Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

In a recent Mackinac Policy conference, Detroit’s Mayor Mike Dugan proposed *drum roll* a land value tax. Sort of. Mayor Dugan’s proposal would create separate tax rates for land and capital improvements (i.e. the buildings on top). Specifically, he wants to decrease the tax rate on buildings by ~30% and increase rates on land by ~300%. The change would increase revenue for the city and also cause a series of second order effects. Taxing Blight & Rewarding Investment Detroit’s existing tax structure disincentives development. Holding vacant land or land with dilapidated (i.e. assessed as worthless) structures is cheap from a tax perspective. Actually developing land triggers a tax increase because of the brand new structure who’s value gets figured into the tax bill. What’s worse, the existing tax system encourages land hoarding. Land speculators sit on neglected parcels on the off chance that a developer needs it as part of a larger project. To caveat that, though, not all land speculation is bad. Holding some land off market and releasing it later into a development cycle can have positive benefits. In Detroit’s case, however, these are mostly vacant lots and abandoned buildings creating public health hazards the city has to deal with. The Political Economy of Land Value Taxation Unexpectedly – for me as a latte sipping coastal urbanite in California – Dugan’s LVT would also lower tax bills for homeowners. Land values in Detroit are low — in absolute terms and relative to structure values. Making the shift to taxing the less valuable land component of a property nets out positive for most homeowners. And the fact that it’s a win for homeowners makes me think it’s politically viable, both in Detroit and elsewhere. In places struggling to get back on a growth footing — places where land values […]

Arbitrary Lines is the newest must read book on zoning by land use scholar and Market Urbanism contributor, Nolan Gray. The book is split into three sections, starting with what zoning is and where it comes from followed by chapters on its varied negative effects, and ending with recommendations for reform. For even deep in the weeds YIMBYs, it’s well worth picking up. There’s nothing dramatically controversial here, but give it a thorough read and you’re guaranteed to learn something new. In particular, the book’s third section on reforms is outstanding. It starts with a slate of policy proposals typical to this kind of text, but quickly goes much farther afield. After suggested policy changes, we’re invited to consider a world without zoning via an in-depth look at Houston’s land use regime. Here we’re treated to both an explanation of how it works and the unique political history that left the city unsaddled with zoning. Nolan goes on to close his recommendations with a call to reimagine what a city planner could be in a post-zoning American city; a call that, as a former New York City planner, he is uniquely fit to make. Aside from the content, this book deserves points for prose. Arbitrary Lines is blessedly readable. The writing flows and the varied anecdotes interspersed throughout the book make it feel less like a policy tract and more like a conversation with your favorite professor during office hours. For those already initiated, buy the book and enjoy nodding your head and learning a couple new things. And for those trying to share the good news of land use reform, consider making Arbitrary Lines that one thing you get friends or family to read. It’s among the most accessible books on land use I’ve ever read, and it’s a […]

