Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Suburban sprawl gets preferential tax treatment in the US. As a result, it is cheaper to spend a dollar on housing than on something else, so it encourages people to spend more money on housing. The tax code also favors new construction over renovation and infill development.

Suburban sprawl gets preferential tax treatment in the US. As a result, it is cheaper to spend a dollar on housing than on something else, so it encourages people to spend more money on housing. The tax code also favors new construction over renovation and infill development.

These protections are pervasive throughout federal and state tax codes, but a few rules stand out:

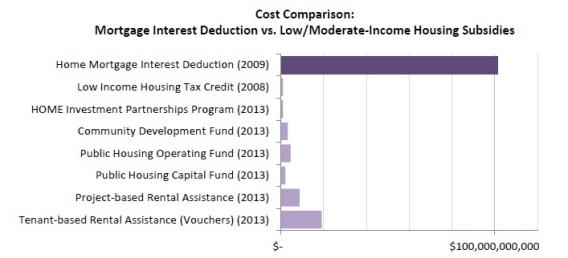

Mortgage interest does not count as taxable income. In other words, homeowners can write off interest paid on their home loan in what is called the Mortgage Interest Deduction (MID). The MID was designed to encourage homeownership, but it benefits wealthy people who would have bought a home anyways the most. The MID encourages these people to spend more on their house, because the higher their tax bracket and the bigger their mortgage, the more they save.

The deduction is (tax bracket) * (mortgage interest). So if you’re in the 25% tax bracket and you pay $5,000 per year in interest, you save $1,250 on your taxes. If you buy a bigger, more expensive house and pay $10,000 per year in interest, you save $2,500.

Property taxes can also be deducted from a homeowner’s income. This has a similar effect as the MID, and it makes housing a much more attractive investment. It also encourages homeowners to lobby for regulations that increase their home’s value, because they are not taxed on increases in that value. This further tips the scales for people who own their home and against those who rent.

These lavish tax breaks push Americans towards the suburbs, because they encourage people to buy homes when they might otherwise rent. They also encourage people to buy larger homes than otherwise, because a dollar spent on a larger mortgage goes farther than that same dollar on any other purchase.

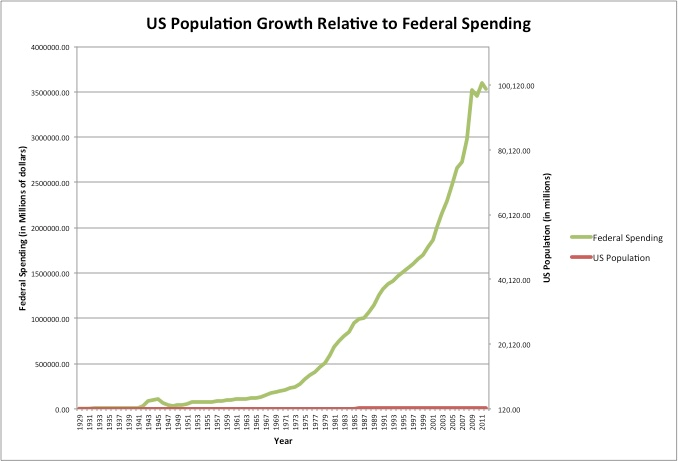

These rules were not intended to encourage the expansion of suburbia. When the income tax was first created in 1913, only the wealthiest Americans paid income tax at all. The total amount of taxation was far lower at this time—the federal government itself was much smaller at the beginning of the 20th century—so its relative impact on the economy was small. But as the federal government expanded in the post-war period, tax revenues grew along with it, and so did their influence on the economy.

The MID and property tax deduction amount to some of the largest subsidies in the US. These two tax breaks cost $90 billion in 2015. For comparison, this is double the amount spent on public housing programs that year.

The tax code provides huge incentive to purchase a home as an investment; it favors homeownership over investment alternatives by exempting home sales from capital gains tax. In other words, if your home value increases by the same amount as some other investment, the home investment has a greater net return, because the tax burden is zero. This encourages people to funnel capital from other forms of investment towards housing.

Between 1951 and 1997, you could avoid taxes on home-sale profit if you used the money to buy another, more expensive house. This encouraged people to move into increasingly large homes over the course of their lifetime, even if they would have preferred to downsize as they got older. For instance, a retired widow with grown children might want to move out of her big suburban house and into a smaller apartment closer to downtown. But the tax code would have penalized that move by taxing the capital gains on her original more expensive house, giving her a reason to either stay in her home or purchase another one rather than renting. Researchers from Cleveland State University found that this deduction pushed people to continue owning homes longer than they might otherwise, and it bolstered the market for ever-more-expensive dwellings. In short, our tax code subsidized “upsizing” and uninterrupted homeownership.

In 1997, the Taxpayer Relief Act (TRA) expanded this deduction. Now, homes are exempt from capital gains in most cases, making homeownership even more attractive. By eliminating the tax burden for most home sales, the law made homes a better investment than alternatives with the same “upside” and risk profile.

Some economists point to this tax change as a key cause of the housing bubble and subsequent crash in 2007. Economist Russ Roberts credits it for the run-up in prices in the early 2000s, and Nobel Prize winner Vernon Smith argued that “the end of the capital-gains rainbow … fueled the mother of all housing bubbles”. Even before the crisis, it was clear that the TRA had dramatically increased the subsidy to homeownership. In 2005, Chris Farrell attributed “the powerful lure of tax-free profit [as] one reason that home prices [had] risen at a nearly 7% annual rate, vs about 4% for the stock market since 1997”. The value of selling a home went up, so homeownership became more attractive relative to alternatives.

