Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

“Everything passes. Nobody gets anything for keeps. And that’s how we’ve got to live.” –Haruki Murakami I feel lucky to live in Brooklyn Heights. It’s been called New York City’s first suburb. It offers easy access to most parts of Manhattan, thanks to the convergence of several important subway lines, and the view of Lower Manhattan from here is one of the most spectacular in the City. Not surprisingly it’s one of the most desirable and expensive neighborhoods to live in. Along its periphery, warehouses and office buildings are constantly being converted into residences, to go along with townhouses in the neighborhood proper that were built in the early 1800s, as developers try to keep up with a demand that has remained strong even in a slack housing market. In my opinion the Brooklyn Heights district is one of the most charming, and probably the prettiest, in all of New York. So what’s to complain about? Urban Renewal and Landmarks Preservation Three things. First, in 1939 the area just east of the neighborhood underwent the largest urban renewal project of its time, razing 125 buildings over 21 acres and creating “Cadman Plaza,” the first of many so-called “super-blocks” built in major cities across the United States in the mid-twentieth century. Later, between 1947 and 1954, local authorities constructed the Brooklyn-Queens Expressway (BQE) along the northern and western borders. Then in 1965 Mayor Wagner signed a law that made Brooklyn Heights the City’s first historic district (there are currently 100 such districts in New York) and eventually gave rise to the important Landmarks Preservation Commission. Cadman Plaza and the BQE effectively cut the Heights off from the hurly-burly of commercial development in neighboring districts. The Landmarks Preservation Commission has made it very hard and very costly to change the existing […]

This week on the Market Urbanism Podcast, I chat with Samuel Zipp and Nathan Storring on the wonderful new volume Vital Little Plans: The Short Works of Jane Jacobs. From Jacobs’ McCarthy-era defense of unorthodox thinking to snippets of her unpublished history of humanity, the book is a must-read for fans of Jane Jacobs. In this podcast, we discuss some of the broader themes of Jacobs’ thinking. Read more about the ideas discussed in this week’s episode: Pick up your copy of Vital Little Plans on Amazon. Mentioned in the podcast, Manuel DeLanda discusses Jane Jacobs in A Thousand Years of Nonlinear History. Read more about the West Village Houses here. The question of Quebec separatism is a fascinating—and under-considered—element of Jacobs’ work. Help spread the word! If you are enjoying the podcast, please subscribe and rate us on your favorite podcasting platform. Find us on iTunes, PlayerFM, Pocket Casts, Stitcher, and Soundcloud. Our theme music is “Origami” by Graham Bole, hosted on the Free Music Archive.

Italo Calvino’s Invisible Cities is a short, often wonderful but consistently enigmatic (at least to me) novel about an extended conversation between Marco Polo and Kublai Khan. Marco tells the Khan a series of tales about fantastical cities he’s perhaps only imagined. I’ve always assumed that the book’s title refers to that imaginary quality, since no one besides Marco himself has actually seen the cities he describes, and they likely exist only in his mind or in the words as he utters them. Recently, I hosted a couple of group “tours” of my neighborhood. These tours are called “Jane’s Walks” in memory of the great urbanist Jane Jacobs. In the course of explaining her (mostly laissez-faire) principles to the group, I realized there’s another interpretation of Calvino’s title that I much prefer. It is this: A city—especially a great one—cannot really be seen. Paradoxically, the closest we can come to actually seeing one is through the imagination. Otherwise, it’s invisible. Moreover, if you can fully comprehend a place, then it’s not a city. You Don’t See a City on a Map If you think about a particular city that you know, what comes to mind? An image, a feeling, a smell, or a sound? Before we visit a city, we may look at pictures of parts of it, perhaps its famous landmarks, but these mean little to us in themselves. We may study a map of Paris to get a sense of the layout or the general shape of the metropolis. But what we are seeing is not the city of Paris but something highly abstract, abstracted not only from Paris but also from the particular reality of our lives. If, before going there, we could somehow look at a photo we will take of Paris, the scene would not evoke much from us […]