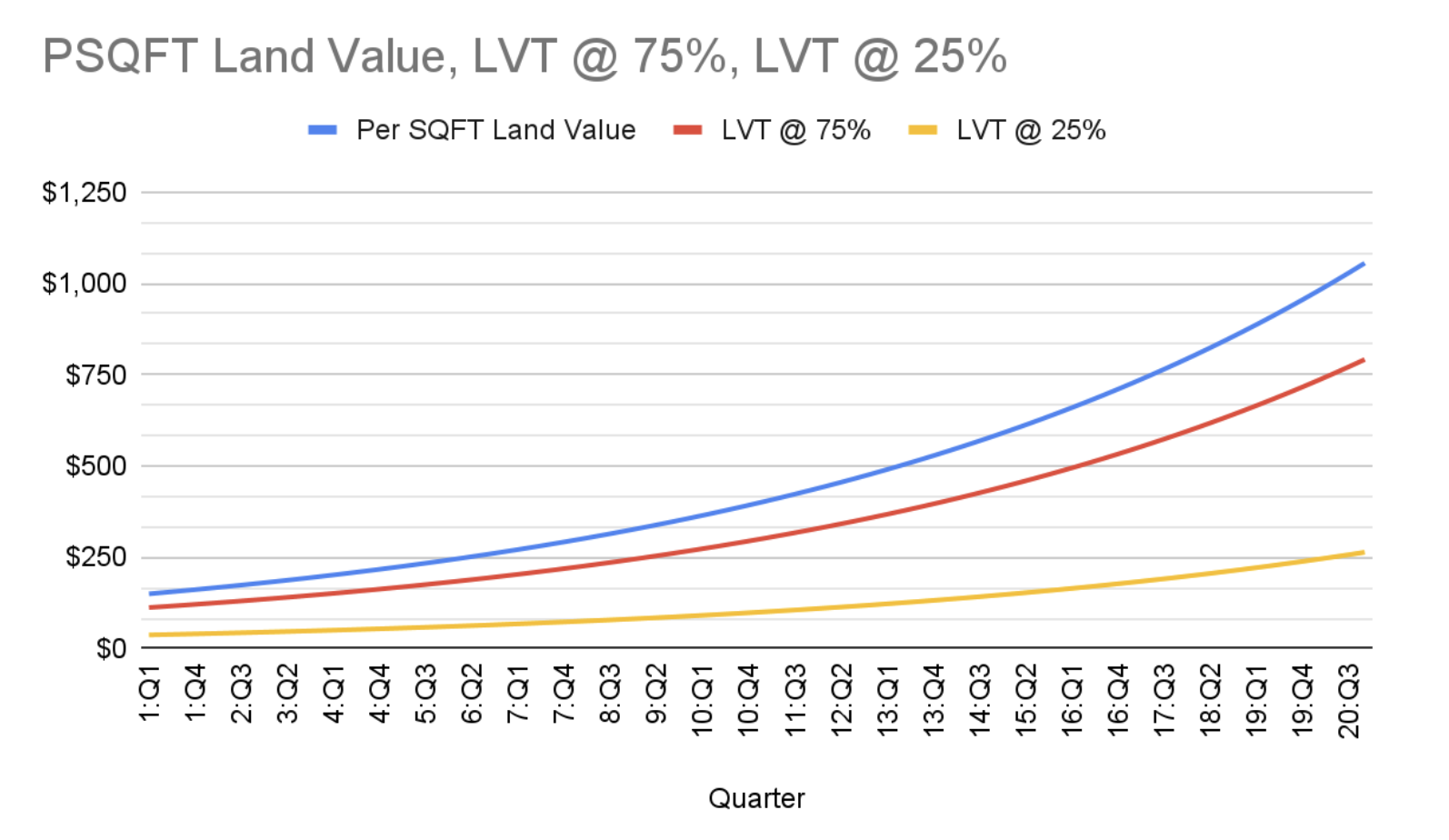

Georgists assert that a Land Value Tax (LVT) ensures land is always put to its most efficient use. They claim that increased carrying costs deter speculation. And if valuable land is never held out of use, society is better off. I think the story about incentives is correct. But I question whether pulling development forward in time is definitionally more efficient. In a world with transaction costs, tradeoffs abound and it’s worth thinking through the implications of an LVT. A Tale of Two Cities Picture a growing local economy with increasing land values and an LVT. Now suppose we split the time stream and create two parallel universes with different tax rates. In scenario A, we apply an LVT at 75%; in scenario B the LVT is set at 25%. There are two important questions here: 1) When will a given parcel be forced into development? 2) What intensity of development will the parcel support at the moment it’s put into productive use? To answer our first question, we look at the tax curves and make some assumptions. Suppose carrying costs push land into productive use at $250 psqft in LVT costs, scenario (a)’s parcel goes into development around year 9 at a $331 psqft. Scenario (b)’s parcel doesn’t see development until year 20 and a ~$1K psqft value. Given the delta between year 9 and year 20’s psqft valuations, we could expect to see different intensities of development. We’re now left with the question of whether a duplex in nine years is better than a mid-rise in twenty. Appropriating the full rental value of land would pull development forward, but that doesn’t definitionally lead to it being put to its highest and best use. Highest and best is contingent upon what time scale we’re optimizing for and that choice […]