“There’s probably no special interest that’s more favored by the existing tax code than real estate,” said tax lawyer and Brookings fellow Steven M. Rosenthal in a New York Times interview. Countless tax breaks favor the new construction, and these in turn subsidize sprawl on the fringes of existing communities.

“There’s probably no special interest that’s more favored by the existing tax code than real estate.”

For example, builders can deduct the depreciation of new commercial buildings. A 1954 law permitted “accelerated depreciation”, which allows businesses to take most of the deduction in the first years of the structure’s life. It was intended to spur businesses to update factories, but its greater effect was to make construction a lucrative tax shelter. Thomas Hanchett noted in From Tenements to the Taylor Homes:

As investors discovered the twist, money began pouring into real estate development. Though intended to spur factory modernization, the law’s language referred simply to “income-producing” buildings, which included stores, offices, and rental housing, as well as industrial structures. “Profits in Losses: Real Estate Investors Turn Depreciation Tax Write-Offs into Gains” headlined an enthusiastic 1961 front-page story in The Wall Street Journal. By the mid-1960s, the tax break was costing the U.S. Treasury more than $700 million per year. By comparison, Washington had spent virtually that same amount over ten years of the Urban Renewal Program aimed at revitalizing America’s central cities.

Hanchett continues, explaining how these depreciation rules inadvertently favored suburbia:

Accelerated depreciation rules inadvertently favored suburbia. The write-off was greater for new construction than for renovation, and new construction was usually easiest on the open lands of the urban periphery. Also, the law forbade write-offs for depreciation of land, so that developers often shied away from urban projects with high land costs.

This is one of many tax breaks that benefit new construction. These policies, combined with the tax breaks directed at individual home owners, promote new dispersed development and redirect investment away from urban areas. Though its rules were shaped with different goals in mind, this feature of the US tax code is a massive subsidy to suburban development.

Our tax code favors suburbia. Homeownership, greenfield development, and sprawl receive preferential tax treatment, and the market responds to incentives built into the code. As a result, a disproportionate amount of capital flows to those investments. In many cases, it has been an unintentional side effect of pursuing other goals. The combined effect is that our tax system plays a huge role in shaping our communities. Its influence is an important factor to understanding how residential design in the US became what it is today.

This post was originally published on Medium.

Oh PLEASE hurry with the next two articles in the series, about paving suburbia, etc. I am so interested in this.

Compare: A homeowner of a $500K house in suburbia. A homeowner with a$500K condo on the 30th floor of a urban high-rise… please explain how the MID and property tax “subsidies” encourage more of suburbia vs high-rise residential?

If only you knew about the many obstacles to getting financing to buy condos in multi-unit, mixed-use buildings.

It’s income based. If you only knew of the many obstacles to getting financing to buy a house. /

That is the stupidest comment I have ever read.

I got pre-approved up to $250K, but all sorts of pointless regulations (percentage of commercial space in building, percentage of owner-occupancy, percentage of units owned by a particular individual) affect my ability to buy a condo I want. Ask any realtor about the problems with condo financing. Don’t presume stuff about others.

The “Stupid” comment is yours, coming right back at you. Educate yourself before posting your crap.

You don’t even have anything to say. You need to educate yourself first. Asshole.

Hilarious. You’re two months late and two bits short. MID is non-discriminatory. Take your bias with you when you exit.

For your homeowner gets major tax breaks section, I’d like to suggest a couple of changes.

First, as you say, mortgage interest is deductible for federal income tax. So is property tax (as well as a host of other things), but the property tax deduction means that you understate the federal subsidy to home ownership.

Second, the IRS allows a standard deduction of $6,300, or $12,600 for married filing jointly. My wife and I own a home, and pay state income tax (which is also deductible), but we are at the margin of whether it is useful to itemize. If we had a smaller, less expensive house, there would be, in effect, no federal subsidy of our home ownership. If we had a larger, more expensive house, then there would be a greater federal subsidy of our home ownership.

Great point, Kevin. The preference for suburbia come more from the preference for new construction, and the rules to qualify for FHA guarantees that are described in the previous article.

Still, the MID is a disaster, and should be phased out. This article incorrectly describes it as a benefit to homeowners, but it isn’t because anyone who has paid off their home receives no benefit. It is really a subsidy for home BORROWERS, and the more you borrow, the more you benefit. Its real beneficiaries are realtors and builders who benefit from higher home prices, and the banks that do the lending. It’s sold as an economic boost, but as a witness to the crash in 2008, it is hard not to see it as a stimulant that de-stabilizes the market.

The mortgage interest deduction applies for condos as well. And suburban property taxes can be pretty steep and are often higher than urban ones. And when it comes to greenfield development the tax benefits are probably a minor consideration compared to the cost of land.

This is one of many tax breaks that benefit new construction

https://dxboffplan.com/property-for-sale-dubai

Great article. Now with the booming of tourism, and the benefits that brings to cities, I think people should be encourage to move to the cities, and invest in architecture there, instead of a suburb that nobody would visit. Has something like this been proposed?