Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Are there diverse places in the U.S. where racial differences among residents are small enough to be undetectable to a typical resident? Places where Roger Starr's ideal of "integration without tears" might be a reality, where people of different races socialize as equals, share culture and priorities, and work in the same range of occupations?

A trip to Houston reveals how a city can design without shame, urbanize around cars, and achieve privacy in a context of radical integration.

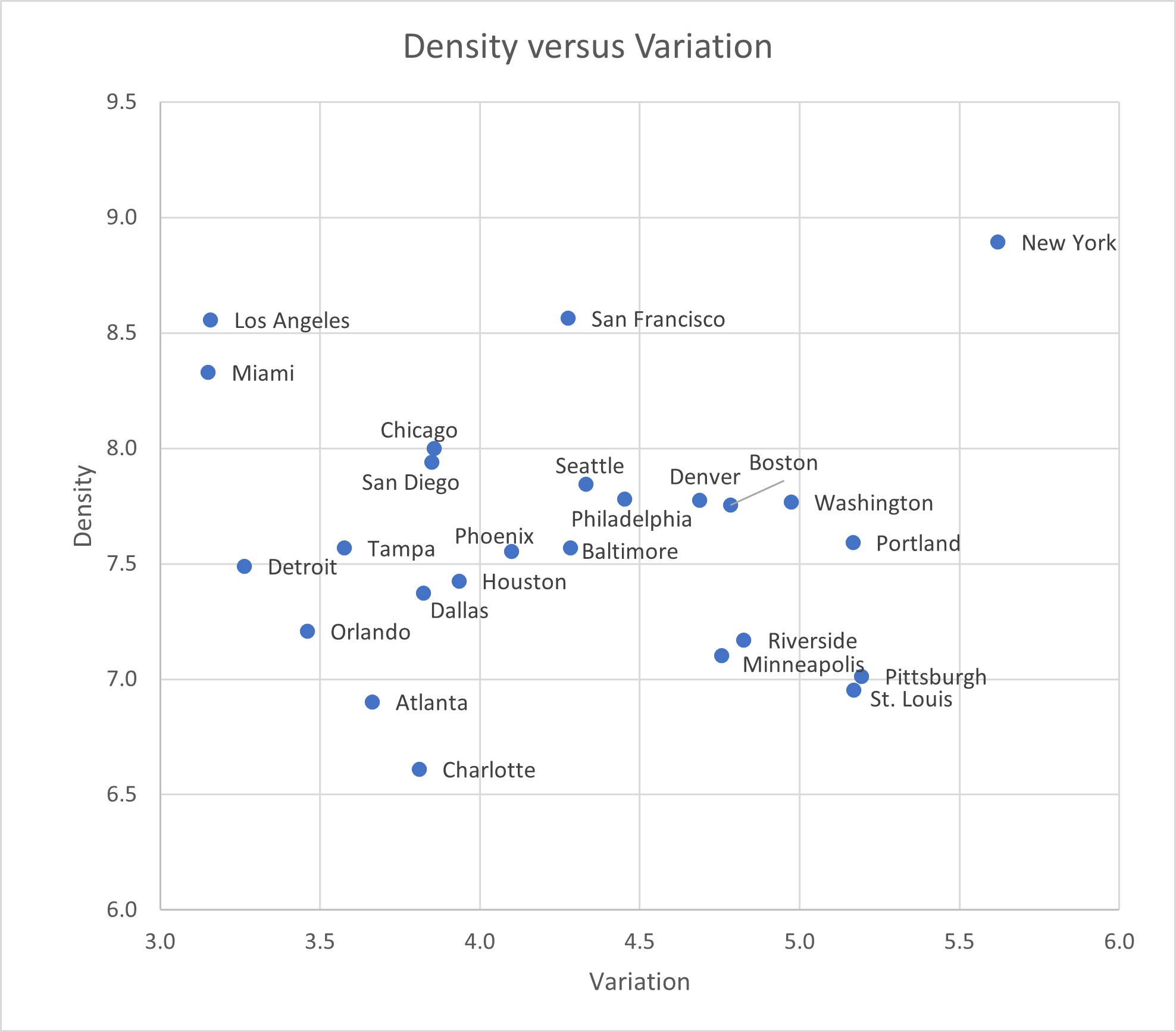

A quick data exercise shows that LA really is unique among big American metros, matched only by its East Coast twin, Miami.