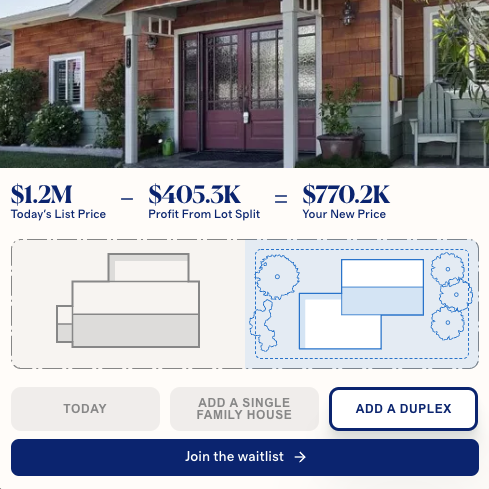

Discussions about land use reform focus on policy – as they should. Overcoming NIMBYism will require deep legal, political, and regulatory reform. That said, entrepreneurs may be helping to short circuit the perverse incentives that give rise to NIMBYism in the first place. New companies may be encouraging homeowners to embrace density and helping to break the tie between homeownership and anti-deveolpment attitudes in the process. Creating Demand for Density Belong is an early stage startup making it easier for homeowners to rent out their single family home. The main use case is that of a homeowner renting (instead of selling) after a move. A lot goes into becoming a landlord and Belong’s elevator pitch is that they simplify the process. The company’s customers access insurance, connect to contractors for repair and renovation, get help with listing, and find anything else they need all in one place. To the extent they’re successful, they’ll be creating a class of small scale landlords with every reason to develop missing middle housing. Transforming the family home from a speculative asset to one producing a monthly stream of revenue makes ADUs and duplexes more attractive. More units mean more tenants and therefore better monthly returns. And once an owner is no longer an owner-occupier, “neighborhood character” concerns become less salient as well. That said, this is admittedly speculative. Whether single property landlords will be as YIMBY as I suspect is an empirical question for the future. More immediate, though, are the incentives another new startup is creating for homeowners across California. Densification as the Path to Homeownership Homestead is a property developer that’s using legislation like California’s SB9 and SB10 to build housing. They work with homeowners interested in the upside of doing a lot split and adding housing like a duplex or an […]

