Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

One alternative to market urbanism that has received a decent amount of press coverage is the PHIMBY (Public Housing In My Back Yard) movement. PHIMBYs (or at least the most extreme PHIMBYs) believe that market-rate housing fails to reduce housing costs and may even lead to gentrification and displacement. Their alternative is to build massive amounts of public housing. On the positive side, PHIMBYism, if implemented, would increase the housing supply and lower housing costs, especially for the poor who would be served by new public housing. And because there is certainly ample consumer demand for new housing, PHIMBYism would be more responsive to consumer preferences than the zoning status quo (which privileges the interests of owners of existing homes over those of renters and would-be future homeowners). But PHIMBYism is even more politically impossible than market urbanism. Market urbanists just want to eliminate zoning codes that prevent new housing from being built- a heavy lift in the political environment of recent decades. But PHIMBYs want to override the same zoning codes, AND find the land for new public housing (which often will require liberal use of eminent domain by local governments), AND find the taxpayer money to build that new public housing, AND find the taxpayer money to maintain that housing forever. And to make matters worse, the old leftist remedy of raising taxes on the rich might be inadequate to fund enough housing, because the same progressives who are willing to spend more money on housing also want to spend more public money on a wide variety of other priorities, thus making it difficult to find the money for housing.

One common argument against all forms of infill development runs something like this: “In dense, urban areas land prices are always high, so housing prices will never be affordable absent government subsidy or extremely low demand. Furthermore, laws that allow new housing will make land prices even higher, thus making housing more unaffordable.” This argument seems to be based on the assumption that land prices are essentially a fixed cost: that is to say, that they can only go up, never go down. In fact, land costs are extremely volatile. For example, a recent Philadelphia Inquirer story showed that in Philadelphia, land costs per square foot of vacant land fell by 46 percent over the last year. Why? A developer quoted in the story suggests that as supply has started to keep up with demand, rents have declined, causing land prices to decline. In other words, when supply increases, rents go down AND so do land prices.

Scott Alexander, a West Coast blogger, has written a post that has received a lot of buzz, called “Steelmanning the NIMBYs”; apparently, “steelmanning” is the opposite of “straw manning”; that is, it involves making the best possible case for an argument you don’t really support. There have been so many comments to this post that I don’t feel the need to respond to every point (and many of the points are very San Francisco-specific). But here are a few points, each of which begin with a quote from Alexander: “Even in the best case scenario, increased housing supply will just make apartments slightly more affordable.” But the post states that if housing supply increases by the admittedly ambitious 2.5 percent a year, the monthly rent for a one bedroom San Francisco apartment will go down from $3500 to $2100- a forty percent decrease. Moreover, in looking at the effects of new supply it isn’t enough to compare the benefits of reform to the status quo, because it is quite possible that if we continue “business as usual” policies rents will keep rising. So instead of comparing $2100 to the current rent, maybe we should compare it to whatever the rent will be if San Francisco continues along its current path (which I am guessing is more than $3500). “If your theory predicts that turning a city into Manhattan will make rents plummet, then consider that turning Manhattan into Manhattan made rents much worse, and so maybe your theory is wrong.” This is another version of the theory that density causes rent to rise. I have responded to that argument here. (Brief summary: Manhattan has gotten LESS dense over time, so if density was bad for rent, Manhattan should be a bargain now!) “And I have heard YIMBYs counter that if people don’t want […]

Earlier this year, researchers Paavo Monkkonen and Michael Manville at the University of California Los Angeles (UCLA) conducted a survey of 1,300 residents of Los Angeles County to understand the motives behind NIMBYism. As part of the study, they presented respondents with three common anti-development arguments, including the risk of traffic congestion, changes to neighborhood character, and the strain on public services that new developments may bring. But according to their findings, the single most powerful argument motivating opposition to new development was the idea that a developer would make a profit off of the project. At first blush, this finding might seem kind of obvious. People really don’t like developers. As Mark Hogan observed last year on Citylab, classic films from “It’s a Wonderful Life” to “The Goonies” depict developers as money-grubbing villains. But, when you think about it, it’s pretty weird that this is the case. In what other contexts do we actively dislike people who provide essential services, even if they happen to turn a profit? I don’t begrudge the owner of the corner grocery every time I buy a loaf of bread or a gallon of milk, and I hope you don’t either. In fact, most of us are probably happy that folks like doctors and dentists earn a lot for what they do. So why are developers, who provide shelter, any different? One possibility is that developers are often, for lack of a better term, assholes. This is surely the case with at least some developers. Our president is arguably America’s most famous developer, even if he isn’t exactly the master builder he played on television. And President Trump’s defining characteristic in his “Celebrity Apprentice” role—and evidently in real life—is that he is a bit of an asshole. But it isn’t just him. Most cities have […]