Why are a growing number of libertarians fascinated by cities and indeed pinning their hopes for a freer future on cities? Two examples of this just from recent Freeman issues are by Zachary Caceres on startup cities and the winner of the Thorpe-Freeman Blog Contest, Adam Millsap, responding to one of the articles in an entire cities-themed issue. There is a deep affinity between cities and markets, and indeed between cities and liberty. (As the old saying goes, “City air makes you free.”) Cities aren’t merely convenient locations for markets; a living city (which I’ll define in a moment) is a market, and the first cities probably originated as markets. Much has been written on this connection, but I’d like to point out another link between cities and markets—one that comes from the great 20th century urbanist, Jane Jacobs. Consciously or not, Jacobs followed the tradition of the influential German sociologist Max Weber in seeing cities as essentially markets. Indeed, in her 1969 book The Economy of Cities, she defined a city, or what I like to call a “living city,” as “a settlement that consistently generates its economic growth from its own local economy.” Moreover, I’ve written elsewhere that today’s economic phenomena of demand, supply, the price system, markets, externalities, public goods, and division of labor had their genesis in an urban setting. The fundamental (classical) liberal concepts of property rights, economic freedom, and the rule of law did not develop among wandering nomads, farmers, or in small villages but perforce from the interactions of strangers with diverse cultures and backgrounds interacting in dense proximity with one another. Diversity… In her great book of 1961, The Death and Life of Great American Cities, Jacobs first presented her argument that the key feature of any great city is its diversity. […]

HUD has released 2015 building permit tallies. Austin’s tallies for 2015: Single Family Units: 2,846 Duplex units: 326 Units in 3-4 unit buildings: 30 Units in 5+ unit buildings: 6,890 This bipolar split is typical of American cities. Some cities build more single-family than multi-family. Some build more multi-family than single-family. But the fourplex is dead. We build very little small-scale multi-family these days, which is why the “missing middle” is a focus of zoning code rewrites and a meme among the New Urbanist crowd. Although “missing middle” housing could easily be added to established single-family neighborhoods while preserving “neighborhood character,” it is mostly illegal in Austin and most other American cities, at least within the single-family districts, and it is often staunchly resisted by homeowners in older neighborhoods, where the form of housing makes most sense. Some homeowners, in fact, seem to dislike “missing middle” housing more than any other kind of housing. It is worth thinking about why. It is useful to first think about building technologies. After manufactured housing, the simplest, cheapest housing technology is the low-rise, wood-frame construction used in detached single-family homes. Small apartment buildings can be built using essentially the same techniques. Most large suburban apartment projects, in fact, are developed as a cluster of two-three story buildings containing 8-12 units each. These buildings would actually form nice low-rise, urban neighborhoods if they were arranged around a public street grid, but instead they are arranged around parking lots, private drives and landscaped common areas in garden-style developments. The next step up from low-rise, wood-frame technology is the mid-rise apartment building of four to seven stories. This type of development requires elevators (and thus a concrete elevator core) and usually consists of “stick and brick” construction over a concrete podium. It is at least twice as expensive per square foot as similar quality single-family housing — more if it includes structured […]

Despite its poor track record, homeownership is the bad investment idea that never seems to die. Even though the financial crisis revealed the risks that homeowners take on by making highly leveraged purchases, policymakers are still developing new programs to encourage home buying. Both the Clinton and Trump campaigns are continuing the political support for homeownership that dates back to the Progressive Era. Since the New Deal, homeownership has been touted as a tool to reduce poverty and as a route to wealth-building for the middle class. Even before the subprime-lending crisis revealed the risk that low-income borrowers took on with homeownership, researchers have explained the problems with using homeownership programs as a poverty reduction tool. Joe Cortright recently pointed out that homeownership is a particularly risky bet for low-income people who may only have access to credit during housing market upswings, leaving them more likely to buy high and sell low. Even for middle- and high-income households, homeownership is a weak investment strategy. Politicians across the political spectrum tout homeownership as key to a middle-class existence, but homeownership will make many buyers poorer in the long run compared to renting. The real estate and mortgage industries have popularized the claim that “renting is throwing your money away,” but owning a home comes with a steep opportunity cost. Renters can invest the money that they would have spent on a down payment in more lucrative stocks, and they don’t take on the risk of home maintenance. The New York Times created a popular calculator designed to determine whether renting or owning makes better financial sense. The calculator’s defaults assumptions are overly optimistic in favor of homeownership as the better strategy for most households. They include a 1% rate of house price increases after accounting for inflation, but the historical average is just 0.2%. Similarly, the calculator defaults to a […]