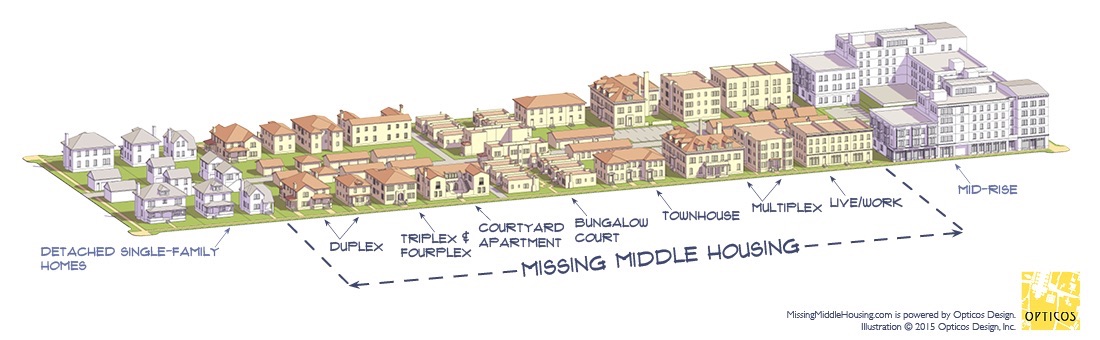

After over a century, Berkeley, California may be about to legalize missing middle housing – and it’s not alone. Bids to re-legalize gradual densification in the form of duplexes, triplexes, fourplexes, and the like have begun to pick up steam over the last several years. In 2019, Oregon legalized these housing types statewide while Minneapolis did the same at the city level. In 2020, Virginia and Maryland both tried to pass similar legislation, though they ultimately failed. This year, though, Montana and California may pick up the torch with their own state bills (even while the cities of Sacramento and South San Francisco consider liberalizing unilaterally alongside Berkeley). Allowing gradual densification is an absolutely necessary step towards general affordability. Supply, demand, and price form an iron triangle–the more responsive we can make supply to demand, the less price will spike to make up the difference.* What I really want to focus on here, though, is less about policy and more about political economy. I believe allowing medium-intensity residential development could make additional reforms easier to achieve and change views around development going into the future. We Love What We Know More often than not, I think a generalized status quo bias explains a lot of NIMBYism. Homeowners are most comfortable with their neighborhoods as they are now and are accustomed to the idea that they have the right to veto any substantial changes. Legalizing forms of incrementally more intense development could re-anchor homeowners on gradual change and development as the norm. The first part of the story is about generational turnover. If the individuals buying homes today–and the cohorts that follow–are exposed to gradually densifying neighborhoods in their day-to-day, they’ll anchor on that as what’s normal and therefore acceptable. Moreover, if we’re debating whether to rezone an area for mid-rise […]

Current events being what they are, I’m happy to be writing about something positive. Once again, we’re getting an ambitious housing reform package in the California legislature. The various bills focus on removing obstacles to new housing and are a sign of the growing momentum Yimby activists have built up over the last few years. The permitting process for new housing in California is the bureaucratic equivalent of American Ninja Warrior. Localities use restrictive zoning and discretionary approvals to block new construction. When faced with state level oversight, California cities have historically leaned on bad faith requirements to ensure theoretically permitted and approved housing remains commercially infeasible. And as if that weren’t enough, “concerned citizens” can use the ever popular CEQA lawsuit to kill projects themselves (independent of direct involvements from electeds). This year’s housing package helps reduce the difficulty of getting a project through the gauntlet. Still an obstacle course, but with a few less water hazards and a slightly shorter warped wall. Still suboptimal, but directionally correct in a very big way. There are several pro-supply bills in the package, but two are especially worth calling out. SB 6 allows for residential development in areas currently zoned for commercial office or retail space. The bill would also create opportunities for streamlined approval if some portion of a proposed project site has been vacant. This last bit seems to be intended to encourage redevelopment of dead malls and similar retail heavy areas that could be better put to use as housing. SB 9 allows for duplexes and lot splits in single family zones by right. This type of missing middle housing could – at least in certain parts of California – be new housing that’s less expensive then existing stock; that’s a great outcome from a policy perspective, but […]

Anti poverty programs have been taking center stage as the 2020 Democratic primary heats up. Proposals from Kamala Harris and Corey Booker target high housing costs for renters and make for an interesting set of ideas. These plans, however, have major shortcomings and fail to address the fundamental problem of supply constraints in high cost housing markets. Harris and Booker on Housing Both the Harris and Booker plans call for direct subsidies to renters via the tax code. Harris’ Rent Relief Act (RRA) is a refundable tax credit for renters making $100,000 or less and spending more than 30% of their income on rent. The credit would be worth a percentage of the delta between the recipient’s rent (capped at 150% of area fair market rent) and 30% of their income. Actual benefits would be bigger or smaller depending on the size of the gap. Booker’s Housing, Opportunity, Mobility, and Equity (HOME) Act is also designed as a refundable tax credit for renters paying more than 30% of their income in rent. Unlike Harris’ RRA, there’s no sliding scale for benefits. The credit covers the entire difference between 30% of the recipients income and their rent (also capped by area fair market rent). Both programs are in the same vein as other democratic anti-poverty proposals which use the tax code to affect transfer payments. The others, though, are expansions of the federal Earned Income Tax Credit (EITC) whereas these two proposals more narrowly target housing. Devils in the Details Housing costs are a major impediment to financial stability for many, so it’s good to see reducing them called out as a poverty reduction strategy. And transfer payments (as opposed direct government provisioning or price fixing) make for better social safety nets. However, as Tyler Cowen points out, juicing the demand side […]