If you type “housing crisis” into Google search, “2008” is no longer the first result. The subprime mortgage crisis that toppled the global economy just a decade ago has been supplanted on Google trends by “housing crisis 2018.” This time, the crisis isn’t an overabundance of housing; it’s a chronic housing shortage. But economist Kevin Erdmann argues that the 2018 housing crisis is just the second act of the same tragedy. With local governments issuing fewer building permits and millennials beginning to buy their first homes, millions of Americans struggle to find affordable housing in 2018. The crisis is arguably the worst in California, where about one-third of all city-dwellers cannot afford local rents in every city in the state, San Diego to Sacramento. Economists and policy experts that study housing largely agree that the chronic unaffordability of American housing stems from persistent shortages in the quantity of housing supplied relative to the quantity demanded. Most housing scholars agree that “not in my back yard” (NIMBY) zoning laws are to blame. In many areas, NIMBY zoning laws have prevented developers from building multifamily housing in residential areas or forced developers to adhere to mandated minimum lot sizes. What resemblance, then, does our world of NIMBY-induced housing shortages have to do with the pre-2008 world with fast-and-loose credit policies [pdf] and overbuilt McMansions? That pre-2008 world, Erdmann argues, doesn’t really exist. [pdf] The traditional loose credit story is an easy one to tell––it appeals to populist sentiments (by demonizing rich bankers) and exudes the moral weight of an anti-capitalist parable about greed and gluttony. It makes for a great movie, “The Big Short.”And, to its credit, the traditional credit story even seems to explain much of the financial bedlam of 2008. Banks and investors placed too much confidence in risky mortgage-backed assets, […]

A headline in the Boston Globe screams: “Boston’s new luxury towers appear to house few local residents.” The headline is based on a report by the leftist Institute for Policy Studies, which claims that in twelve Boston condo buildings, “64 percent do not claim a residential exemption, a clear indication that the condo owners are not using their units as their primary residence.”* The report accordingly concludes that these buildings do not “address Boston’s acute affordable housing crisis.” This seems to be another version of the common “foreign buyers” argument: that new housing does not hold down rents, because it will all be bought up by rich foreigners who will let the units sit unoccupied forever. Although the report does not explicitly endorse restrictive zoning, it does urge the city to require new residential buildings to be carbon-neutral- a rule that might make residential construction more difficult. But this inference would be wrong. If you own a condominium, you have three choices: (1) to live in it; (2) to sit on it and lose money on your mortgage; or (3) to rent it out. Obviously, you make the most money through choice (3)- renting out the condo. So even a condo owner who does not choose option (1) has a strong incentive to adopt choice (3). Thus, it seems likely that at least some, if not all, of the condos will be rented out, thus increasing rather than decreasing regional housing supply, which in turn will have a positive effect on housing prices. *The residential exemption saves Boston homeowners up to $2500 per year on their tax bill. I would think that at least some owner-occupants are unaware of or forget to file for this exemption- but since I have no idea how common this is, I am reluctant […]

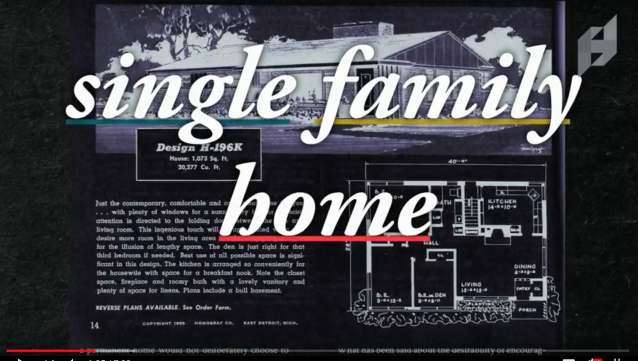

It’s an understatement to say that zoning is a dry subject. But in a new video for the Institute for Humane Studies, Josh Oldham and Professor Sanford Ikeda (a regular contributor to this blog) manage to breath new life into this subject, accessibly explaining how zoning has transformed America’s cities. From housing affordability to mobility to economic and racial segregation to the Jacobs-Moses battle, they hit all the key notes in this succinct new video. If you need a go-to explainer video for the curious new urbanists, this is the one. Enjoy!