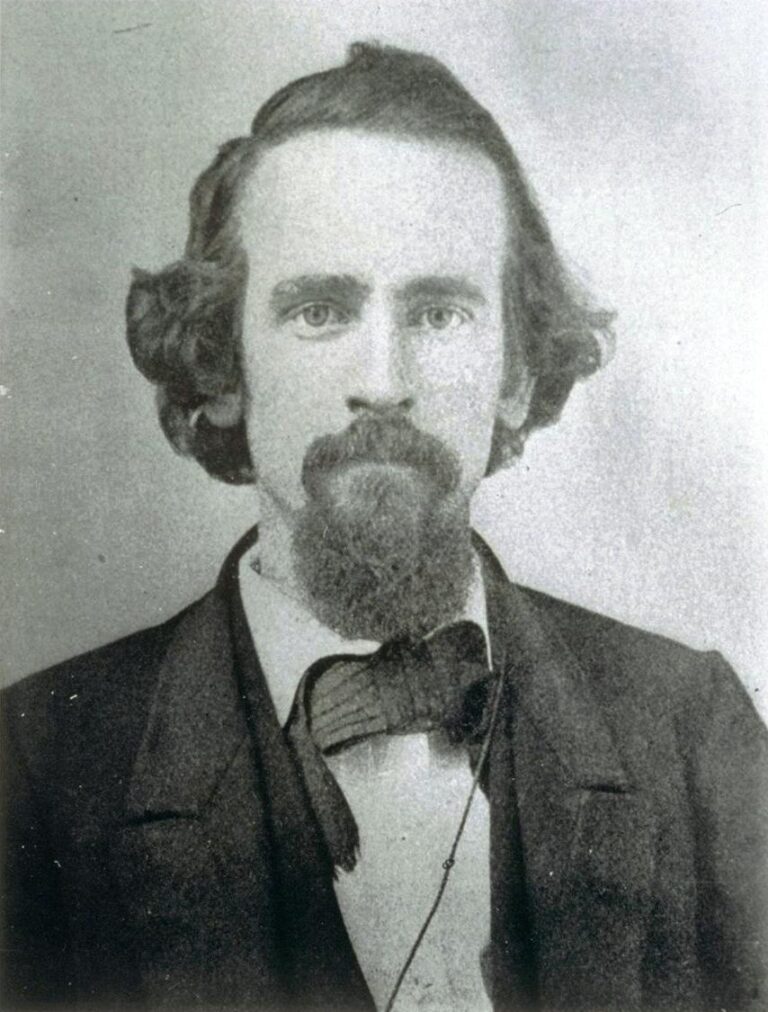

Henry George and Jane Jacobs each have an enthusiastic following today, including, I’m sure, some readers of The Freeman. For those who might not know, Henry George is the late-19th-century American intellectual best known for his proposal of a “single tax” from which he believed the government could finance all its projects. He advocated eliminating all taxes except that on the rent of the unimproved portion of land. He viewed that rent as unjust and solely the result of general economic progress unrelated to the actions of landowners. Jane Jacobs, writing about one hundred years later, is an American intellectual best known for her harsh and incisive criticism of the heavy-handed urban planning of her day. She advised ambitious urban planners to first understand the microfoundations of urban processes — street life, social networks, entrepreneurship — before trying to impose their visions of an ideal city. Much has been written, pro and con, on George’s single tax and also on Jacobs’s battles with planners the likes of Robert Moses, and if you’re interested in those issues you can start with the links provided in this article. Here I would like to contrast their views on the nature of economic progress and the significance of cities in that progress. Some interesting parallels There are some interesting parallels between George and Jacobs. Both were public intellectuals who rebelled against mainstream economic thinking — for George it was classical economics, for Jacobs neoclassical economics. Both had a firm grasp of how markets work, were critical of crony capitalism, and concerned with the problems of “the common man.” And both established their reputations outside of academia. George was a strong advocate for free trade and an opponent of protectionism. He also understood Adam Smith’s explanation of the invisible hand. As George writes in […]