Five years ago everything in California felt like a giant (land use policy) dumpster fire. Fast forward to today we live in a completely different world. Yimby activists have pushed policy, swayed elections, and dramatically shifted the overton window on California housing policy. And through this process of pushing change, Yimbyism itself has evolved as well. Learning by Listening Yimbys started out with a straightforward diagnosis of the housing crisis in California. They said, “…housing prices are high because there’s not enough housing and if we want lower prices, we need more housing”. And they were, of course, completely right…at least with regards to the specific problem-space defined by supply, demand, and the long run. As Yimby’s started coalition building, though, they began recognizing related, but fundamentally different concerns. For anti-displacement activists, the problem was not defined by long-run aggregate prices. It was instead all about the immediate plight of economically vulnerable communities. Increasing supply was not an attractive proposal because of the long time horizons (years, decades) and ambiguous benefit for their specific constituencies. Yimbyism as Practical Politics Leaders in the Yimby movement could have thrown up their hands and walked away. But they didn’t. Instead they listened and developed a yes and approach. The Yimby platform still embraces the idea that, long run, we need to build more housing, but it now also supports measures to protect those who’ll fall off the housing ladder tomorrow without a helping hand today. Scott Weiner’s SB50 is a great example of this attitude in action. If passed, the bill will reduce restrictions on housing construction across the state. It targets transit and job rich areas and builds in eviction protections to guard against displacement. At a high level, it sets up the playing field so that renters in a four story […]

There’s been an ongoing debate in urbanist circles about whether autonomous vehicles (AVs) will damn us to perpetual sprawl and super commuting. I don’t believe that they will. In the first place, the business conditions under which AVs could conceivably induce more sprawl are unlikely. And in the second, there are numerous other factors that will affect the future of urban development in the US. That’s not to say we won’t double down on past mistakes, but it won’t be AVs that single handedly bring about that future on their own. No One Wants To Sell You a Self Driving Car For AVs to even begin to induce more sprawl, they need to facilitate super commuting. For that to happen at any significant scale, they need to be ubiquitous and privately owned. And that is something I don’t think we’re going to see for one simple reason — it’s a product no one is selling. Ole Muskie notwithstanding, no one with capital to burn thinks selling private AVs is a winning strategy (with good reason). Given the accumulated R&D costs of the last several years, the price a firm would need to charge for the first generation of personal AVs would be astronomical. Moreover, a company selling personal AVs would give up on mountains of valuable data generated as the vehicle racked up mileage. Trip data feeds back in to improving the ability of AVs to navigate and data about consumer habits is valuable as well. We should also remember that the state of AV technology is still quite…meh. And in the absence of a step function improvement in the technology, the fastest way to get to market is to restrict the problem space. That means means a driverless TNC service that can be limited to trips in certain areas […]

The Public Wealth of Cities by Dag Detter and Stefan Fölster proposes a series of reforms to improve municipal finances. The authors lay out guidelines for creating urban wealth funds (UWFs) and argue that financial stability is key to societal success. Detter and Fölster first call for basic financial competency. According to the authors, most cities don’t even know what they actually own. Real estate and equipment are often owned directly by individual departments with no central record to provide a bird’s eye view of a city’s assets as a whole. When this is the case, good asset management becomes impossible because no one knows what they’re managing. The authors also point out the need for cities to decide what is and is not a commercial asset. Where administrators designate an asset as commercial, maximizing ROI should supersede all other objectives. That doesn’t mean everything a city owns has to be managed to turn a profit, but where a piece of real estate or a facility is meant generate income, it ought to be managed explicitly to that end. Professional financial planning is Detter and Fölster’s third major prescription. They argue that cities should hire professional asset managers to oversee their portfolios and that these managers should be shielded from the democratic process. They go on to make a very public choice argument that elected officials have inappropriately short time horizons and that pressure to please constituents can lead to decisions at odds with the long term sustainability of municipal finances. After developing that line of reasoning, they provide Singapore as an example of a municipality that does this pretty well. In terms of the ideas presented, I loved the book. It touches on the organizational challenges of getting municipal finance right while speaking to what execution has […]