With the Democrats scrambling to come up with a legislative agenda after their November takeover of the House of Representatives, an old idea is making a comeback: a “Green New Deal.” Once the flagship issue of the Green Party, an environmental stimulus package is now a cause de celebre among the Democratic Party’s progressive wing. While it looks like the party leadership isn’t too receptive to the idea, newly-elected Representative Alexandria Ocasio-Cortez has spearheaded legislation designed to create a “Select Committee for a Green New Deal.” The mandate of the proposed committee is ambitious, possibly to a fault. At times utopian in flavor, the committee would pursue everything from reducing greenhouse gas emissions to labor law enforcement and universal health care. A recent plan from the progressive think tank Data for Progress is more disciplined, remaining focused on environmental issues, with clearer numerical targets for transitioning to renewable energy and reducing greenhouse gas emissions. Yet in all the talk about a Green New Deal, there’s a conspicuous omission that could fatally undermine efforts to reduce greenhouse gas emissions: little to no focus is placed on the way we plan urban land use. This is especially strange considering the outsized role that the way we live and travel plays in raising or lowering greenhouse gas emissions. According to the Environmental Protection Agency (EPA), transportation and electricity account for more than half of the US’ greenhouse gas emissions. As David Owen points out in his book “Green Metropolis,” city dwellers drive less, consume less electricity, and throw out less trash than their rural and suburban peers. This means that if proponents of the Green New Deal are serious about reducing carbon emissions, they will have to help more people move to cities. One possible reason for this oversight is that urban planning […]

There’s been an ongoing debate in urbanist circles about whether autonomous vehicles (AVs) will damn us to perpetual sprawl and super commuting. I don’t believe that they will. In the first place, the business conditions under which AVs could conceivably induce more sprawl are unlikely. And in the second, there are numerous other factors that will affect the future of urban development in the US. That’s not to say we won’t double down on past mistakes, but it won’t be AVs that single handedly bring about that future on their own. No One Wants To Sell You a Self Driving Car For AVs to even begin to induce more sprawl, they need to facilitate super commuting. For that to happen at any significant scale, they need to be ubiquitous and privately owned. And that is something I don’t think we’re going to see for one simple reason — it’s a product no one is selling. Ole Muskie notwithstanding, no one with capital to burn thinks selling private AVs is a winning strategy (with good reason). Given the accumulated R&D costs of the last several years, the price a firm would need to charge for the first generation of personal AVs would be astronomical. Moreover, a company selling personal AVs would give up on mountains of valuable data generated as the vehicle racked up mileage. Trip data feeds back in to improving the ability of AVs to navigate and data about consumer habits is valuable as well. We should also remember that the state of AV technology is still quite…meh. And in the absence of a step function improvement in the technology, the fastest way to get to market is to restrict the problem space. That means means a driverless TNC service that can be limited to trips in certain areas […]

How much should we blame planning for the degree to which cities sprawl? As much time as we (justifiably) spend here on this blog explaining how conventional U.S. planning drives excessive sprawl, it’s worth periodically remembering that, at the end of the day, the actual extent of the horizontal expansion of cities is largely outside the control of urban planning. Consider Houston. Whenever I say anything nice about Houston’s relatively liberal approach to land-use regulation, someone invariably comments some variation of the following: “Yes, that’s all well and good in theory. But in practice, heavily regulated cities like Boston are far more urban and walkable, so maybe relaxed land-use regulations aren’t so great.” Indeed, most of Houston is classic sprawl. But this begs the question: to what extent can urban planning policy be blamed for sprawl? The urban economist Jan Brueckner, drawing on an extensive literature, distinguishes between the “fundamental forces” that naturally drive urban growth outward and the market failures that push this growth beyond what might occur in an appropriately regulated market. (For the purposes of this post, I’ll be using “sprawl” and “horizontal urban expansion” interchangeably. In the same paper, Brueckner thoughtfully distinguishes the two.) The latter, urban planners can address. The former, not so much. Let’s look first at the “fundamental” variables that planners have little to no control over. Brueckner identifies three: population growth, rising income, and falling commuting costs. The first variable is obvious: as cities grow, demand for all housing goes up, and some of that housing goes out on the periphery regardless of planning policy. Metropolises like Houston, Dallas, and Atlanta are currently experiencing 2% population growth every year, meaning they are on track to double in population in the next 35 years. You would expect a lot of horizontal expansion, all else […]

