Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

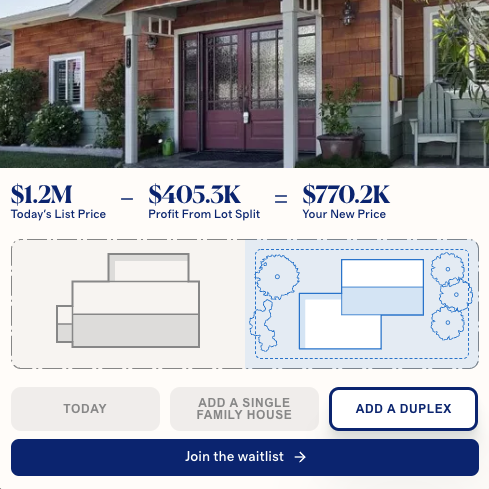

Discussions about land use reform focus on policy – as they should. Overcoming NIMBYism will require deep legal, political, and regulatory reform. That said, entrepreneurs may be helping to short circuit the perverse incentives that give rise to NIMBYism in the first place. New companies may be encouraging homeowners to embrace density and helping to break the tie between homeownership and anti-deveolpment attitudes in the process. Creating Demand for Density Belong is an early stage startup making it easier for homeowners to rent out their single family home. The main use case is that of a homeowner renting (instead of selling) after a move. A lot goes into becoming a landlord and Belong’s elevator pitch is that they simplify the process. The company’s customers access insurance, connect to contractors for repair and renovation, get help with listing, and find anything else they need all in one place. To the extent they’re successful, they’ll be creating a class of small scale landlords with every reason to develop missing middle housing. Transforming the family home from a speculative asset to one producing a monthly stream of revenue makes ADUs and duplexes more attractive. More units mean more tenants and therefore better monthly returns. And once an owner is no longer an owner-occupier, “neighborhood character” concerns become less salient as well. That said, this is admittedly speculative. Whether single property landlords will be as YIMBY as I suspect is an empirical question for the future. More immediate, though, are the incentives another new startup is creating for homeowners across California. Densification as the Path to Homeownership Homestead is a property developer that’s using legislation like California’s SB9 and SB10 to build housing. They work with homeowners interested in the upside of doing a lot split and adding housing like a duplex or an […]

One common argument against new urban housing runs as follows: “If we build new housing, it will all be bought up by rich investors who will sit on it. So new supply doesn’t restrain housing costs.” This argument (at least as I have phrased it) strikes me as absurd. Here’s why: for the argument to justify restraining supply, the argument presupposes that if you build 100 new condos/houses/apartments, every single one of them will be bought by an investor, and every single investor will irrationally choose to sit on the unit rather than renting it out. I can’t prove this is wrong, but it seems really hard to believe.* Even leaving aside the logical weirdness of the argument, it seems to have a questionable factual basis. If there was really a wave of nonresident investors in expensive cities, we might find (1) that the most expensive markets had the highest housing vacancy rates and (2) that these vacancy rates have been rising as housing costs rose. But Census data suggests otherwise. Here’s some data: (all for central cities, not metros) Expensive 2010 2015 Manhattan 12.7% 13% San Francisco 9.8 7.9 Los Angeles 6.7 6.5 San Diego 7.8 7.1 Boston 9.1 8.0 Not so Expensive 2010 2015 Dallas 12.8% 10.6% Houston 14.0 12.1 Philadelphia 14.1 13.3 Chicago 13.8 13.2 By and large, the expensive cities have lower vacancy rates- exactly what you would expect in a free market. The only exception is Manhattan. But it seems to me that if pied-a-terres led to higher rents, Manhattan’s empty-house rate would have climbed as rents did- which does not seem to have been the case. The only way to save the “empty house” theory is to suggest that expensive cities’ empty houses are different from everyone else’s – that is, they are especially […]

In a recent 48 Hills post, housing activist Peter Cohen aimed a couple rounds of return fire at SPUR’s Gabriel Metcalf. The post comes in response to Mr. Metcalf’s own article critiquing progressive housing policy. Mr. Cohen bounces around a bit, but he does repeat some frequently used talking points worth addressing. Trickle-down economics Mr. Cohen calls the argument for market-rate construction ‘trickle down economics’. Trickle down economics actually refers to certain macro theories popularized during the Reagan years. These models assumed a higher marginal propensity to save among wealthier individuals. And given this assumption, some economists concluded that reducing top marginal tax rates would result in higher savings. This would then mean higher levels of investment which would, in turn, have a positive effect on aggregate output. And from there we get the idea of a rising tide lifting all ships. Note that none of that has anything to do with housing policy. Labeling something ‘trickle down’ is a way to delegitimize certain policy proposals by associating them with Ronald Reagan. It’s somewhere between rhetorically dishonest and intellectually lazy. Though to be fair, it’s probably pretty effective in San Francisco. The concept Mr. Cohen is trying to critique is actually called filtering. In many instances, markets do not produce new housing at every income level. But they do produce housing across different income levels over time. Today’s luxury development is tomorrow’s middle income housing. The catch, however, is that supply has to continually expand. If not, prices for even dilapidated housing can go through the roof. For a more thorough explanation, see SFBARF’s agent based housing model. If you build it, they’ll just come But even accurately defined, Mr. Cohen still objects to the concept of filtering. He cites an article by urban planning authority William Fulton to make […]