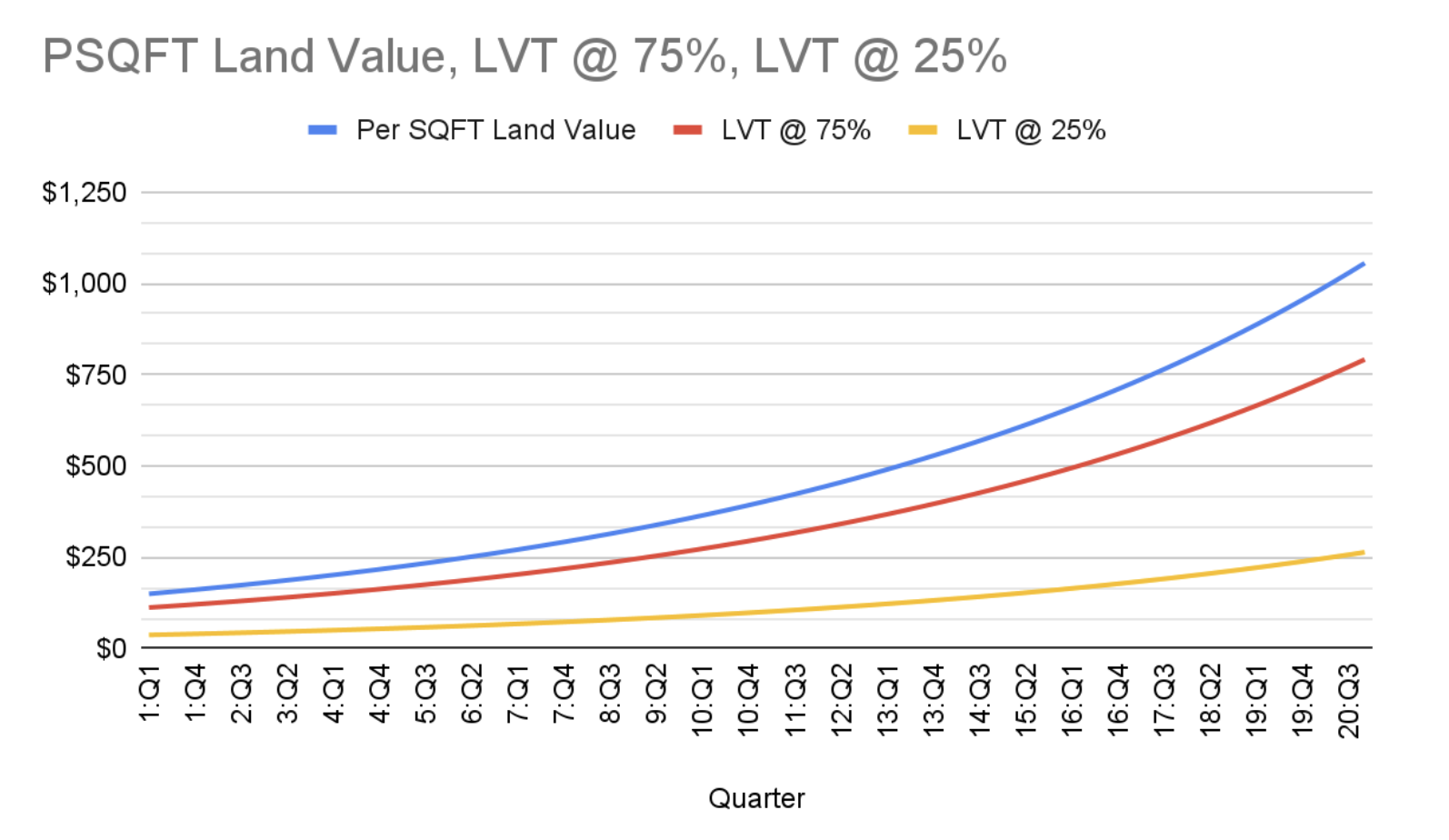

Georgists assert that a Land Value Tax (LVT) ensures land is always put to its most efficient use. They claim that increased carrying costs deter speculation. And if valuable land is never held out of use, society is better off. I think the story about incentives is correct. But I question whether pulling development forward in time is definitionally more efficient. In a world with transaction costs, tradeoffs abound and it’s worth thinking through the implications of an LVT. A Tale of Two Cities Picture a growing local economy with increasing land values and an LVT. Now suppose we split the time stream and create two parallel universes with different tax rates. In scenario A, we apply an LVT at 75%; in scenario B the LVT is set at 25%. There are two important questions here: 1) When will a given parcel be forced into development? 2) What intensity of development will the parcel support at the moment it’s put into productive use? To answer our first question, we look at the tax curves and make some assumptions. Suppose carrying costs push land into productive use at $250 psqft in LVT costs, scenario (a)’s parcel goes into development around year 9 at a $331 psqft. Scenario (b)’s parcel doesn’t see development until year 20 and a ~$1K psqft value. Given the delta between year 9 and year 20’s psqft valuations, we could expect to see different intensities of development. We’re now left with the question of whether a duplex in nine years is better than a mid-rise in twenty. Appropriating the full rental value of land would pull development forward, but that doesn’t definitionally lead to it being put to its highest and best use. Highest and best is contingent upon what time scale we’re optimizing for and that choice […]

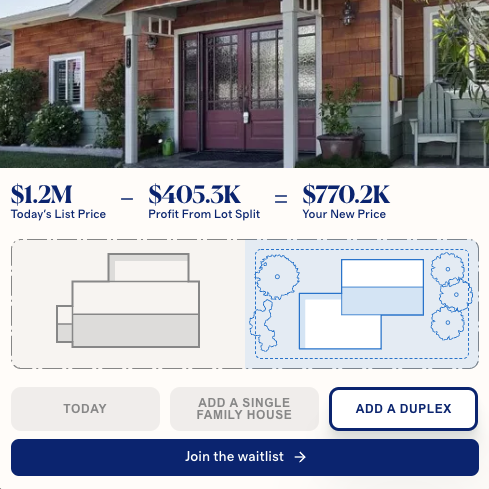

Discussions about land use reform focus on policy – as they should. Overcoming NIMBYism will require deep legal, political, and regulatory reform. That said, entrepreneurs may be helping to short circuit the perverse incentives that give rise to NIMBYism in the first place. New companies may be encouraging homeowners to embrace density and helping to break the tie between homeownership and anti-deveolpment attitudes in the process. Creating Demand for Density Belong is an early stage startup making it easier for homeowners to rent out their single family home. The main use case is that of a homeowner renting (instead of selling) after a move. A lot goes into becoming a landlord and Belong’s elevator pitch is that they simplify the process. The company’s customers access insurance, connect to contractors for repair and renovation, get help with listing, and find anything else they need all in one place. To the extent they’re successful, they’ll be creating a class of small scale landlords with every reason to develop missing middle housing. Transforming the family home from a speculative asset to one producing a monthly stream of revenue makes ADUs and duplexes more attractive. More units mean more tenants and therefore better monthly returns. And once an owner is no longer an owner-occupier, “neighborhood character” concerns become less salient as well. That said, this is admittedly speculative. Whether single property landlords will be as YIMBY as I suspect is an empirical question for the future. More immediate, though, are the incentives another new startup is creating for homeowners across California. Densification as the Path to Homeownership Homestead is a property developer that’s using legislation like California’s SB9 and SB10 to build housing. They work with homeowners interested in the upside of doing a lot split and adding housing like a duplex or an […]