On August 23rd, a California assembly bill aimed at increasing transit-oriented development, like housing, was passed by the state senate, confirmed by the assembly, and headed to Governor Jerry Brown’s desk for signing. The bill, AB 2923, specifically targets the San Francisco Bay Area—making it easier than ever for the Bay Area Rapid Transit (BART) to build housing on the land it owns around its transit stations. Previously, housing developments on BART-owned land were still subject to local zoning rules, pushing projects through local processes to be approved before building began. This local control led to many delays, and, as a result, housing denials in the midst of an ongoing housing shortage—on that repeatedly spurs news headlines decrying four-plus hour super commutes, median home prices over $1 million, and neighborhoods blocking affordable housing. State bills like AB 2923 are a response to these reports, as well as the local control that led to them. If passed, AB 2923 and other bills like it, will bypass local control’s draconian rules to allow more housing to be built and ease the housing shortage. Under current law, land owned by BART is often subject to discretionary review in Bay Area cities. This forces BART to become de facto experts in every municipality zoning code, an impossible task that would take away from their focus on improving their transit system. Even attempting to master the zoning codes of every municipality takes time. Ultimately, this causes delays in building housing that’s so sorely needed. But this could easily be avoided if BART could establish their own zoning rules under AB 2923. Housing and transit is intrinsically linked and, just like suburban home developers build the roads to best suit their development, urban transit authorities like BART must utilize their capacity to build the homes best […]

A recent headline in the Forbes blog screams: “Additional Housing Won’t Make City More Affordable, Says Fed Study.” This blog post cites a Federal Reserve Study showing that adding 5 percent more housing in the most desirable urban neighborhoods would lower rents by only 0.5 percent. But if you read the study more carefully, it doesn’t stand for what the headline says it stands for. First of all, it refers only to increasing housing supply in the most expensive neighborhoods. But housing markets are citywide- so of course if you increase housing supply in just one or two neighborhoods, you are not going to get significant rent reductions. If you raised housing supply by 5 percent everywhere, presumably you would get more than a 0.5 percent rent reduction. The study itself states: ” The papers that find large effects of regulation on house prices are not necessarily at odds with our findings in this paper, because regulations can have very large effects on the housing stock. For example, Jackson (2016) finds that an additional regulation reduces residential permits by 4 to 8 percent per year. Glaeser and Ward (2009) estimate even larger effects on supply. These effects on construction can accumulate into very large changes to the housing stock, especially when these regulations are in place for many years, as is often the case.” (p. 5) In other words, the study admits that supply-limiting regulations do affect housing costs: precisely the opposite of what a careless reader might think from reading the Forbes headline. Second of all, 5 percent is not exactly a huge increase. Even the author of the Forbes blog post concedes that more aggressive supply increases might lead to more aggressive rent reductions. Third, the study assumes a zero vacancy rate (p. 13) which seems to be an assumption that […]

A pure libertarian might argue that in an ideal world, there’d be no need for government-subsidized housing for low- and moderate-income households. Nevertheless, it seems to me that in the world we actually live in, even people generally opposed to the welfare state should favor more such housing. This is so for several reasons. First, government raises the cost of housing through a wide variety of regulations- some justified (e.g. building codes necessary for safety), some not-so-justified (e.g. exclusionary zoning). These regulations, by raising the cost of housing, effectively take money from all households. And because these restrictions aren’t based on ability to pay, they are especially painful for low-income households. Public housing and similar programs, rather than being a subsidy to the undeserving poor, are merely compensation for this act of plunder. Second, even if the United States abolished zoning tomorrow, it might take decades for housing supply to increase enough to bring rents down. So in the interim, lower-income households would still be suffering from the effects of zoning, and would deserve compensation just as much as they do under the status quo. Third, even if the United States abolished zoning and similar restrictions tomorrow, public health and safety might support certain restrictions that nevertheless increase the cost of housing- for example, some basic safety protections in building codes. It seems to me that as a matter of justice, government should not be forcing people into homelessness, so government should subsidize housing in order to make up for the costs imposed by even the most legitimate regulations. Finally, even if there were no housing-related regulations at all, the cost of land would create a floor under housing costs, which means some people would be homeless without government support. So if homelessness creates harmful social externalities of any kind, […]