In a recent piece published by 48hills, former Berkeley planning commissioner Zelda Bronstein takes aim at…well…too many things for me to succinctly recount in detail. So instead of attempting to respond to every single argument littered throughout her 7,000 word article, I’ll focus on the big stuff. Supply and demand: it’s a thing…we promise Ms. Bronstein asserts that supply and demand is, in fact, not a thing. Or at least if it is, it doesn’t apply to the Bay Area housing market. She writes that in California generally and the San Francisco Bay Area specifically, …the textbook theory of supply-and-demand—prices fall as supply increases—doesn’t apply. I’m unsure why Ms. Bronstein thinks the laws of supply and demand (ceteris paribus) don’t work here, but they’ve certainly been in force in Tokyo. Japan’s capital has seen sustained population growth as well as productivity increases over the last couple decades. And after twenty years of allowing housing to be built when and where people demand it, prices have remained gloriously flat. Just as expected. And when we look at American cities with the most supply elastic housing markets, we see a strong relationship between the ease with which new market rate construction can be developed and lower price increases overall. Unsurprisingly, San Francisco has one of the least elastic housing markets in the country and has experienced some of the most extreme percentage increases in housing prices as a result. No matter what example we look at or how we cut up the data, there’s nothing out there to contradict the basic YIMBY story about supply, demand, and price. Unless, of course, you don’t actually understand the story, which may be the problem in Ms. Bronstein’s case. For her benefit, I’ll restate the general position. More supply equals lower prices (in the aggregate and over time) The pro-supply […]

People sometimes support regulations, often with the best of intentions, but these wind up creating outcomes they don’t like. Land-use regulations are a prime example. My colleague Emily Washington and I are reviewing the literature on how land-use regulations disproportionately raise the cost of real estate for the poor. I’d like to share a few of our findings with you. Zoning One kind of regulation that was actually intended to harm the poor, and especially poor minorities, was zoning. The ostensible reason for zoning was to address unhealthy conditions in cities by functionally separating land uses, which is called “exclusionary zoning.” But prior to passage of the Civil Rights Act of 1968, some municipalities had race-based exclusionary land-use regulations. Early in the 20th century, several California cities masked their racist intent by specifically excluding laundry businesses, predominantly Chinese owned, from certain areas of the cities. Today, of course, explicitly race-based, exclusionary zoning policies are illegal. But some zoning regulations nevertheless price certain demographics out of particular neighborhoods by forbidding multifamily dwellings, which are more affordable to low- or middle-income individuals. When the government artificially separates land uses and forbids building certain kinds of residences in entire districts, it restricts the supply of housing and increases the cost of the land, and the price of housing reflects those restrictions. Moreover, when cities implement zoning rules that make it difficult to secure permits to build new housing, land that is already developed becomes more valuable because you no longer need a permit. The demand for such developed land is therefore artificially higher, and that again raises its price. Minimum lot sizes Other things equal, the larger the lot, the more you’ll pay for it. Regulations that specify minimum lot sizes — that say you can’t build on land smaller than that minimum […]

If you restrict the supply of housing, other things equal, what will happen to the price? That’s not a trick question. Any competent Econ 101 student would answer correctly that the price will rise. One reporter for the Washington Post gets it. In a hopeful sign of spreading economic literacy, Emily Badger writes: In tight markets, poor and middle-class households are forced to compete with each other for scarce homes. And so new market-rate housing eases that competition, even if the poor aren’t the ones living in it. Over time, new housing also filters down to the more affordable supply, because housing becomes less desirable as it ages. That means the luxury housing we’re building today will contribute to the middle-class supply 30 years from now; it means today’s middle-class housing was luxury housing 30 years ago. Typical critics of soaring housing prices have a much harder time grasping this. They don’t see that zoning rules and restrictions meant to make urban life more “livable” (often for the well-established homeowner) reduce supply and put strong upward pressure on prices. Minimum lot sizes, maximum density restrictions, minimum parking requirements, and so on all contribute to reducing the supply. And it raises prices not only for the wealthy, but also for middle- and lower- income families, as well. Instead, they think that new construction of market-rate housing is somehow the source of the problem, rather than a solution. (Emily Washington and I recently published a useful summary of the literature on the regressive effects of land-use regulation.) Ever wonder how ordinary people could afford to live in major cities before there were rent controls and land-use regulations? Builders built wherever it was the most profitable. The middle-incomers didn’t have to compete with the wealthy for middle-income housing, and the poor then didn’t have to compete with the middle-incomers for low-priced […]