During an urbanist twitter free-for-all last week, the thoroughly awesome term “liberty machines” was used to describe the virtues of the car. The claim was made that cars let individuals go wherever they want, whenever they want and are therefore a ‘freedom enhancing’ form of transit. This isn’t the first time I’ve heard this argument in libertarian(ish) circles. But it doesn’t tally with my experience and I’m not sure it makes any sense even within its own premise. A Personal Anecdote and a Couple Thoughts When I learned to drive way back when, it was in the great state of Texas where driving is basically a necessity. In that context, getting my license (and being economically fortunate enough to have access to a car) was certainly liberating for me after a fashion. Thinking back, though, I enjoyed far less mobility as a car bound teenager in suburban Houston than I do now living in Oakland, California. I walk to the grocery, take BART to work, bike to the gym, catch a Lyft to go out, and/or drive myself when the occasion demands. Most of my trips are multimodal and the integration of transit modes affords me far more freedom of movement than car use alone ever could. The biggest reason for this is that single occupancy vehicle use doesn’t scale as a stand alone system. Unpriced roadways are prone to hitting congestion points and, as readers of this blog are probably aware, adding lanes doesn’t help. When roads become clogged, and there are no viable alternatives, a reliance on cars becomes a constraint. And to respond to the idea that mass transit relies on government subsidies and car use does not…the technical term for that would be factually incorrect. Mass transit is more than capable of paying for itself and let’s just say highways don’t […]

My last post, on urban geographic constraints and housing prices, led to an interesting discussion thread. The most common counter argument was that because dense cities are usually more expensive, density must cause high cost. But if this was true, cities would become cheaper as they became less dense. Most American urbanized areas have become less dense, not more, over time due to suburban sprawl. Even where city populations have grown, much of that growth has been in areas that where undeveloped a century ago. Thus, the developed part of even growing cities were, I suspect, more dense in 1917 than than they are today: for example, Manhattan’s population peaked at 2.3 million in 1910, about 40 percent more than its current population. So rents should have come down. Did they? Apparently not. The Census date has statewide data showing that rents rose pretty much everywhere in real terms over the late 20th century. In the District of Columbia, real rents increased from $346 to $612 in real dollars between 1950 and 1990, even as the city was losing population and the region was de-densifying. If Washington is typical, it appears that lower density and higher rent went hand-in-hand.

Our tax code favors suburbia. Homeownership, greenfield development, and sprawl receive preferential tax treatment, and the market responds to incentives built into the code. As a result, a disproportionate amount of capital flows to those investments. In many cases, it has been an unintentional side effect of pursuing other goals. The combined effect is that our tax system plays a huge role in shaping our communities. Its influence is an important factor to understanding how residential design in the US became what it is today.

The government exercises tremendous power over residential design in the US. Its influence is nearly invisible, because it works through complex financing programs, insurance incentives, and secondary markets. These mechanisms go unnoticed, but their effect is hard to miss—they remade the United States into a nation of sprawling suburbs. This is the second post in a series about government policies that encouraged suburban growth in the US. You can find the first post here. What image springs to mind when you picture “federally subsidized housing”? Most people imagine a low-income public housing tower, a homeless shelter, or a shoddy apartment building. Nope—suburban homeowners are the single biggest recipient of housing subsidies. As a result, suburbs dominate housing in the United States. For decades, federal finance regulations incentivized single-family homes through three key mechanisms: Insurance, National mortgage markets, and New standards for debt structuring The housing market hides these details from the typical home buyer. As a result, most people are unaware of these subsidies. But their effects are striking—they determined the location and shape of development across America for generations. A New Deal to restore the housing industry Debt has a negative connotation these days. Credit cards, student loans, and auto loans are the anchors that keep many Americans in debt for most of their life. Meanwhile, we view mortgages very differently—they are seen as an investment, a symbol of adulthood, and a sign of financial stability. This was not always the case. In the early 1900s, mortgages were just like any other kind of debt. Nowadays payments are spread out over decades, but back then they came due all at once after a few years. Most people didn’t have enough cash at the end of the term. It was standard to pay back some and negotiate a new loan for […]